Hopes of improved market framework at the French General State of Solar Heat Conference

July 18, 2023

The French solar thermal industry is confident about 2023. The 10th edition of the recognized annual conference Etats Generaux de la Chaleur Solaire (General State of Solar Heat) counted a record number of participants – 120 in person and more than 500 online. The one-day event was jointly organized by the French syndicate of solar professionals Enerplan, the French energy agency Ademe and the Grand Est region. With guest panellists from all these organizations, discussions covered improvement pathways for support schemes, the heterogeneous solar thermal market development and the biggest barriers that slow market growth. The programme and the presentations are available for download.

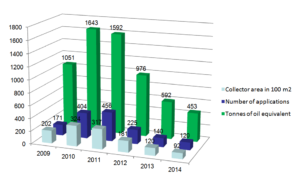

Following the growth dynamic in 2021 with +70 % initiated by new large-scale solar heat plants, the French solar heating market declined by 10 % in 2022 with 49.4 MW installed during the year – equivalent to 70,600 m², according to statistics released by Uniclima and Enerplan. In 2022 only one large collector field with 1,200 m2 started operation at the Timmel tanker cleaning in Beinheim. The 10.5 MW solar heat plant (15,000 m2) at the dairy Lactalis Group in Verdun was under construction in 2022 and did not count for the annual statistics in that year.

Numbers presented by Valérie Laplagne from Uniclima showcased a strong momentum in the individual residential sector (“CESI” and “SSC” in French) with a 45 % increase. The segment of solar hot water for multi-family houses (“ESC collective” in French) grew slightly by 7%.

| 2020 [m2] | 2021 [m2] | 2022 [m2] | Growth 2022/2021 | |

| Single-family houses | 22,530 | 32,100 | 46,500 | 45% |

| Multi-family houses | 23,600 | 21,500 | 22,900 | 7% |

| Total of small systems | 46,130 | 53,600 | 69,400 | +29% |

| Large-scale systems | 0 | 24,680 | 1,200 | -95% |

| Total | 46,130 | 78,280 | 70,600 | -10% |

French market statistics for glazed collectors (flat plate and evacuated tube collectors) between 2020 to 2022. Source: Uniclima and Enerplan

Renewed demand for harmonization of financial incentives

The efficiency of the available supporting frameworks was questioned during round-table discussions, in which industrial professionals and installers met public representatives and researchers. The current support framework for solar heat in France is divided into the Fonds Chaleur, with its tenders for large installations, and MaPrimeRenov (MPR) and Energy Economy Certificates (CEE) for renovation in the residential sector. Since early 2020, the MPR programme has offered incentives to low-income households for installing a variety of energy-saving measures and technologies, such as solar hot water, solar space heating, heat pumps, PV-thermal, biomass boilers, and insulation.

The complex application forms of the Fonds Chaleur, its requirements in terms of certification as well as the long application approval time were quoted as major barriers to market uptake in France. There is a risk that suppliers and clients ditch the scheme before completion. Simplification work is already underway between Enerplan and Ademe for the renewal of the scheme, whose budget increased from EUR 350 million in 2022 to EUR 520 million in 2023 according to Franck Leroy, Director General of the Grand Est region.

As France will submit a new roadmap for the heating sector in 2024 to meet the emission reduction objectives of EU FitFor55 policy, the government is reviewing renewable heat deployment targets, including for solar thermal. Mathilde Pierre from the French Ministry of Energy Transition shared an encouraging agenda. A new government order will align the criteria for CEE and MPR. It will also strengthen the support systems for households to ensure that installations are appropriate. Deployment shares for solar thermal in the Energy Climate Law will be voted on in the autumn, before being set out in the “Pluriannual Programming of Energy” for the period 2024-2033. Official metrics will be known by the end of 2023, but Pierre already expects “the strong deployment to be driven by large-scale installations”, adding that “the Ministry is interested in maximizing the production potential in France, sustaining national industry majors”. Ahead of a national framework, regions such the Grand Est are already setting their goals, with Franck Leroy, President of the region, aiming at “multiplying the share of renewable solar heat by seven within the next 25 years.”

Local administration urged to take action

Another alarming issue was raised by B2C solar installers: the multiple cases of eco fraudsters operating on fake invoices, fake Qualisol certificates and RGE (recognized as an environmental guarantor) renovation labels. Gaël Parrens, representative of Qualit’EnR association, pointed to the financial and confidence losses provoked by this phenomenon. Yet, the number of labelized Qualisol professionals is growing, reaching 2,349 in 2022 according to Qualit’EnR.

Suppliers and installers of solar thermal systems cited a lack of harmony of regional urban codes and certification standards as another barrier to scaling up. Despite initiatives such as the Climaxion platform or Ademe’s SOCOL knowledge being available, local and regional bodies were identified as having major leverage in providing the emerging solar thermal market with both security and visibility.

Many flagship projects operating across France were presented: from SDH systems such as Creutzwald, Narbonne, Chateaubriant and Pons to SHIP projects like those at the Lactalis factory in Verdun and Timmel tanker cleaning in Beinheim. The solar thermal sector needs the numerous successful projects “to be promoted and different technologies to be flagged for low-temperature applications by the government” underlined Hugues Defreville, CEO of Newheat and Vice President of Enerplan.

Successful installations from different sectors. Source: Ademe (Climaxion)

Industry consensus: quality and a sectoral approach will be critical

“Commercial partners are not eager to fill in paperwork, but ready to invest in installation whose payback they can measure” commented Nicolas Dayot, President of the National Federation of Outdoor Hotels. In the light of higher energy prices, functioning and reliable installations will be needed as well as more sector meetings to share feedback and knowhow. Tighter control on applicants is demanded from the administration, but the technology providers are also expected to invest in human capacity and qualification.

Quality and a sectoral approach to clients were agreed to be major success factors for the market uptake. Moran Guillermic from the AtlanSun association pointed out that building interprofessional networks would strengthen credibility and allow projects to be multiplied. To him, success will depend on the development of purposeful solar thermal installations that integrate into the client’s operations and co-exist with competing sources like solar PV or heat pumps in applications where the most value can be added.

With industry majors like Viessmann, rising heat providers such as Newheat, Helioclim (linear Fresnel collector manufacturer), Syrius (flat plate collector producer and installer) and many others, the French industry might well set itself on a steady growth dynamic. Yet, to increase the yearly solar heat production from 1.3 TWh in 2022 to 6 TWh in 2030 as envisaged in the Pluriannual Energy Programming (PPE), much stronger engagement at all levels of the state will be essential.

Installation of Heliolight 4800 collector near Saint Louis, Senegal. Photo: http://www.helioclim.fr/

Companies & organizations mentioned in this article:

Enerplan – https://www.enerplan.asso.fr/energie-solaire-systeme-thermique

Ademe – https://www.ademe.fr/

Grand Est Region – https://www.grandest.fr/

DGEC – https://www.ecologie.gouv.fr/direction-generale-lenergie-et-du-climat-dgec

Uniclima – https://www.uniclima.fr/

National Federation of Outdoor Hotels – https://fnhpa-pro.fr/

AtlanSun – https://www.atlansun.fr/

NewHeat – https://newheat.com/

Viessmann – https://www.viessmann.fr/?

Helioclim – http://www.helioclim.fr/

Syrius – https://syrius-solar.fr/catalogue-produits-composants-accessoires/

SOCOL: https://www.solaire-collectif.fr/

Climaxion: https://www.climaxion.fr/programme-climaxion