Market and technology trends in the global PVT sector

June 8, 2024

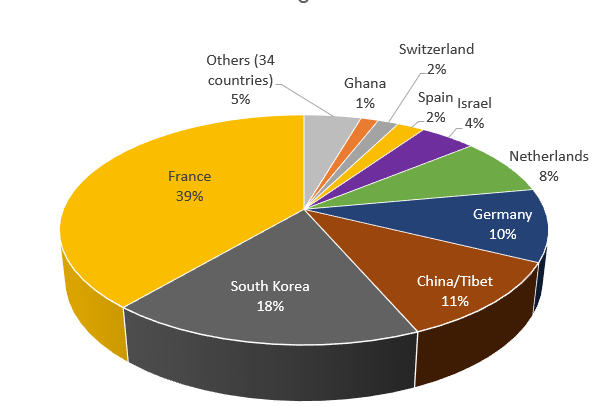

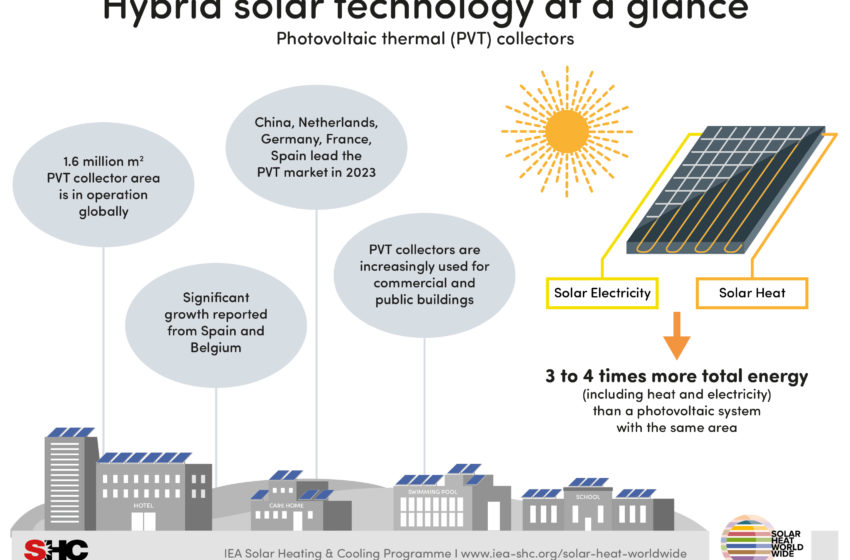

Europe is the leading region worldwide for PVT technology. Of the global 1.6 million m2 of PVT collectors in operation, 64 % are installed in Europe. The leading countries are France, Germany and the Netherlands. The largest PVT markets outside Europe in terms of capacity in operation are South Korea, China and Israel. The majority of the global installed PVT capacity is unglazed collectors (63 %), followed by air PVT collectors (33 %) and uncovered PVT collectors with 4 %. This is data from the recently published Solar Heat Worldwide edition 2024. It includes a specific PVT chapter illustrating major market and technology trends globally based on surveys among PVT collector manufacturers carried out annually since 2017. The IEA Solar Heating and Cooling Programme has supported the PVT surveys since the beginning.

Source: IEA SHC Programme

Figure 1: Proportion of PVT in operation globally in different countries at the end of 2023; the total is almost 1.6 million m2. Solar Heat Worldwide includes PVT market figures from 57 countries. Source: Solar Heat Worldwide edition 2024

Altogether, 46 PVT manufacturers provided sales data between 2017 and 2020. However, not all manufacturers participated in the survey every year. This year’s survey saw a sharp drop in numbers. Only 28 companies provided data compared to 43 companies that participated in the survey a year ago.

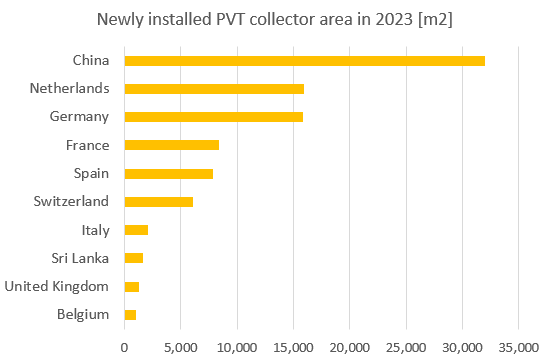

“Some PVT manufacturers have responded to the increased demand for PV technology by mainly focusing on the PV market now. PVT has not been able to capitalize on the PV momentum in all countries”, summarized the authors of the Solar Heat Worldwide report. Consequently, the newly installed PVT area in 2023 (42,143 m2) declined by 30.3 % in relation to the newly installed thermal capacity in 2022. Among the countries with a strong drop were Germany (-22 %) and the Netherlands (-59 %). The fluctuations are partly due to the fact that some PVT suppliers do not take part in the survey every year. High growth rates were reported from Spain (34 %) and Belgium (20 %).

Figure 2: Countries with more than 1,000 m2 of newly installed PVT collector area in 2023

Source: Solar Heat Worldwide edition 2024

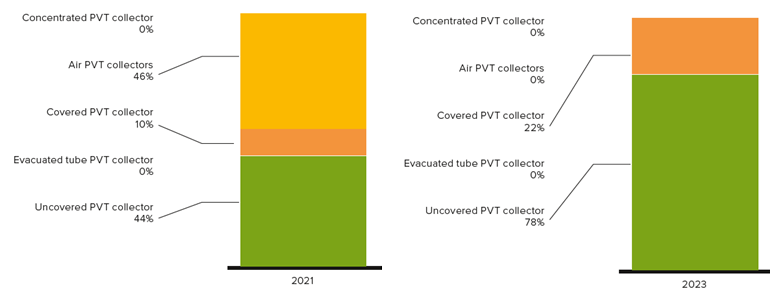

The PVT market shows high fluctuations not only in terms of technology providers, but also in terms of technologies, as can be seen in figure 3. It shows the shares of different PVT collector types in the global market in 2021 and 2023. Air PVT collectors (yellow), which still had a high share of the global market in 2021, will no longer play a role in the following years. This is because PVT technology was no longer included in the French national home renovation subsidy scheme MaPrimeRenov from 2022.

In 2023, it is noticeable that the share of covered PVT collectors (orange) has increased sharply to 22%. This came mainly from the Spanish market, where the manufacturer Abora Solar, which produces a covered PVT collector, has a high market share.

Figure 3: Distribution of newly installed PVT collector area worldwide by collector type

Source: Solar Heat Worldwide edition 2024

Websites of organizations mentioned in this news article:

IEA SHC Programme: https://www.iea-shc.org/

Solar Heat Worldwide: https://www.iea-shc.org/solar-heat-worldwide

AEE INTEC: https://www.aee-intec.at/index.php?params=&lang=en

Abora Solar: https://abora-solar.com/