Mood on the SHIP market: High interest but slow decision making

March 28, 2023

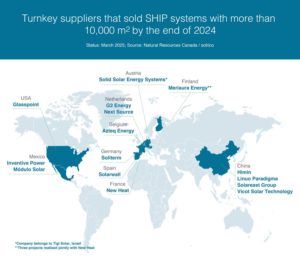

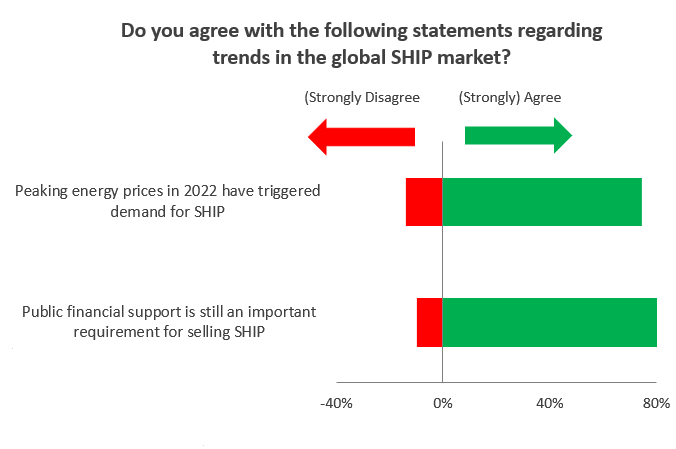

Last year, gas shortages in Europe dominated the headlines for months. Energy prices peaked and heat-intensive producers had to increase the prices of their products. Against this background we asked solar industrial heat project developers for their assessment of the progress in the business. Of the around 70 companies listed on the SHIP Turnkey Supplier World Map, 51 filled out an extensive questionnaire. Two-thirds of the companies confirmed that the demand for solar process heat solutions increased in 2022 (see chart above). But “potential SHIP customers are very undecided and the process is rather slow. There are a large number of opportunities and little outcome,” was how one participant from Switzerland summarised the mood in sales last year. The survey was carried out by the German agency solrico and supported by the German research project Modulus. You can also read the news about the high level of dynamism on the SHIP world market in 2022. Figure: solrico / source: Survey 2023 among the companies listed on the Turnkey SHIP Supplier World Map

Despite the gas crisis in 2022, the tenor of the company statements was again that solar industrial heat is a challenging market in which to build a sustainable business. Evidence of this is the high number of companies (78 %) that still answered the question “Are you satisfied with the sales volume of SHIP plants in 2022?” with a resounding “no”. Although this rate is slightly lower than for 2021 (85 %), it still shows that there are massive obstacles that project developers have to overcome in order to conclude contracts with industrial customers.

Significant financial risk for suppliers

The long project development time was cited by a striking number of companies as a reason for dissatisfaction this year. An Austrian survey participant put it this way: “The decision-making paths are very long, so that a project only comes about years later, if at all.” A technology provider from Israel complained that “given the energy crisis and focus on energy transition I would have expected faster decisions.” The conclusion is made clear by the CCO of a startup company: “High project development costs often coupled with inefficient decision-making processes of customers result in significant financial risks for suppliers.”

Subsidies are still an important requirement for selling SHIP

On the other hand, it is interesting to see where the companies that are satisfied with their business development are located. Many of them are from the Netherlands: not only did we have an increased number of participants from this small European solar thermal market this year, but also the majority answered with “yes – satisfied”. One participant justified his “yes” with a growing project pipeline both in numbers and in volume. The national support scheme for solar thermal systems up to 200 m2 through the Investment Grant for Sustainable Energy (ISDE) is the key supporting factor, but the strong discussion about phasing out gas production is also significant. The Netherlands was the most prolific market for SHIP in 2022 with 38 new systems, mostly in agricultural businesses, totalling 7.2 MW.

In general, government funding still plays a crucial role in the development of SHIP markets. As shown in the chart above, 84% (strongly) agreed with the statement “Public financial support is still an important requirement for selling SHIP”. This is also confirmed when one considers that the majority of the newly commissioned SHIP systems in 2022 were subsidised. Only 20 systems out of 114 were installed without government funding.

Weak performance of the Spanish market

Spain was the beacon of hope for the SHIP market last year after 51 solar heat projects totalling 62 MW received grant approval within the Thermal Energy Production subsidy programme at the end of 2021. But rather mixed statements came from the Spanish project developers in the current survey. One participant said “2022 was a good year in the solar thermal sector due to high energy costs, favourable policies, and subsidies.” But one of his competitors is not satisfied and stated that “potential clients only focused on PV to reduce electricity costs, and were not interested in reducing energy costs through renewable heat”.

Overall, Spain performed rather weaker than expected with only six new SHIP projects in 2022 totalling 2.8 MW. Some of the projects in the outlook 2022/2023 for concentrating heat that were already considered binding in August 2022 have been delayed or customers have dropped out completely, according to statements of survey participants. The reasons for this need to be further investigated. However, the final balance of the Thermal Energy Production subsidy programme can only really be drawn after June 2023. This is when the systems that received grant approvals need to be completed.

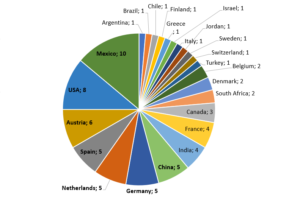

A wide-spread industry: Location of the 72 SHIP suppliers that took part in the SHIP Turnkey Supplier World Map Survey 2023 Graphic: solrico

Mexico: SHIP industry hub

With ten specialist companies, Mexico is the most strongly represented country on the SHIP Turnkey Supplier World Map (see pie chart above), followed by the USA (8 companies) and Austria (6 companies). The overall performance of the Mexican SHIP market with 13 new projects was a bit weaker than in recent years with 18 projects in 2021 and 16 in 2020. One collector manufacturer stated that the “SHIP market has been growing since the pandemic”. He explained that with the rising energy prices and the increased awareness for reducing CO2 emissions. But a competitor reported delays in project implementation. He gave two reasons – the delay in payment by the clients as well as delays in the supply chain of important parts for the projects. Other Mexican project developers were busy meeting an increasing demand for solar thermal solutions from the service sector in the past year, so that they did not focus on industrial clients.

Growing interest in SHIP in Northern America

The Northern American SHIP industry experienced strong fluctuations in the last six years. On the first SHIP Turnkey Supplier World Map from 2017 (see map below), only five companies in the USA and Canada were listed, three of which are no longer included in the new map 2023. Instead, six other US-based companies and two new Canadian-based companies took part in this year’s survey.

The survey participants from these countries confirmed growing demand for solar industrial solutions. Two companies ticked “yes” as they were satisfied with the size of the plants for which they were able to conclude contracts with industrial customers. But there are barriers here too, as this statement shows: “Growth of the industry is good, but we still have issues with the installation capabilities of contractors”. And another participant commented that US manufacturing businesses are “responding to ecological and social governance commitments, but still too slowly and are badly informed”.

So we are back at the beginning: “high interest, but slow decision making” also describes the situation in Northern America. If politicians also want to bring industrial heat onto the decarbonisation path, then they must rely even more clearly on mandatory renewable quotas and/or carbon taxes in order to speed up the decision-making processes of industrial customers.

Extract from the SHIP Turnkey Supplier World Map 2017 Graphic: Solar Payback 2017

Websites of organisations mentioned in this news article:

Modulus: https://www.dlr.de/sf/en/desktopdefault.aspx/tabid-9315/22254_read-74328/

Solrico : https://www.solrico.com/index.php?id=2

SHIP Supplier World Map: http://www.solar-payback.com/suppliers/