High interest in PV and heat pumps has reduced collector sales in India

March 14, 2023

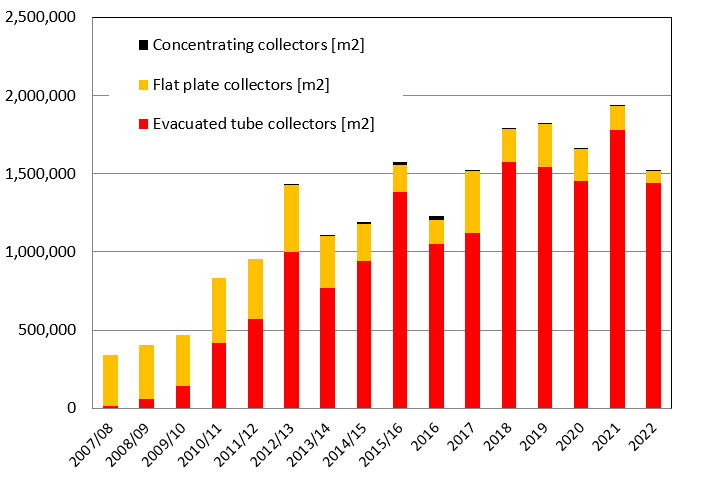

In 2022 the Indian solar thermal industry was hit severely by consumers opting for photovoltaic systems. A survey carried out by the Indian Malaviya Solar Energy Consultancy revealed a sharp decline of 19 % in vacuum tube collector sales and 50 % in flat plate collector sales. Solar thermal system providers sold an estimated 1.06 GWth (1.52 million m2) of glazed collector area in 2022 compared to 1.35 GWth (1.93 million m2) the previous year. Declining PV prices together with the net-metering system made roofs more attractive for solar electricity harvesting. Thermosiphon systems for single-family houses continued to be the main solar thermal application in India. Read as well the news about the market development in India in 2021 and 2020.

Source: Malaviya Solar Energy Consultancy

The market data was based on a survey of the leading solar vacuum tube collector suppliers and the major flat plate and absorber fin collector manufacturers. The following table shows the break-up in terms of number of sold vacuum tubes in the calendar year 2022 according to the size of the tubes. An authorised market research agency that maintains the data on imports of goods into India validated the figures according to import statistics under the four HS codes (84191920, 84199010, 84199090 and 84191910).

| Size of tube | Estimated No. of tubes sold | Share of tube size in the total vacuum tube market | Area per tube m2/tube | Total net area (m2) |

| 47 x 1500 mm | 9,800 | 0.2 % | 0.158 | 1,548 |

| 58 x 1800 mm | 2,889,200 | 56.20 % | 0.261 | 754,081 |

| 58 x 2100 mm | 2,241,300 | 43.60 % | 0.306 | 685,838 |

| Total number of tubes | 5,140,300 | Total absorber area | 1,441,467 |

Data on vacuum tubes imported into India in the calendar year 2022. A little over 5.1 million tubes were sold, totalling around 1.44 million m2 of collector area.

Source: Malaviya Solar Energy Consultancy

Interest in heat pumps is increasing in business and tourism

“The financial attractiveness of photovoltaic systems with a faster return on investment is challenging India’s solar thermal market despite greater awareness from end customers about adopting renewable energy systems”, said consultant Jaideep Malaviya who is also Secretary General of the Solar Thermal Federation of India (STFI). “Heat pumps have been penetrating the commercial and hospitality market quickly due to their simple advantage of 24/7 hot water availability, which is further denting the appeal of solar collectors.”

Karnataka was once again the leading state in 2022, with a market share of over 75% due to the strict mandatory policy for residential buildings it has had since 2007 and also due to rising costs of electrical power.

Most of the solar thermal manufacturers and project developers said there is a lack of policy drive by the government and agreed that the growing attractiveness of rooftop PV has and will further reduce collector sales in India. The net-metering scheme, which started already in 2016, increased interest from end users in PV systems as they can feed solar electricity into the grid for later use. Additionally, a federal subsidy in place since 2021 makes PV investment even more attractive.

Flat plate collector industry might vanish

The flat plate collector market fell drastically by 50% compared to 2021, to a little over 75,000 m2. Only 5% of the newly installed collector area consisted of flat plate collectors, the lowest share for eight years. In the best years 2012/2013 and 2010/2011 around 400,000 m2 of flat plate collector area were sold.

Flat plate collector sales were strong for large commercial heat consumers, but this is exactly the segment where heat pumps have gained market share in recent years. Hence, several industry experts feel sales of flat plate collectors will be limited to niche applications. In fact, they won’t be surprised if the Indian flat plate collector industry vanishes in another five years as material prices rise over time and heat pumps become more and more standard.

Finally a standard for all-glass evacuated tube collector systems is available

Just recently, in December 2022, the Bureau of Indian Standards (BIS) published the long awaited standard for all-glass evacuated tube collector systems (IS 16544) (see document for download attached).

Furthermore, the Ministry of New and Renewable Energy is preparing a quality control order for solar collectors. This will make it mandatory that any solar collector system installed in India, including imported ones, has to pass the BIS certification. Once in place in several months, the order will, to a certain extent, protect consumers from low-quality imported systems and also protect domestic manufacturers, who are facing stiff competition from cheaper imports.

64 concentrating dish collectors with an aperture area of 280 m2 from the Indian manufacturer Quadsun Solar Solutions commissioned in July 2021 at a pharmaceutical producer in southern India Photo: Quadsun Solar Solutions

Small number of new concentrating heat plants

Solar plants using concentrating solar thermal technologies were again small in 2022 owing to lack of policy support. Concentrating solar heat plants with less than 1,000 m2 started operation during 2022 both for industrial and other commercial clients. Industrial companies are looking for sustainable heating solutions owing to high fuel prices, but the high capital cost of solar thermal technologies without financial support makes them less attractive. Even financial institutions are seeking stricter security for any loan borrowed for solar heat plants.

Bharat Shrivathsa, Managing Director of Lanasol explained: “The capital-intensive nature of high-temperature solar thermal technologies will make it difficult to attract investments unless the systems are subsidised, otherwise PV will be the favoured investment.”

The association STFI concludes that electricity supply companies are the biggest beneficiaries of a growing solar thermal market as their peak electricity demand is reduced when electric heating boilers are replaced by solar water heaters. The association plans to share the successful case study of Karnataka state utility with all the state utilities in India and make demands for a financial incentive in the electricity bill to draw end users’ attention to solar water heating options.

“Unless some drastic policy measures mandating solar collectors are announced, the markets will continue to face challenges”, concludes Malaviya in his market assessment.

Organisations mentioned in this news article:

Solar Thermal Federation of India: http://www.stfi.org.in/

Ministry of New and Renewable Energy: https://mnre.gov.in/

Bureau of Indian Standards: https://www.bis.gov.in/

Lanasol: https://www.lanasol.com/