Germany: Today’s System Suppliers Wary of Fixed-Price Marketing Campaigns

August 8, 2016

The German solar thermal market is still stuck in recession. Although incentives are higher than they have ever been, demand has not really picked up over the first five months of this year, according to the market statistics by the two associations BSW Solar and BDH. The total collector area sold until the end of May was again down by 5.3 % compared to the previous year, although vacuum tubes have been more strongly affected by the slump (-18 %) than flat plate collectors (-4 %). Installers are viewed as the bottleneck in the supply chain and an increasing number of solar thermal suppliers have run advert campaigns to try and reach end customers on their own. Solarthermalworld.org has already reported on the new end-customer sales strategies employed by Thermondo. This article describes how the campaigns of another German system supplier, Sonnenkraft, have changed over the years. The image depicts an advertisement for the campaign from 2005 (left) and one from 2015 (right).

The German solar thermal market is still stuck in recession. Although incentives are higher than they have ever been, demand has not really picked up over the first five months of this year, according to the market statistics by the two associations BSW Solar and BDH. The total collector area sold until the end of May was again down by 5.3 % compared to the previous year, although vacuum tubes have been more strongly affected by the slump (-18 %) than flat plate collectors (-4 %). Installers are viewed as the bottleneck in the supply chain and an increasing number of solar thermal suppliers have run advert campaigns to try and reach end customers on their own. Solarthermalworld.org has already reported on the new end-customer sales strategies employed by Thermondo. This article describes how the campaigns of another German system supplier, Sonnenkraft, have changed over the years. The image depicts an advertisement for the campaign from 2005 (left) and one from 2015 (right).Image: Sonnenkraft

“In addition to public subsidies, we are currently offering private-sector end customers a voucher carrying a rebate of up to EUR 3,000 depending on the size of the solar system,” explains Karl-Heinz Hartmannsgruber, Member of the Executive Board of Sonnenkraft Germany. The requirements are fairly simple: The end customer must apply for the voucher before the end of this October and the solar system needs to be installed by a Sonnenkraft partner before the end of 2016. The Sonnenkraft subsidy has been promoted on the company´s website and in direct mail campaigns by Sonnenkraft partners as well as on flyers distributed during in-house exhibitions.

2015/16: Marketing campaign promising full margins to installers and no fixed prices

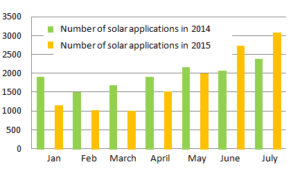

“Our sales force has responded in detail to all customers who applied for a voucher. However, the end customer will be referred to one of our installation partners, which sells the system in the end,” Hartmannsgruber explained. “If we gave the rebate to the installer, he might not pass it on to the customer,” Hartmannsgruber said about the campaign, which was launched in January 2015. By mid-July 2016, the company had sent out 2,500 vouchers. What is important to note is that no end-customer prices have been communicated and there has been no reduction for Sonnenkraft installers in resale price margins, as the end-customer rebate comes out of the marketing budget.

This shows the strong position of plumbers across the supply chain. Nowadays, system suppliers are well advised not to cut the margins of installers or promote end-customer prices in order to avoid installer associations publicly protesting the decision.

2005: Installers covered one-third of systems costs during end-customer marketing campaign

Ten years ago, Sonnenkraft’s end-customer campaigns took quite a different approach. In summer 2005, the company sold solar water heaters and combi systems to end customers at a reduced and fixed price by doubling the public incentive and offering up to 33 special deals, for example, a solar thermal system kit for only EUR 550. The campaign was accompanied by a massive direct mail effort sending advertising materials to around 3 million German households selected by the around 550 Sonnenkraft partners, which joined the campaign and contributed one-third to its around EUR 0.5 million budget.

“The responses from 35,000 interested end customers exceeded our expectations – although 30 % of those were not useful because people just wanted to take part in the competition,” Hartmannsgruber said. In the end, around 20 % of the responses – about 7,000 – turned out to be from prospects.

Obviously, the fixed-price offers reduced installer margins, but the financial losses were offset by the large number of orders. “We had a high booking rate, since our sales team and the installers joined forces to respond to each interested end customer,” Hartmannsgruber, who had been the company’s sales director at that time, explained one of the key elements of the 2005 campaign. The board member recalled that after the boom years of 2008 and 2009, which saw strongly increasing demand for solar thermal installations, the number of responses from end-customer campaigns dropped and installers were no longer motivated to provide capacity and financing.

More information: