Spain´s solar thermal market impacted by various new policies

June 23, 2023

Spain’s solar thermal market contracted again in 2022 by 12 % according to the latest market survey by the solar energy association ASIT. New emerging segments are PVT and solar industrial heat (SHIP). Although sales in these two technologies are still small, sector representatives expect double-digit growth in the years to come. The photo shows the expanded production line of the PVT producer Abora Solar in Zaragosa, Northern Spain. Photo: Abora Solar

Over the last 15 years, Spain’s solar thermal market has been highly dependent on these three words: Technical Building Code (CTE). The CTE obliged housing developers to install solar thermal on new and refurbished buildings. However, after the solar obligation was dropped from the building code at the beginning of 2013, solar thermal is only one of several possible technology choices for the residential hot water demand, along with heat pumps, PV etc. Furthermore, PV has been mandatory for electric users since 2022. Consequently the demand for solar thermal equipment in this classical segment has slowed down.

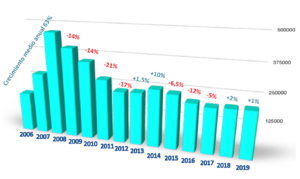

While the market was stable and even growing until 2019, the pandemic and then the legal changes in the CTE have caused a clear contraction in newly installed capacity. After a reduction of 13 % in 2021 the market shrank again by 12 % in 2022 down to 145,500 m2 (102 MW).

According to ASIT´s General Secretary Pascual Polo, previously the CTE was responsible for up to 85 % of the annual sales. He observed that “now many building developers opt for heat pumps which require a lower capex upfront investment, although solar thermal still remains competitive.”

Market development in Spain: the blue columns illustrate the newly installed annual collector area, whereas the green line shows the cumulated installed collector capacity. Source: Annual market report of ASIT (see attached pdf)

New incentives show positive impact in 2023

Despite the clear contraction, Polo demonstrates bomb-proof optimism: “We are starting to notice the effects of the latest Decrees 477 and 1124, which redirect European recovery funds towards solar thermal”.

Polo says that the sector is experiencing a noticeable uptick and the association expects between 5 and 10 % growth this year thanks to the subsidy lines. Royal Decree 477, approved in June 2021 and modified in May 2022, provides direct grants to autonomous communities and cities for incentive programmes related to renewable heat systems in the residential sector. The subsidy averages 40 % of the systems’ costs in most communities. The deadline for submission of applications is 31 December 2023.

The other new Royal Decree 1124 offers two lines:

- Implementation of renewable heat plants in the industrial, agricultural, service, and other sectors of the economy, including the residential sector.

- Implementation of renewable heat plants in non-residential buildings, facilities, and infrastructure of the public sector.

The grants provided by Royal Decrees 1124/2021 will be in effect until 31 December 2023, with an initial budget of EUR 150 million distributed among the different autonomous communities and cities. However according to Polo an extension of the subsidy might be expected. “We are only starting to notice the effects of these budget lines in 2023, as they were not in force last year.”

The first renewable district heating subsidy line which was also part of the big funding package of 2021 did not really benefit solar thermal. According to market insiders only one of the projects submitted by October 2022 included a solar district heating system. Most of the district heating developers come from the biomass and pellet sector and therefore prefer biomass boilers as their decarbonization strategy.

New automated production line at Abora Solar

The PVT market is one of the segments where further growth is expected. Last month, Abora Solar, the main PVT producer in Spain, has commissioned an assembly line to increase its module production. According to Alejandro del Amo, Abora’s CEO, the line will manufacture both PV and PVT in a single, fairly automated line with three robots. “Our production line automates the manufacturing process, producing fully tested panels with a flash test certification in a highly cost-effective way”, said del Amo. The line is set to produce a new generation of covered and insulated PVT collectors which will be launched to the market during 2024 under the name SHE, which stands for Solar Heat & Electricty. The new manufacturing line has been built up using machines already existing in a previous manufacturing line located in Spain. Abora bought the machines two years ago, refurbished and adapted them. The total manufacturing capacity of Abora’s two manufacturing lines is 100.000 panels per year.

Del Amo says that the company will produce around 25,000 m2 of PVT this year. “Our company is experiencing significant growth with annual increases of 300 % to 400 %”, he added. According to the ASIT´s market reports PVT sales added up to 8,000 m2 in Spain in 2021 and 2022. This was 5 % and 6 % of the total new additions in these two years.

Hopes for the effect of Energy Saving Certificates are high

The solar industrial heat market is playing an important role in the expansion of Abora Solar. Del Amo believes that the new Energy Saving Certificates (CAEs) traded since January 2023 are a valuable mechanism to promote energy efficiency by incentivizing energy-saving measures. The certificates represent the achieved energy savings and can be bought and sold on a market. CAEs are generated when investments are made in energy-efficient projects and the funds obtained from selling them are a source of revenue for the investor. “With this refinancing mechanism up to 50 % of the panels can be subsidized. Hopes are high.” concluded del Amo.

Websites of organizations mentioned in this news article:

ASIT

Abora Solar

Solar Keymark

Royal Decree 477

Royal Decree 1124

Energy Certificates CAEs