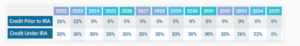

Quick facts on Solar Investment Tax Credits prior to and under the IRA

The federal Solar Investment Tax Credits are an important funding instrument for the solar PV and solar thermal market in the USA. In the current version, set out in tax code section 25d for private individuals and section 48 for commercial customers, the tax credits for solar thermal energy are guaranteed until 2024. The Inflation Reduction Act (IRA) of June 2022 now regulates the renewal of ITCs. Here, the choice of words is often ambiguous. Sometimes “energy” and “solar” are mentioned, which probably includes solar thermal, but in one crucial section of the law the text refers only to “electricity” (see IRA for download below).

Illustration: http://www.fotolia.de

Tax credit regulations for home owners prior to and under the Inflation Reduction Act (IRA)

Source: https://www.seia.org/initiatives/solar-investment-tax-credit-itc

Investment Tax Credits prior to the IRA

The federal Solar Investment Tax Credit (ITC) was introduced in 2006 for solar PV and solar thermal. According to Section 25D of the tax code, individuals profit from a 30 % tax credit and according to section 48, commercial clients are also able to deduct 30 % of the investment costs in their following income tax return. The tax credit is therefore a dollar-for-dollar reduction in the income taxes that a person or a company would otherwise pay the federal government. The ITC scheme has been regularly extended over the last 15 years. The current version of the tax code includes a guarantee of the existence of residential and commercial tax credits up to 2023, but with reduced rates already this year (see table above).

Investment Tax Credits under the IRA

Extension of residential tax credits: The Inflation Reduction Act passed in June actually provides for an extension of the tax credits for a further ten years. This is definitely true for home owners. In part 3 under “Clean Energy Efficiency Incentives for Individuals” the key is the word “energy”, which includes electricity and heat. The IRA says: “The act extends through 2032 the tax credit for nonbusiness (residential) energy property expenditures.” So the full 30 % tax credits can be used until 2032 with a phase out period in 2033 (26 %) and 2024 ( 22%) (see table above).

Extension of commercial tax credits: Part 1 entitled “Clean Electricity and Reducing Carbon Emissions” regulates the extension of tax credits for commercial energy producers. According to section 13102, however, only an extension until the end of 2024 is planned – actually only one year longer than the current version of the ITC. According to the understanding of the solar thermal industry, the decisive sentence here includes solar thermal because of the word “solar” in brackets: “The act extends through 2024 the tax credit for investment in certain energy properties (e.g. solar, fuel cells, waste energy recovery, combined heat and power, small wind property, and microturbine property) and expands the energy properties with storage technology.”

Some of the solar thermal system providers also mention the new “domestic content requirement” in part 1 positively. Commercial solar investors can obtain an additional 10 % tax credit for solar thermal systems that are largely produced locally.

Introduction of advanced energy project tax credits: Part 5 entitled “Investment in Clean Energy Manufacturing and Energy Security” introduces a new application for the 30% tax credits that could be suitable for solar industrial heat projects. The 30 % advanced energy project tax credit should apply to investments in “projects that reequip, expand, or establish certain energy manufacturing facilities for the production or recycling of renewable energy property, energy storage systems and components, or other energy property.” Admittedly, this sentence is not easy to understand, but some US solar thermal suppliers are confident that this paragraph applies to solar process heat systems that decarbonize a significant portion of the factory’s heat.

Introduction of a feed-in tariff: In the press one can often read that the IRA made solar generation projects, for the first time, eligible for production tax credits (PTC), which grant a performance-based incentive at a 2023 rate of 2.75 US-cent/kWh generated over a 10-year period (rates will fluctuate going forward). Applicants can choose between ITC and PTC: whatever gives them a higher revenue stream.

However, if you look at Part 7 of the IRA, this rule clearly only applies to green electricity. It says: “The act creates a new tax credit for the production of clean electricity. The credit is for the sale of domestically produced electricity with a greenhouse gas emission rate not greater than zero. To qualify for the credit, electricity must be produced at a qualifying facility placed in service after 2024.”

This last section clearly disadvantages commercial solar thermal, whose customers will no longer have the opportunity to use tax credits after 2024. However, the manufacturers of PVT assume that this technology will fall under Section 7.

Read more about ITC before and after IRA:

SEIA about ITC

Inflation Reduction Act

Energy.gov