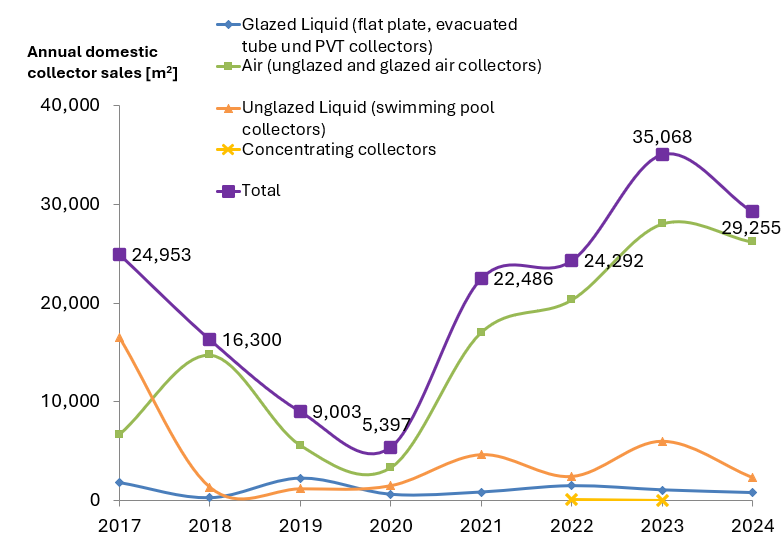

The Canadian solar market declined from its 2023 peak but still outpaced 2022

May 7, 2025

Solar air heating was once again the main application for the solar thermal industry in Canada. 90 % of the newly installed collector area in 2024 was glazed and unglazed air collectors. Good funding conditions in the province of Quebec drove the market. However, the record year 2023 with 28,054 m2 of newly installed solar air collectors (1.96 MW) could not be beaten. The market volume of air heating declined by 7 % compared to 2023, but was still significantly higher than in 2022 (20,336 m2; 1.42 MW). The second strongest segment of the Canadian solar thermal market, solar pool heating, experienced a severe decline of -63%, so that the market across all applications shrank by 17%. These are results from the most recent market survey commissioned by Natural Resources Canada, which took place in January and February 2025. 19 companies reported sales figures. You can find the full market report for download here.

Chart: NRCan

The mood among suppliers of flat-plate and vacuum tube collectors has worsened. Demand has continued to decline as solar water heaters are not explicitly mentioned as one of the eligible technologies within the national Greener Homes Grant programme. Without subsidies for residential solar water heater systems and with the clear focus of the national energy policy on PV and heat pumps, market participants do not expect any improvement here. Two companies have already ceased their sales activities for residential solar thermal systems. One company now focuses only on solar pool heating, the other on export.

“Solar air heating represents the cornerstone of Canada’s solar thermal market, demonstrating strong potential for continued growth. We have also seen growing interest in concentrating solar heat solutions for industrial applications, even though this is at early stages of market development. Solar air and concentrating collectors are good examples of ‘made-in-Canada’ solutions that can support emissions reductions and local clean jobs,” said Lucio Mesquita. He is a Senior Research Engineer at CanmetENERGY Ottawa/Natural Resources Canada and commissioned the study. He also noted the concerning outlook for residential solar water heating and swimming pool heating and added: “We have seen continuing decline and market withdrawals by equipment suppliers in those segments.”

New opportunities emerge

Sales of PVT collectors rose sharply in 2024, however still on a low level and not for all suppliers. Uncovered PVT collectors, which serve as a heat source for a heat pump, were popular, while sales of covered PVT collectors were not necessarily satisfactory.

An estimated 238 m2 of PVT collectors were sold in 2024, mainly for emblematic projects supported by local authorities or state governments.

No new systems were reported with concentrating collectors in 2024. However, in mid-February it was announced that the Canadian company Solarsteam would receive a grant of CAD 2.8 million from the Government of Alberta to build the first demonstration project using its enclosed parabolic trough technology. The project is to be built for water treatment at a factory in Alberta. Once completed, this plant will be one of the few major concentrating collector plants in Canada.

Assessment of certain policies

The survey was also used to ask companies from the solar thermal sector to assess certain policies and their impact on solar thermal sales. Nine companies completed this part of the questionnaire. A clear majority agreed with the two statements that “Green building rating programmes, such as LEED, have a positive impact on solar thermal sales” and “A number of subsidized large solar process heat demonstration plants would stimulate demand for such solutions”.

The two statements on the impact of carbon pricing and Clean Technology Investment (CTI) tax credits were part of both the 2025 and 2024 surveys. This year, significantly more companies agreed that carbon pricing has a positive effect on solar thermal sales figures. The approval rate rose from 27 % to 50 %. The mood has also changed somewhat with regard to CTI tax credits. This year, 44 % of companies agreed that they have a positive impact on sales figures, compared with just 36 % last year.

Websites of organizations mentioned in this news article:

Natural Resources Canada: https://natural-resources.canada.ca/home

Eligible retrofits within the Greener Homes Grant programme: https://natural-resources.canada.ca/energy-efficiency/homes/canada-greener-homes-grant/start-your-energy-efficient-retrofits/plan-document-and-complete-your-home-retrofits/eligible-grants-for-my-home-retrofit/23504

Solarsteam: https://solarsteam.ca/