Successes and challenges on the SHIP world market 2023

April 9, 2024

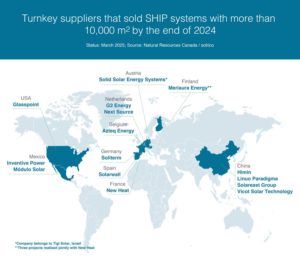

Success and frustration went hand-in-hand on the global solar industrial heat market 2023. Some companies were extremely successful in implementing many small SHIP (Solar Heat for Industrial Processes) projects or a few large ones and met their targets. In general, technology providers around the world are experiencing high demand but the implementation rate is not satisfactory for all companies. “A lot of inquiries, but it takes time to confirm and start the installation,” said one technology provider from China. Another developer from Austria commented in the most recent SHIP world market survey: “Although we had many leads in various countries, we did not close any projects during 2023”. Consequently, there are a lot of changes among the suppliers of solar process heat that are listed on the Turnkey SHIP Supplier World Map. Ten companies will be removed from the updated SHIP World map at the end of April because they have either developed a new portfolio without SHIP or they have closed down. On the other hand, seven new companies will be added that see great potential in the solar process heat market in the years to come. You can also read the news about the results of the SHIP world market survey here. The photo shows the largest linear Fresnel plant installed in 2023. The 6,000 m2 plant provides 220 °C steam to the Heineken beer brewing company in Valencia, Spain. Photo: Solatom

After the update of the World Map at the end of April, 68 companies from 25 countries will be listed. In the pop-up window for each company you will then find the number of SHIP reference projects that the company realized by the end of 2023. A total of 925 SHIP plants with 837 MW will be included on the World Map in this way. Only a few projects are counted twice because two technology suppliers realized the installation together. Please note that solar thermal capacity for the plants mentioned in this article was calculated using the factor 0.7 kW/m2 for all collector types.

Among the top SHIP implementers of the year 2023, with at least ten new SHIP plants, are companies from varies countries:

- The Dutch company G2Energy commissioned 25 systems with flat-plate collectors last year, mostly on animal breeding farms in the Netherlands. The installations with an average surface area of 204 m2 all received a subsidy via the ISDE subsidy programme.

- Modulo Solar registered 15 new projects for 2023 – all with flat-plate collectors for industrial customers. They came from various sectors, including automotive, food and chemicals, and did not receive a subsidy.

- Cona Solar from Austria listed 12 systems with glazed air collectors for agricultural drying; eight of them in Austria, three in Germany and one in Cuba. The installations in Austria and Germany received investment grants from the national subsidy schemes in these countries.

- Solareast Group from China, with its brand Sunrain, realized ten SHIP projects with vacuum tube collectors in the industrial sector last year. The customers came from the food and machinery sectors among others and received no funding. The average size of the projects was 1,583 m2.

- The Dutch company Next Source also reported ten new projects, nine of which were in the animal breeding sector with flat-plate collectors and one project with a PVT collector at an automotive firm. All installations received funding from ISDE subsidy.

The following companies built the largest SHIP capacity in 2023 and were generally satisfied with business development last year:

- The German subsidiary Solarlite of the Belgium company Azteq successfully commissioned two ship plants with parabolic trough collectors totalling 34.3 MW: the field at Heineken in Seville and at Avery Dennison in Belgium.

- The new SHIP capacity of Solarwall Spain in 2023 added up to 14.2 MW of unglazed air collectors including two 7 MW plants at L.Pernia in Seville and Madrid.

- New Heat from France inaugurated a 10.5 MW plant at the Lactalis dairy in Verdun, Northern France.

- As mentioned above, Sunrain reported a new SHIP capacity of 11.1 MW divided into ten projects, all with vacuum tube collectors.

French project developer New Heat planned, built and now operates the 10.5 MW flat plate collector field delivered by Meriaura Energy (formerly Savosolar) from Finland. Together with a 3,000 m3 storage tank the system covers 20 to 30 % of the drying tower’s needs for the dairy in Northern France over the year. Photo taken from a video about the installation: https://www.youtube.com/watch?v=BjDAc1-0P_E&t=1s

Coming and going on the Turnkey SHIP Supplier World Map

It is still challenging to build a sustainable business with SHIP. A project developer from the World Map describes it like this: “Although the SHIP market has demonstrated a high growth potential, the sales cycle for industrial clients has not shortened as we had expected.” The difficult market environment is also reflected in the fact that two companies from the World Map filed for insolvency at the end of 2023 and another company was closed.

The German firm Industrial Solar, a supplier of Fresnel collectors and part of the Swedish Clean Industry Solutions Holding Europe Group, was unable to find an investor during the relatively short period in which salaries could still be paid under German insolvency law. The company was dissolved in February 2024. The French company Idhelio, also a provider of Fresnel collectors, ended its business in November 2023 due to the difficult market situation. The Austrian project developer Solid Solar Energy Systems also filed for insolvency in November 2023. The Austrians were able to find an investor in Tigi Solar from Israel, which took over the company at the beginning of April after it had been largely relieved of debt as a result of the insolvency. Solid’s uninterrupted operations were secured for the last few months and the company remains on the Turnkey SHIP Supplier World Map.

Largest plant from Sunrain in 2023: A 6,000 m2 vacuum tube collector field installed on the factory roof of a state-owned food producer in Xuzhou, China. Photo: Sunrain

Satisfied startups in the field of solar industrial heat

Some of the companies that have been added to the World Map in recent years have been satisfied with the first milestones they have achieved. One example is Heliovis, the Austrian manufacturer of a foil parabolic trough collector in an inflatable tube, which stated in the survey: “We are nearing commissioning of our first commercial project and are developing two further ones. Thus overall progress is very satisfactory.”

Another example is the engineering company Placentino Cia from Argentina, which has observed that “the SHIP idea is taking off in our region”. Under the brand name Friosolar, the company develops multi-MW systems for drying seeds and crops for international companies in Argentina.

When the World Map is updated at the end of April, seven new companies will be added:

- Grammer Solar, German manufacturer of covered air collectors, which is installing more and more systems for agricultural drying.

- Energetyka Solarna Ensol, Polish manufacturer of large-area flat-plate collectors, which have already been used in Austrian SHIP systems.

- Solarus Smart Energy Solutions, Dutch provider of PVT solutions, which restarted in 2020 after a business interruption.

- Soblue, a Swiss manufacturer of PVT elements, which commissioned its first major SHIP system with 530 m2 at an automotive supplier in December 2023

- Suncom, a Dutch supplier of parabolic trough collectors, which commissioned its first project with 50 Sunarc collectors (690 m2) at an agricultural business last year

- Naked Energy, a manufacturer of vacuum tubes with a PVT absorber, which were installed at a poultry farm in the Netherlands in 2023.

- Soleaheat, a Spanish supplier of parabolic trough collectors, which is currently still planning its first demonstration project.

Uncertainty is holding back investor decisions

Looking through the reasons why SHIP suppliers were satisfied or dissatisfied with business development in 2023, it is noticeable that the development of the gas price and uncertainty on future energy markets were often cited as impacting factors. “Customers are cautious because the energy market situation cannot be assessed. Gas prices dropped while interest rates increased,” observed one German company listed on the World Map. Another project developer from Germany stated: “The increasing energy costs had a positive effect on the one hand, but on the other hand the uncertainty made it very difficult to convince clients because uncertainty causes investors to hold back from important decisions.”

The Mexican market, traditionally a strong SHIP market because of its competitiveness, suffered from falling gas prices. “Mexico has very low natural gas prices, which lead to hard negotiations with clients”, mentioned one Mexican project developer in the survey. Another company from Mexico described the dilemma even more precisely: “The price of fuel in Mexico has been decreasing, for example in 2020-2021 the price of LPG was around MXN 14 per litre and in 2023 it was around MXN 9 per litre. Furthermore, our raw materials for manufacturing and installing continuously increased in price.”

Although demand is high, it will therefore continue to be difficult to conclude sales contracts with industrial customers.

Websites of organizations mentioned in this news article:

G2 Energy: https://g2energy.nl/

Modulo Solar: https://modulosolar.com/en/index.html

Cona Solar: https://www.conasolar.com/en/

Solareast Group / Sunrain: https://en.sunrain.com/

Next Source: http://www.nextsource.nl

Solarlite: https://www.solarlite.de/en/

Azteq: https://azteq.be/

Solarwall Spain: https://www.solarwall.com/

New Heat: https://newheat.com/en/

Clean Industry Solutions – CIS: https://cleanindustrysolutions.com/

Solid Solar Energy Systems: https://www.solid.at/en/

Tigi Solar: https://www.tigisolar.com/

Solatom: https://solatom.com/

Heliovis: https://heliovis.com/

Placentino Cia / Friosolar: website under construction

Grammer Solar: https://grammer-solar.com/de/

Energetyka Solarna Ensol: https://www.ensol.pl/en

Solarus Smart Energy Solutions: https://solarus.com/en/homepage/

Soblue: https://www.soblue.com/en/

Suncom: https://suncom-energy.com/

Naked Energy: https://nakedenergy.com/

Solareaheat: website under construction