Taiwan and Japan: Commonalities and Differences

October 29, 2015

Taiwan and Japan have more in common as it seems at first glance: Both countries do not only belong to the same world region, but their 2014 market volume was of the same size too – around 100,000 m2 of newly installed collector area. And last but not least, vacuum tubes play only a minor role in both countries. Another factor which Taiwan and Japan have in common: they are hardly in the focus of the global solar thermal industry. One difference, however, is that Taiwan benefits from a support structure, whereas the Japanese industry is on its own – still, both markets are shrinking. The photo shows a larger swimming pool installation with collectors by Japanese manufacturer Chiryu. Photo: Chiryu

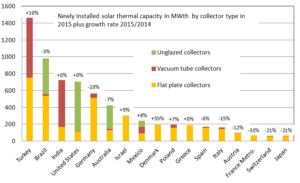

“Solar thermal in Japan has a rather negative outlook, because the government still wants to promote nuclear power,” says Yasuo Okamoto, President of Chiryu. Additionally, the Japanese economy is weak on growth and the price of oil is low. Hence, the flat plate collector manufacturer with over 50 years of history saw annual production volume drop to only 1,200 m2 last year. In better years, such as back in 2010, Chiryu manufactured 5,500 m2. The overall market figures from the around 10 members of the Japanese Solar System Development Association (SSDA) have shown a constant decline since 2011 – the year when Fukushima turned March into a news source on nuclear disaster (see the chart below). After the incident, the industry expected higher demand for solar thermal technology, but Fukushima turned out to be an impetus for solar power generation only. The solar thermal market dropped in 2014 by 14 %, down to 107,654 m2.

The share of each system type has remained fairly constant over the years. Thermosiphon solar water heaters are in the majority, covering between 67 and 76 % of the market. The second-largest group is composed of small pumped systems, which have a market share of between 21 and 29 %. The association only registers vacuum tube collectors in the segment of smaller pumped systems – the share is negligible.

Taiwan: Incentive scheme loses momentum

In contrast to Japan, solar water installations in Taiwan have profited from a national investment grant since 1986. In 2009, the subsidy amount was even doubled to 2,250 Taiwan Dollar (TWD) per m2 for glazed collectors, in order to increase deployment (see table below). It resulted in a peak market volume of 127,751 m2 in 2010. The subsidy covers around 21 % of the investment costs of a residential solar water heater, for which costs have remained fairly stable at around 10,500 NTD /m2. But the 2010 market volume was never to be reached again. “The long-term subsidy scheme has lost its momentum in expanding the market,” researcher Kung-Ming Chung from the Energy Research Center of the National Cheng Kung University (NCKU) concludes in the 2015 paper Incentives to using solar thermal energy in Taiwan (see the attached PDF). “In 2014, end users could submit applications only until the end of November. Many systems received grants only in 2015.”

Figures of newly installed collector area per year, published by the Energy Research Center of the National Cheng Kung University.

The above-mentioned paper describes some particularities of the Taiwanese solar thermal market:

- The rate of households using solar energy for hot water preparation stagnated over the last decade at about 3.5 %, although around 20,000 residential units were newly installed every year. The stagnating numbers are a result of the continuous decrease in Taiwan’s average household size over the years, and today there are around eight million households, one million more than in 2000.

- It is also worth noting that more than 80 % of end users have positive experiences with the solar performance of their systems, and most of them (75 %) would be willing to purchase a solar water heater again. This results in a growing number of replacements after a typical economic life of 15 years.

- Between 2001 and 2013, a total of 279,698 solar thermal units was sold, most of which were residential water heaters of below 10 m2 (57 %) and 41 % had a size of 5 to 10 m2. The researchers only counted 154 systems above 100 m2, which were installed at dormitories, swimming pools or restaurants, and they stress the fact that it will need additional support to win over this commercial segment. Most small and medium enterprises in Taiwan suffer from an insufficient capital base, says Chung. He proposes a support measure that is different from a direct subsidy to end users: Financing in form of a performance-based tariff, which should be provided to Energy Service Companies installing solar thermal systems in the commercial sector.

More information:

NCKU’s Energy Research Center: http://solar.rsh.ncku.edu.tw/ (Chinese only)

National Cheng Kung University (NCKU): http://web.ncku.edu.tw/bin/home.php?Lang=en

Solar System Development Association: http://www.ssda.or.jp/ (Japanese only)

Subsidy scheme in Taiwan

The national subsidy scheme in Taiwan was in place between 2009 and December 2017, however the level of subsidise changed regularly and depended now on the type of solar collector and the location where the collector is installed.

| Country | Taiwan |

| Name of programme | Incentive Measures for Promoting Solar Water Heating Systems in Taiwan |

| Type of incentive | The subsidy is based on the area of solar collector installed. 2,250 New Taiwan Dollar (NTD) per m² (around 50 EUR/m²) |

| Eligible technologies | Solar water heaters |

| Applicable sectors | End-users |

| Amount

|

|

| Maximum incentive | The maximum incentive depends on the system size, it differs from applicant to applicant |

| Requirements for installation | n/a |

| Finance provider | Taiwanese Bureau of Energy of Ministry of Economic Affairs |

| Total funds | n/a |

| Effective date | 2009 |

| Expiry date | 2019 |

| Website | http://www.moeaboe.gov.tw/About/webpage/book_en1/page2.htm

|

| Last review of this tabloid | January 2013 |