Producers point to forced electrification and cheap natural gas as barriers for solar thermal in the US

August 30, 2023

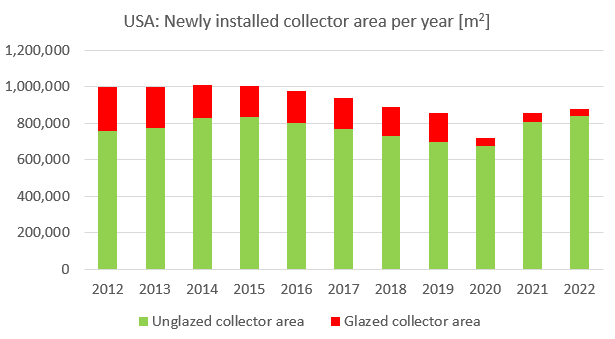

For many years already, solar thermal for residential and commercial use in the United States has been eligible to benefit from Solar Investment Tax Credits (ITC) and diverse federal and regional incentive programmes. However, as Solar Heat Worldwide data shows, over the last year the newly installed flat plate and vacuum tube collector area decreased again by 17 % compared to 2021 and has reached a dramatically low level of only 41,834 m² (red on the chart above). This is almost six times lower than in 2021 (241,700 m2), whereas the unglazed collector market (green parts of the columns in the chart), which is primarily for private pool heating, recovered after the COVID years to a level above 800,000 m2 in 2022. We asked solar thermal system integrators how this negative development in new non-pool heating installations can be explained in times when decarbonization is a declared priority of the US government.

Source: Annual editions of Solar Heat Worldwide

Will Giese from Solaray Corp in Honolulu put it simply: “All markets wax and wane, and solar thermal is no different.” With AET Solar in Florida and Sunearth in California his corporation has two of the leading solar thermal system producers in the country. While Giese acknowledges that Solar Investment Tax Credits is a useful financial tool in incentivizing solar thermal technology in both the residential (section 25D) and commercial (section 48) market segments, he sees external factors influencing their negative development: “Photovoltaic prices have decreased dramatically, as have natural gas prices for domestic hot water heating purposes.”

According to him, water heating energy efficiency programmes have “targeted a wider range of technologies, but mainly heat pumps, which have subtracted from solar thermal’s market share“. Besides this, federal, state and utility run programmes such as the ones from Massachusetts Clean Energy Center and California’s Self-Generation Incentive Program (SGIP) “have decreased solar thermal incentives or did not include solar thermal as an eligible technology at all“. If he is nonetheless optimistic, it is because Solaray´s producing companies AET Solar and SunEarth are “among the few US manufacturers whose solar thermal systems meet domestic content requirements for renewable technologies“. Indeed the 30 % tax credit can be combined with an additional 10 % benefit as a domestic content credit. You will find further background information on ITC prior to and under the Inflation Reduction Act (IRA) in the Quick facts on Solar Investment Tax Credits.

“Solar thermal is not favoured by the regulators”

For Ole Pilgaard, CEO of Heliodyne, a producer of solar hot water systems based in Richmond California, tax credits and incentive schemes have a greater significance for photovoltaics than for solar thermal since “solar thermal is usually not financed by tax credit investors and more often installed by non-profit organizations, who can’t monetize the tax credits“. In addition, the energy market in the US is “highly regulated by the energy and public utility commissions, who are pursuing electrification at an increasing rate“.

The implementation of ordinances, incentives and regulations has put solar water heaters at a disadvantage compared to electric technologies such as photovoltaics and heat pumps, Pilgaard complains. “Although it’s a financially more attractive solution for heating water, solar thermal has historically been linked to natural gas and oil as a back up and therefore not favoured by the regulators.“

Instead of promoting certain technologies through tax credits or grant programmes, Pilgaard thinks it would be “more effective to sanction the use of fossil energy sources through high taxes or fees“. In his opinion, if the market was deregulated “the advantages of solar thermal could prevail over electrically based technologies such as heat pumps and PV”.

Commercial case studies by Heliodyne. Source: Photos from http://www.heliodyne.com/

“US may lead industrial decarbonization”

While Heliodyne stays focused on solar water heating systems for residential and commercial purposes, Solaray Corp also sees opportunities in the market for solar process heat. “Sunearth and AET projects are already underway in the US. As we work towards increasing solar thermal’s market share in the US, we expect this market to expand as well“, Giese said.

SHIP is also one of the key markets for the New York-based company Glasspoint. As Glasspoint CFO Brian Gardner pointed out, SHIP projects are still eligible for tax credits, “but only until the end of 2024“. “We are examining several routes to continue to benefit from tax credit support beyond that date“, he made clear. One way are the advanced energy project tax credits introduced in part 5 of the IRA which cover industrial decarbonisation, is Gardner convinced. “Projects remains explicitly covered which offer at least 20 % decarbonisation for an industrial process and Glasspoint tends to offer its clients 2 to 3 times that level of fossil fuel displacement”, he added.

His colleague and Glasspoint CTO Markus Balz elaborated that the US has “a number of locations with good solar radiation and at the same time many industries with enormous process heat demand“. With an increasing demand for decarbonization based on rising costs for fuel itself or CO2 taxes, regulatory changes and sustainability goals, Balz hopes “the US may lead industrial decarbonization“.

“SHIP is not generally popular and a hard to sell”

Although still benefitting from tax credits, William Guiney, the CEO of Artic Solar from Florida, sees the SHIP opportunities as not generally popular and hard to sell. He cited cheap natural gas prices as “the financial driver for not using solar thermal“. “We are getting inquiries, but companies want a two to three year return on investment, while for solar thermal it is generally three to eight years in most locations“, Guiney explained. His company manufactures a vacuum tube collector with a larger reflector reaching temperatures between 100 and 200 °C, which gives it “many market opportunities for commercial and industrial applications“. Also, he sees “more global companies based in the US looking at SHIP“.

24 PVT collectors on the roof of a hotel in Bakersfield California Photo: Sundrum

“It’s not a great help knowing that the tax credits for process heat will end soon“

For Michael Intrieri from Sundrum Solar in Hudson, Massachusetts, the SHIP Market has “great potential“ but “it will take a while before it becomes a reality“. He sees “two issues slowing adoption down“, with the natural gas price being the most important. “It is three times cheaper than the price a SHIP customer has to pay“, he said and added: “Until corporate executive and plant management salaries are significantly tied to achieving emission goals, the pace will also be slow“.

At the moment, Intrieri is still satisfied with the tax credits for SHIP, but he regrets that within the IRA process heat will be excluded for most solar heat technologies beyond 2024 (see quick facts on ITC). “It’s not a great help knowing that the tax credits for clean process heat will soon end“, he said. He is still optimistic because “Sundrum Solar PVT provides zero-emission heating and electricity from the same system“. And that should still be an eligible opportunity within the ITC scheme even after 2025, he hopes. “Sundrum Solar technology has a great deal of promise in this market“, said Intrieri.

Websites of organizations mentioned in this news article:

Solaray / SunEarth: https://sunearthinc.com

AET: https://www.aetsolar.com

Heliodyne: http://www.heliodyne.com

Glasspoint: https://www.glasspoint.com

Artic Solar: http://www.articsolar.com

Sundrum Solar: https://www.sundrumsolar.com

Solar Heat Worldwide: https://www.iea-shc.org/solar-heat-worldwide

IEA SHC Programme: https://www.iea-shc.org/