Cautious optimism for the coming years in Spain

December 17, 2021

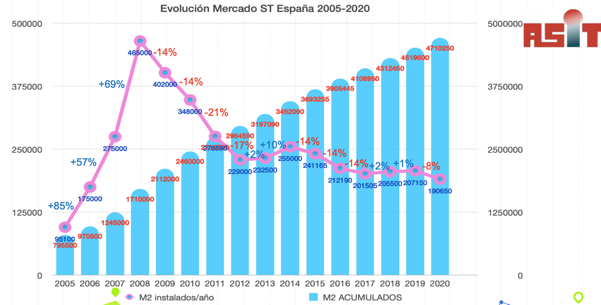

The Spanish residential solar thermal market is showing signs of resurgence. After a decline of 8 % in 2020 due to Covid-19, the market experienced 1 % growth in the first half of 2021, according to the solar thermal association ASIT. Solar PV seems an ever-harder contender, sometimes battling for the same resources as solar thermal such as surface areas, customers or even incentives. Nevertheless, increasing subsidies sourced partly from the European recovery fund suggest an even better outlook for 2022.

Photo: Fabrisolia

Solar thermal in Spain has traditionally been dependent on the real estate and construction segment. This is not without reason as Spain’s CTE building regulations have been the main stabilising factor in a market because the CTE used to require the installation of solar thermal systems to meet some of the hot water demand in new housing and construction projects. Despite a reform in 2019 that dropped the obligation to include solar thermal technologies (now a minimum of 60% to 70% renewable share when meeting hot water needs is required but without mentioning solar thermal specifically), the sector has still managed to maintain market volume in 2021.

During the pandemic year of 2020 a total of 133.5 MWth (190,650 m2) was installed, meaning an 8 % decrease over 2019. However, according to Pascual Polo, ASIT’s President, currently the overall solar thermal market is stabilising and even already experiencing a little growth, “According to our market survey, for the first half of 2021, a 1 % increase compared to the first half of 2020 has been achieved and we expect the market to grow further in the second half of the year,” affirmed Polo.

Evolution of the solar thermal market in Spain: New additions (pink), cumulative (blue)

Source: ASIT

Subsidies may push demand in 2022

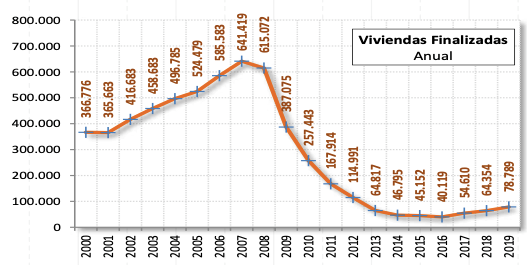

The reasons for a positive outlook in the solar thermal sector come not only from the recovery of the housing construction segment (see chart below) but also from the strongly expected European recovery subsidies. Currently there are two main lines that might help solar thermal technologies:

- The Real Decreto 737/2020 introducing the Energy and Efficiency Building Rehabilitation Programme (PREE), which increased its budget from EUR 40 million in 2020 to around EUR 400 million in 2021. The programme will provide direct subsidies for new solar water heaters, biomass boilers, and heat pumps until 3rd December 2023.

- The Real Decreto 477/2021, which allocates EUR 100 million to renewable heat technologies (solar thermal, biomass, geothermal). However, there is no mandatory share of solar thermal. The calls for projects are gradually published in the regions. In December 2021 the calls in Madrid and Andalusia were launched.

Although these subsidy lines have only recently been implemented or published, their results will start to be seen in 2022. “That is why we are cautiously optimistic about the coming years,” explained Polo. In the case of solar thermal technologies, construction is showing an uptick. Together with the economic growth and the various new subsidy lines this suggests more demand is coming.

Houses built annually in Spain

Source: ASIT

PV hinders solar thermal

Despite some moderate optimism from the industry, the global growth in PV technology seems to be casting a shadow on solar heat. “It is a market overshadowed by photovoltaics. In public speeches I recognise the virtues of this technology, but I insist that the most efficient choice for water heating is solar thermal. It is not logical to heat water with photovoltaics in the summertime” says Polo. He believes that a large number of installers are opting to switch to photovoltaics due to easier installation and that the available rooftop surface is mostly being occupied with PV panels. “Our proposal is that these technologies should coexist or be hybridised and that some space should be left on roofs for solar thermal”. Actually, the latest figures suggest a booming self-consumption PV market. In 2020, despite Covid, solar PV grew a surprising 30 %.

Links

Royal Decree on Incentives: RD 477/2021 https://www.boe.es/boe/dias/2021/06/30/pdfs/BOE-A-2021-10824.pdf

Programme for Building Rehabilitation (FEDER Funds), EUR 402 million budget. https://www.idae.es/ayudas-y-financiacion/para-la-rehabilitacion-de-edif…