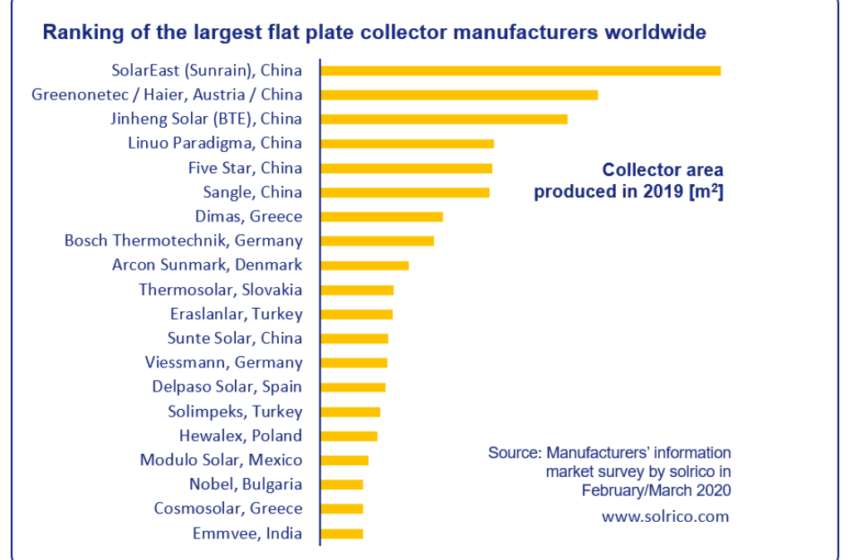

World’s largest flat plate collector manufacturers in 2019

March 20, 2020

One-half of the world’s largest flat plate collector manufacturers participating in the most recent survey expressed satisfaction with how business developed in 2019. One-third achieved production volumes ‘as expected’ and only one-fifth seemed dissatisfied. The large manufacturers again managed to increase production by, on average, 9 %, a slightly higher rate than the 7 % at which output grew the previous year. Their success was the result of demand from China, for flat plate collectors in new high-rise buildings, and from a growing customer base in new markets. The dissatisfied survey participants said barriers to trade included a lack of political support, the hype surrounding PV, and electrification of the heating sector.

Source: solrico / data supplied by manufacturers

The supplier rankings are updated regularly by German consulting firm solrico. The 2019 list is based on a manufacturer survey conducted in February and March. The horizontal axis in the chart was left blank, as a few companies were reluctant to share their production figures publicly. You can view the previous two rankings for 2017 and 2018 by clicking on the hyperlinks in this paragraph. The standard collector type manufactured all over the world consists of an aluminium plate and copper pipes. Only 6 % of the collector area delivered by the surveyed companies (which manufactured 4.6 million m2 in total) included copper sheets. However, its greater corrosion resistance made copper the material of choice for 99 % of all pipes.

The big manufacturers based in China consolidated their market positions and the six companies that took part in both surveys in 2019 and 2018 increased production output by 21 % last year (except for Greenonetec). The top three Chinese businesses were even further ahead of the rest of the field than they had been last year. SolarEast Group (which owns the Sunrain and Micoe brands) observed greater demand for flat plate collectors for use in high-rise buildings in urban areas and Eddy Cheng, Marketing Director of International Sales at Sunrain, said the focus of production had shifted from vacuum tube to flat plate collectors.

Despite seeing strong growth in sales, Haier voiced some dissatisfaction mainly with the margin. “We started running a new automated flat plate collector line in April 2019 and were forced to drop prices to utilise our increased production capacity, especially when selling systems that are to be installed in blocks of flats,” said Xiaolei Wu, Solar Product Manager at Haier.

Jinheng Solar, based in China, has been focused on the production of OEM flat plate collectors under the BTE brand name since its foundation in 2010. As early as 2018, it put up another four production lines equipped with six laser welding and two ultrasonic welding machines at its factory. Its success in China’s overall shrinking market was recognised with a CSTIF award during the association’s meeting last December. By contrast, Five Star saw a slight reduction in its flat plate collector business, since it invested a lot of effort in branching out into solar PV.

Fluctuations in contracting market

Year-on-year fluctuations in the large market for solar field projects affected the business of several surveyed collector producers. Arcon-Sunmark, Denmark’s number one in solar district heating, had a successful year, as it was able to put up 10 SDH fields at home and three abroad, each installed in a different country (China, Latvia and Germany). As a result, it made a big rankings jump from 18th to 9th place. Chinese producer Linuo Paradigma enjoyed significant growth thanks to contracts signed with construction companies in 2018 and completed in 2019 and new customers that it acquired last year. Greek-based Dimas identified rising demand from the United Arab Emirates as one of the main reasons for growing sales in 2019.

Solimpeks, based in Turkey, was in an entirely different situation. It dropped from 8th to 15th place, as a large project, the completion of which was expected in 2019, was postponed to 2020, said Yusuf Akay, Key Account Manager at Solimpeks.

Central European manufacturers face tough times

Apart from Arcon-Sunmark, the collector manufacturers based in central Europe had to, once again, deal with steadily falling demand in core local markets. The five companies in this category, Bosch Thermotechnik, Greenonetec, Hewalex, Thermosolar and Viessmann, cut down production by about 8 % in 2019.

Polish market leader Hewalex had to cope with a double-digit drop in sales following the end of the three-year support scheme for clean heating projects in municipalities and plummeted from 10th to 16th place.

Bosch Thermotechnik sold more or less as much as it did the previous year “because lower sales in European markets as a result of electrification were compensated by higher sales outside Europe,” said Flavio Simoes, International Solar Thermal Product Manager at Bosch. The company has lately been concentrating on collector production in Germany and Brazil and phased out collector production facilities in Portugal, India and China.

Economic tailwinds for Emmvee

As the only Indian company on the list, Emmvee defended its place by reporting a slight increase in production output in 2019, since “many customers found flat plate collectors to be more reliable in an extremely hot climate,” explained T Saritha, Marketing and Branding Manager at Emmvee. The large absorber fin producers from India like Bhagyanagar India are not considered for the rankings which only includes collector manufacturers.

Fierce competition on international markets

Australian-based Solahart and German-based Vaillant are not part of this year’s rankings, since both chose not to answer the survey despite being regular participants in the past. Solahart explained its decision by pointing to increased competition in solar thermal markets around the world and to the fact that competitors could use the survey results to monitor its expansion strategy.

Italian-based Ariston and BDR Thermea from the Netherlands have dropped off the list because of declining sales. Ariston reported a significant decline as the boiler manufacturer shut down its production site in India at the end of 2018. In addition, it was hit hard by the decision of several Caribbean countries to end support for the sector, said Marcello Fratini, Product Manager at Ariston.

Organisations mentioned in this article: