Spanish SHIP market falters as deadlines and supply delays halt progress

April 13, 2023

Spain’s solar thermal industry is facing a setback as it struggles to deliver many of the projects awarded in the most recent call for commercial and industrial solar heat projects. The scheme funded by the European Regional Development Fund (ERDF) allocated EUR 108 million to support 51 solar heat projects totalling 62 MW. According to preliminary figures from three project developers, around 70 % of the projects have not gone ahead using this subsidy line. As reasons for the low realisation rate in Spain, industry representatives point to difficulties with the supply of components and hesitant clients. Nevertheless, some technology suppliers remain cautiously optimistic about the future solar heat market in Spain as they have sold the first projects without subsidies.

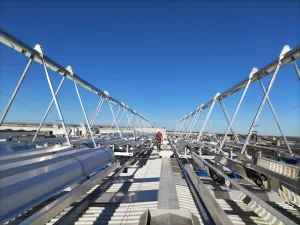

Photo: TCT – Thermal Cooling Technology

The Spanish Institute for Energy Diversification and Saving (IDAE) administered the ERDF budget and each region was assigned an individual amount. The regions launched calls for project submissions in the second half of 2020 and the approval phase took almost a year, with the last projects receiving confirmation in January 2022. The deadline for realising the plants was originally the end of June 2023, but was recently extended to September 2023.

However, a survey carried out by solrico on the global SHIP sector resulted in rather mixed statements on the situation of the Spanish market. That is why solarthermalworld.org contacted some of the Spanish technology suppliers again to find out about their experiences with the awarded projects.

“It was literally impossible to deliver on-time”

Miguel Frasquet, CEO of Solatom, has mixed feelings on the outcome of the subsidy line. “It has been incredibly difficult to have supplies deliverable on time for the original deadline in June this year. For many supplies you normally need a 32-week delivery time and we calculated with only 16 weeks. It was literally impossible to deliver certain devices such as electronic controllers on time.” Frasquet states that some of their projects are under construction and fighting to meet deadlines. He believes that slow authorisation and high bureaucracy has been another hurdle that has hindered timing and delivering.

CSIN, the joint venture between Solatom and Simetría Grupoconstruct, is building a 3.5 MW solar thermal plant with 6,000 m2 of mirrors for the Heineken factory in Quart de Poblet, Valencia. This project, together with the 30 MW plant that is being constructed by Engie in cooperation with the Belgian company Azteq in Seville, will represent the largest SHIP installations in Spain to generate steam in an industrial process so far.

This 250 m2 linear Fresnel system from Solatom started operation in November 2022 at a food processing factory in Valencia. The client received financial support from the local fund IVACE, but not from the ERDF scheme. Photo: Levante-EMV

| Company | Number of awarded projects | Total capacity of the awarded projects | Awarded projects already commissioned | Awarded projects under construction | Awarded projects halted or on standby |

| TCT True Solar Power | 13 | 3.3 MW | 3 projects with 29 kW (car washing), 36 kW (service sector) and 54 kW (pharma) | 1 MW for a cork factory | 9 |

| Solatom / CSIN | 7 | 6.5 MW | 0 | 3 projects, among them 3.5 MW for Heineken | 4 |

| Abora Solar | 3 | 891 kW | 0 | 0 | 3 |

| Total | 23 | 16 |

Low realisation rate in Spain for commercial and industrial solar heat projects for which an approved grant was available. Source: manufacturers’ information

Low realisation rate because of non-binding nature of subsidy scheme

Another manufacturer awarded funding via the IDAE call was TCT – True Solar Power. The Spanish-based concentrating dish manufacturer was awarded support for 13 projects in 2022. According to TCT Board Member Jaime Ruiz Morales only three plants have been built and delivered (see table above). In addition, TCT expects to start construction of a 1 MW plant for a cork processing factory in Extremadura this month. But a total of nine projects with IDAE funding have either been completely stopped (four) or have opted for a different subsidy line (five). These new subsidies will come from the Castilla y León region.

Morales believes that one of the main reasons projects have not gone ahead is the non-binding nature of the grant. “This subsidy line does not carry any kind of guarantee or penalty for non-implementation, which has made it a low priority for some entrepreneurs.” Morales believes that another reason for the lack of timely implementation has been that solar thermal technology has been partly overshadowed by photovoltaic technology and that solar thermal has not yet succeeded in convincing entrepreneurs of its profitability.

No obligation to implement the project

Another project developer Abora Solar, a Spain-based manufacturer of PVT collectors, indicates that none of the three awarded projects has been built. According to Alejandro Del Amo, CEO of Abora, “the customers initially said yes to the subsidy because they did not see any binding obligations for the project. Later, when they had to contribute or pay part of the overall cost of the project upfront (around 40 %), they disassociated themselves from it”.

In Del Amo’s view, the European subsidy is not properly designed. He proposes a European support scheme offering soft loans with zero interest rates including a subsidy for the risk guarantees. Commercial solar heat clients will then repay the loan out of the annual energy savings. “This would avoid missteps and ensure that customers are keen on a well-performing solar heat system,” adds Del Amo.

First unsubsidised projects

However, some of interviewed project developers have been cautiously optimistic about the near future. Miguel Frasquet believes that “there is still a knowledge barrier on the part of industrial clients, but there is more and more interest and understanding, and they are becoming more involved”.

According to Morales “entrepreneurs are becoming more confident; they are no longer as wary about the technology as they were last year. The investment return is highly attractive and many projects are going ahead. We are about to deliver a 380 kW system to a butchery that is going to be the largest system using our concentrated dish technology in Spain. This project is being carried out without any subsidies. Hopefully it will have a tractor effect on other investors and industries,” concludes Morales.

Websites of companies mentioned in this news article:

Solartom: https://solatom.com

TCT True Solar Power: https://www.truesolarpower.com

Abora Solar: https://abora-solar.com/

IDAE: https://www.idae.es/en/home