Update Infographics_SPB 2023

High innovation potential of suppliers for concentrating heat solutions

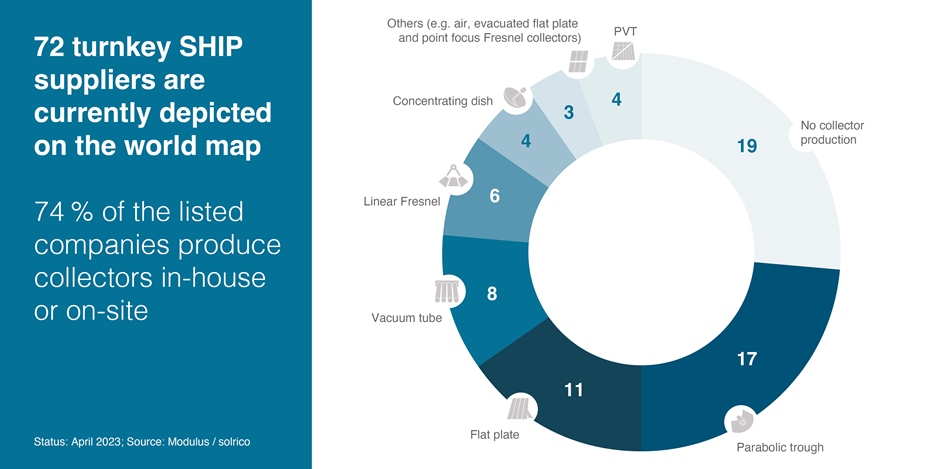

The number of providers with higher temperature solar process heat solutions continues to grow. More manufacturers of concentrating collectors are now listed on the SHIP Supplier World Map than manufacturers of stationary collectors (see pie chart above). The dominant technology is parabolic trough collectors, provided by 17 companies. A total of 72 entities are listed on the updated world map, of which 74 % produce collectors in-house or on-site. The update is based on the solrico survey carried out in February and March 2023. The number of listed companies remained stable as eight companies were newly added and the same number were removed. You can gain further insights into the challenges, opportunities and trends in the global SHIP market during the next IEA SHC Solar Academy webinar on 20 and 22 June. Online registration is available here: https://www.ises.org/what-we-do/webinars

Graphic: Modulus / solrico

Among the newly registered companies are a number of providers of concentrating heat solutions. The first to mention is Glasspoint from the USA. It is the restarted entity using the technology and the marketing approach of the former Glasspoint, which went bankrupt in May 2020. Glasspoint offers solar heat contracts (ESCO business model) based on light parabolic troughs protected by glasshouses.

The three complete newcomers from North America – Phoenix Solar Thermal, Solarsteam and Winston Cone Optics – illustrate the growing importance of solar heat on this continent despite the continuing low energy prices. Phoenix Solar Thermal from Canada has signed a purchase agreement with a value of USD 5.8 million with the Swedish company Absolicon. This Investment will enable Phoenix to run an automated production line for Absolicon’s covered parabolic trough collectors.

Solarsteam from Canada is a startup that has just successfully raised seed equity to further develop its enclosed ultra-lightweight parabolic trough collector.

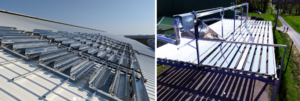

Winston Cone Optics from California is about to commercialise a vacuum tube collector with large CPC reflectors achieving up to 150 °C. The company recently installed its first pilot solar thermal system on the roof of a dairy with support from the California Energy Commission.

Another newcomer on the world map with a concentrating solution is the French company Idhelio. It offers Linear Fresnel collectors that can provide air at up to 250 °C at atmospheric pressure, suitable for drying and dehydration processes.

Figure 1: First demonstration plants of concentrating heat solutions from Winston Cone Optics, USA (left) and Idhelio, France (right). Photo: Winston Cone Optics / Idhelio

Ranking of the top project developers in terms of implemented projects

Modulo Solar from Mexico as well as SolarEast Group and Linuo Paradigma – both from China – defended their top positions in the ranking of turnkey suppliers with the highest number of finalised SHIP plants (see figure 2). G2Energy from the Netherlands overtook the Mexican project developer Inventive Power and is now in fourth place. The Dutch company profits from the national incentive programme SDE++ and realised a large number of solar heat project for farmers and ranchers.

Next Source from the Netherlands, the former HR Solar, made it into the ranking this year for the first time with 17 systems as well as Tigi from Israel. Megawatt Solution, the only Indian company, dropped out of the ranking because they have shifted the business focus to other energy technologies. India was a strong SHIP market in the years 2017 to 2020 until the national incentive programme for concentrating heat was stopped in March 2020.

The ranking is based on annual surveys of the SHIP turkey providers listed on the world map between 2017 and 2023. These surveys asked about the SHIP systems commissioned in the previous year, including their location, collector area, collector type and industrial sector in order to avoid double counting.

Figure 2: Ranking of the top SHIP project developers according to the number of implemented SHIP plants. You can find the ranking of the most experienced SHIP suppliers in terms of installed SHIP project size here.

Source: Modulus / solrico survey 2023

High innovation potential

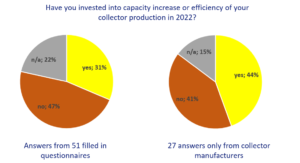

The current survey also included the question: Did you invest in increasing the capacity or efficiency of your collector production in 2022? The relatively high rate of “yes” responses shows that the demand for SHIP solutions is reaching the solution providers (see figure 3). Within the total of 51 questionnaires filled out by companies registered on the world map – some of them manufacturers of collectors – the number of yes answers was 31%. However, if you only look at the answers from collector manufacturers, 44% confirmed that they invested in increasing capacity and efficiency in 2022.

The measures implemented by the companies ranged from “adding more people to the team” to “increasing the capacity of the collector assembly line”. Other entities mentioned “design optimisation of collectors for cost saving” or “optimizing the engineering and piloting of SHIP plants”.

The balance of plant (BoP) was a target of some project developers, which includes the hydraulic unit between the collector field and the client’s heat network. Innovations in this field included the development of a balance of plant that “delivers steam and hot water at the same integration point” or the “development of a containerised BoP”.

Figure 3: Results of the current SHIP supplier survey. Source: Modulus / solrico survey 2023

This article follows two previous news pieces discussing other aspects of the most recent global SHIP survey carried out in February and March 2023:

Mood on the SHIP market: High interest but slow decision making

High level of dynamism on the SHIP world market in 2022

Websites of organisations mentioned in this news article:

SHIP Supplier World Map: http://www.solar-payback.com/suppliers/

Solrico: http://www.solrico.com

Glasspoint: https://www.glasspoint.com/

Phoenix Solar Thermal: https://phoenixsolarthermal.com/

Solarsteam: https://solarsteam.ca/

Winston Cone Optics: https://www.winstonconeoptics.com/

Idhelio: https://idhelio.com/

SolarEast Group: https://www.sunrain.com/

Linuo Paradigma: http://www.linuo-ritter-international.com/

G2Energy: https://www.g2energy.nl/

Inventive Power: https://inventivepower.com.mx/english/

Next Source: https://www.nextsource.nl/

Tigi: https://www.tigisolar.com/