Austria: Tough Competition in a Shrinking Market

April 29, 2013

2012 meant shrinking sales figures in the Austrian solar thermal market for the third time in a row. Although most states have increased their subsidies for solar thermal, 2013 does not seem to get any better. Three companies went bankrupt within the last four months. Collector prices on the market are dropping – some call it normal competition or the end of a high price era, others call it dumping. According to the sales data from Austria Solar members, the market shrank by almost 16% in 2012 compared to 2011, reaching about 200,000 m² last year.

The series of insolvencies started on 19 December 2012 with the proceedings of collector manufacturer ESC Energy Systems at the regional court of Klagenfurt. What makes the case of ESC special is that the Managing Director of Austria´s largest collector manufacturer Greenonetec, Robert Kanduth, addressed the creditors in a personal letter. Kanduth let them know that he saw no chance for ESC to succeed again and that a redevelopment plan would not only be hopeless but also be an additional burden for the Austrian solar thermal market. This irritated Greenonetec’s competitors, especially because Kanduth is also the chairman of the industry association Austria Solar. Still, both sides were either not available for a statement or did not like to be quoted on the subject. What about ESC Energy Systems now? The creditors agreed on a 20 % repayment rate in March 2013 and the company is back on track, confirms General Manager Roland Grubelnig.

The latest insolvency on the Austrian solar thermal market was company Geo-Tec. Proceedings started at the regional court of Klagenfurt on 4 April. A redevelopment plan, which is supposed to bring creditors at least 20 % of their money, is under review. Just a few weeks earlier, collector manufacturer Ökotech had had to file for bankruptcy on 19 March. Ökotech had been well-known for supplying collectors to the large-scale projects of engineering company S.O.L.I.D.. For example, Ökotech had produced the collectors for the world´s largest solar cooling plant in Singapore. The company had also displayed a strong social commitment by hiring employees with disabilities.

In addition to the insolvencies of companies specialised in solar, several other companies have stopped their solar activities in Austria as well – for example, Roto Dach- und Solartechnologie. “We are concentrating our efforts on the larger German solar market, which is more important to us,” says Product Manager Bernd Weckesser.

Much of the shrinking of the solar thermal market takes place in the field of standard retrofit systems. In an interview with the installer´s magazine Der Österreichische Installateur, Rupert Hasenöhrl, Managing Director of solar manufacturer Sonnenkraft, has said that the main reason for the drop in sales was market saturation: “In Austria, there are 0.6 m² of collector area installed per inhabitant. We cannot increase this indefinitely, particularly with systems having a life time of 30 years and more.”

Almost all of the Austrian federal states try to answer the decline of the solar industry by increasing their subsidies. In January 2013, Salzburg doubled the grants for the first 6 m2 of collector area from EUR 100 to 200 per m², increasing the subsidy share for hot water systems to 30 %. Vorarlberg has increased the maximum to EUR 3,500, upping subsidies to 30 % for a 15 m² system. Tirol has dropped its income limit for solar subsidies. Only Burgenland has reduced its incentives. So far, the increase in incentives has not shown the results the states had hoped for. According to first estimations by Austria Solar members, the sales in the first quarter of 2013 will be considerably lower than in 2012. Even though this can be partly blamed on bad weather, it would mean the fourth year of decreasing sales in a row.

The remaining competition seems to contribute to sinking market prices in Austria, but specific data is hard to obtain. Some players have accused others of dumping prices, which would drive smaller companies into insolvency. Others call it the “end of the high price era”.

An example of price competition is Tisun, a major collector manufacturer. Instead of lowering prices, Tisun offers its customers an additional service: Every installer in Germany can get a free installation of Tisun collectors throughout 2013, plus an extended warranty. The company states two reasons for the hidden discount. One is that giving out perks instead of direct rebates will avoid compromising quality. The other is that according to Tisun, many installers could very well sell solar collectors, but do not have the time or motivation to install the collectors themselves. Germany is Tisun’s main market and also important to many other Austrian collector manufacturers. Jennifer Bertsch from Tisun’s Marketing Department says that if the German model works well, it might also be an option for other countries, such as Austria.

Despite the harsh market conditions for standard and retrofit systems, there seem to be niches in which solar companies can survive. Company Siko Solar gained a 5 % plus in 2012 compared to the previous year, according to the company’s own data. Even the first quarter of 2013 has seen a small plus, says Managing Director Arthur Sief – not only for the company’s average, including PV and heat pumps, but also specifically for the solar thermal business. According to Sief, the company relies to a great extent on system kits, such as the Kombibox, and on collaborations with architects.

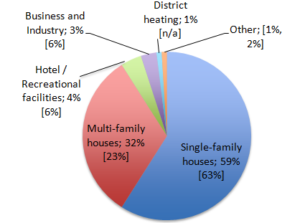

This is very much in line with the statistics provided by Austria Solar: Whereas the retrofit market suffered, the market for new buildings and renovations, for which housing assistance is available, increased by 50 % in 2010 compared to 2009. Assuming that the Austria Solar sales data represents 80 % of the market, there was a total of 231,000 m² of collectors sold in Austria in 2011. The 2012 data shows it close to 200,000 m².

More information:

Austria Solar: http://www.solarwaerme.at

Geo-Tec insolvency (in German only): wirtschaft-aktuell.at/geo-tec-solar-aus-spittal-insolvent/

Ökotech (website in German only): http://www.oekotech.biz

ESC (website in German and English): http://www.estec-solar.at

Greenonetec: http://www.greenonetec.com

Siko: http://www.solar.at

Tisun: http://www.tisun.com