High level of dynamism on the SHIP world market in 2022

The world market for solar process heat (SHIP) is gaining momentum. In 2022, more SHIP systems went into operation than in any year since surveys began in 2017. The project developers reported 114 systems with a capacity of 30 MW. In the preceding years the survey results showed only 71 systems (2021) and 85 systems (2020). In 2022 the top five markets were the Netherlands (38 systems), China (17), France (14), Mexico (13) and Germany (9). The USA is back in the international SHIP market with eight technology suppliers responding to the survey. New solar process heat installations in 2022 featured a wide range of collector technologies. The survey was carried out by the German agency solrico and supported by the German research project Modulus. The photo shows a standardised collector field for an agricultural business in Brittany, France. You can also read the news about the mood on the SHIP market in 2022.

Photo: Sunoptimo

Around 70 technology suppliers and project developers from 25 countries worldwide participated in the SHIP 2023 survey. They are all listed on the SHIP Turnkey Supplier World Map, which was launched as part of the Solar Payback project in 2017 and has been updated annually since then.

The implementation rate of the SHIP specialists has increased. For 2022, 25 developers were able to report at least one completed project, in the preceding years there were only 17 (2020) and 19 (2021) companies with completions.

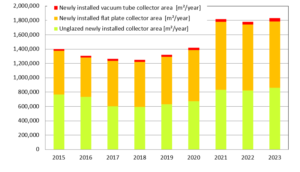

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | Total at the end of 2022 | |

| No. of commissioned SHIP systems | 107 systems | 99 systems | 86 systems | 85 systems | 71 systems | 114 systems | at least 1,089 systems |

| Newly installed collector area | 219,280 m2 | 55,583 m2 | 358,641 m2 | 132,316 m2 | 50,819 m2 | 43,390 m2 | 1.22 million m2 |

| Newly installed solar thermal capacity | 153 MW | 39 MW | 251 MW | 93 MW | 36 MW | 30 MW | 856 MW |

Table 1: Global SHIP market development between 2017 and 2022. The large fluctuations in added capacity were the result of large capacity additions in Oman and China in certain years. Capacity was calculated using the factor 0.7 kW/m2 for all collector types. Source: Annual surveys between 2017 and 2023 of the companies listed on the Turnkey SHIP Supplier World Map.

Top SHIP markets 2022: Netherlands, China, France, Mexico and Germany

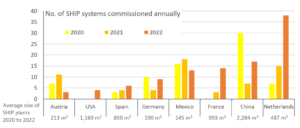

Figure 1 shows the ranking of the countries with the highest number of completed SHIP installations in 2022. Due to a large number of subsidised agricultural systems in the Netherlands and France, these two countries were the top European SHIP markets 2022.

China and Mexico were again the leading SHIP markets outside Europe. China shows the highest fluctuations year by year. This has to do with the fluctuating number of reported installations. The reason is that the major Chinese collector manufacturers often only supply material to construction sites, where local companies take care of the installations, so that the material suppliers do not necessarily know how the solar heat is used by the customer.

For this reason, the high level of dynamism on the world market becomes even clearer if you look at the data excluding China. Outside China, the number of SHIP systems installed annually has almost doubled from 55 systems in 2020 (22 MW) to 97 systems in 2022 (23 MW).

Figure 1: Top markets in terms of the number of new SHIP plants commissioned per year between 2020 and 2022. Source: Annual surveys among the companies listed on the SHIP Supplier World Map

Strongly growing SHIP supply industry in the USA

After many years without any significant activities in the field of solar process heat in the USA, the country managed to reappear in the ranking of the largest SHIP markets in 2022 with four systems. The number of technology providers there is growing continuously. Eight companies took part in the current survey: Artic, ErgSol, Glasspoint, Skyven, Solar Dynamics, Sunvapor, SunDrum Solar, and Winston Cone Optics.

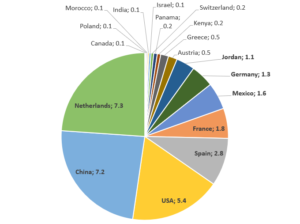

The USA ranked third in terms of the newly installed SHIP capacity in 2022 with 5.4 MW after China and the Netherlands (see figure 2).

Figure 2: SHIP capacity additions 2022 in MW per country. In total, SHIP installations with 30 MW started operation worldwide last year. Source: Survey 2023 of the companies listed on the SHIP Supplier World Map

Wide range of collector types provide solar industrial heat

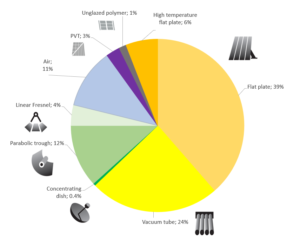

Industrial heat requirements differ significantly from customer to customer. Some require warm air for drying, others hot water, steam or thermal oil. Different collector models are used, depending on the heat requirement. Figure 3 shows that in 2022 SHIP systems with nine different collector types were installed. The usual stationary flat and evacuated tube collectors were used in more than half of the market.

At 11%, air collectors are much more strongly represented on the SHIP market in 2022 than in solar thermal applications for heating in buildings. This is mainly due to the generous funding in Germany, Austria and Spain, which also applies to air collector systems for roof and façade installations.

PVT collectors are still more of a novelty in the SHIP market and were only used in three systems in 2022. However, there are feasibility studies in Austria that envisage a greater use of PVT collectors in combination with heat pumps for industrial clients, so that this segment will gain in share.

Figure 3: Distribution of collector type area in the SHIP world market 2022 (Total: 43,990 m2). Source: Survey 2023 of the companies listed on the SHIP Supplier World Map

Strong increase expected in concentrating heat applications in 2023

Concentrating collectors accounted for only 16 % of the 2022 SHIP global market. According to table 2, this is in the midfield of the last three years. Nine concentrating industrial heat plants with 4.9 MW went into operation last year. A special feature of the year 2022 is three new linear Fresnel collector systems in Spain, after no SHIP system with this collector technology started operating in 2021.

A completely new picture will emerge in 2023. A significant increase in solar process heat above 100 °C is already becoming apparent. The multi-MW plants alone that are currently under construction in Europe and whose commissioning is planned for this year promise a sevenfold increase. These include the chemical site in Turnhout, Belgium, with 2.5 MW and the two Heineken plants in Spain with 28.5 and 4 MW respectively.

| 2020 | 2021 | 2022 | |

| Total area, global SHIP world market (m2) | 132,316 | 50,819 | 43,390 |

| SHIP world market with concentrating collector technologies (m2) | 10,038 | 8,936 | 6,931 |

| Share of concentrating collector technologies | 8 % | 18 % | 16 % |

Table 2: Share of concentrating collector technologies in the global SHIP market from 2020 to 2022. Source: Annual surveys among the companies listed on the SHIP Supplier World Map

Websites of companies mentioned in this news article:

Modulus: https://www.dlr.de/sf/en/desktopdefault.aspx/tabid-9315/22254_read-74328/

Solrico : https://www.solrico.com/index.php?id=2

SHIP Supplier World Map: http://www.solar-payback.com/suppliers/