Deep insights into solar market development on the global, national and sector-specific levels

August 1, 2023

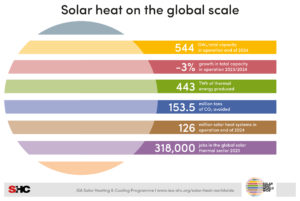

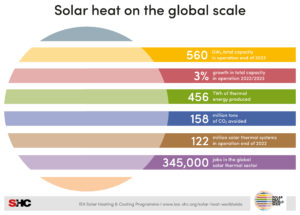

Solar Heat Worldwide 2023 reports mixed growth for solar thermal. While solar thermal markets grew, particularly in Europe, the global market was overshadowed by declines in the two largest markets, China and India. As a result, the global new solar heat capacity in 2022 contracted by 9.3% compared to 2021, totalling 17 GW. For the first time, this year’s report includes a chapter “Outlook 2023 and beyond” highlighting the clear upward trend in solar district heating and solar industrial heat. Published annually by AEE INTEC and the IEA Solar Heating and Cooling Programme, Solar Heat Worldwide has become a well-trusted source of solar thermal data and a go-to reference for international organizations such as REN21 and IRENA. For more key takeaways, click here and download the entire document or listen to the recording of the IEA SHC Solar Academy webinar from June.

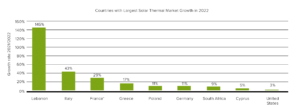

Ranking of fastest growing solar thermal markets 2022

While the report includes very detailed market data on 71 countries for the year 2021, the main growth markets for 2022 are also indicated (see figure 1). The ranking of the fastest growing solar thermal market 2022 is led by Lebanon followed by Italy, France and Greece. Lebanon’s incredible 145 % market growth in 2022 “underscores the power of subsidies and timing”, according to the IEA SHC press release from June 2023. This growth has been mainly driven by the removal of electricity subsidies, the rise in fuel prices and currency depreciation that made solar water heaters an affordable alternative to electric heating.

Figure 1: Reporting countries with the highest growth rates in 2022. The data from France based on the Uniclima report only includes the small-scale sector. Source: Solar Heat Worldwide 2023

Clear upward trend in solar district heating in Europe

In addition to gathering detailed data for national market development, the authors of Solar Heat Worldwide have also built up a comprehensive database of solar district heating (SDH) systems. According to this overview, there were 325 SDH systems worldwide with 1.8 GW in operation at the end of 2022 – including a growing number of systems in China.

The new chapter “Outlook 2023 and beyond” underlines that “increased demand is particularly expected in the district heating sector”. The authors justify this with the fact that more and more policies for renewable heat are being implemented and large solar thermal plants are cost-effective with their heat prices of between 20 and 50 EUR/MWh.

There are SDH systems in the pipeline with 400 to 500 MW according to Solar Heat Worldwide. The report refers to the multi-MW solar heat plants planned in Leipzig, Germany (45.5 MW), in Groningen in the Netherlands (33.6 MW) and in Pristina, Kosovo (40.6 MW). It also quotes the good prospects for the German SDH market published by Solites: “Nine systems representing a collector area of 28,000 m² (19.6 MW) are under construction or in an advanced planning stage. Another 66 systems with a collector area of 454,550 m² (318 MW) are in discussion.”

High fluctuations on the major European PVT markets

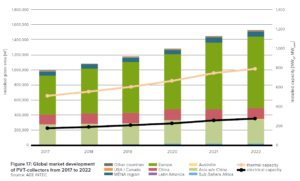

Figure 2: Cumulated PVT collector area in operation in different world regions between 2017 and 2022. Source: Solar Heat Worldwide

Another interesting chapter in the report is about PVT market development. AEE INTEC has been conducting annual surveys of PVT providers worldwide since 2018. This year 43 took part, an increase on the 38 participating technology providers last year. The annual surveys are financially supported by the IEA Solar Heating and Cooling Programme.

When the surveys began in 2017 a little more than 1 million m2 of PVT area was in operation worldwide. This grew to 1.5 million m2 by the end of 2022. Of the global total, the largest share is installed in Europe (62 %), followed by Asia without China (21 %) and China (10 %).

The relatively young national PVT markets still show high fluctuations. Italy (+415%) and Germany (+126%) achieved the highest growth rates in 2022 (see table below).

The Netherlands topped the key PVT markets in 2022. Nevertheless, the participating PVT suppliers reported 19,587 m2 of installed PVT area, a decrease of 43% compared to the previous year. The fluctuations are partly due to the fact that some PVT suppliers do not take part in the survey every year.

France dominated new additions in 2021 with a huge amount of air PVT collectors. This high demand was triggered by the national home renovation subsidy scheme MaPrimeRenov. When air PVT systems were no longer eligible for MaPrimeRenov in 2022, the market collapsed almost completely, resulting in a 90 % decline in PVT sales.

| Newly installed PVT collector area 2021 [m2] | Newly installed PVT collector area 2022 [m2] | Growth 2022/2021 | |

| Netherlands | 34285 | 19587 | -43% |

| Germany | 8430 | 19089 | 126% |

| France | 97165 | 10015 | -90% |

| Spain | 3852 | 5862 | 52% |

| Switzerland | 2390 | 4840 | 103% |

| Italy | 499 | 2568 | 415% |

Top six PVT markets in Europe according to additions in 2022. The figures include glazed and unglazed PVT collectors as well as air-driven PVT collectors. Source: Solar Heat Worldwide 2022 and 2023

Websites of organizations mentioned in this news article:

AEE INTEC: https://www.aee-intec.at/index.php?params=&lang=en

IEA SHC: https://www.iea-shc.org/

Solar Heat Worldwide: https://www.iea-shc.org/solar-heat-worldwide