Solar air heating and drying – an attempt to assess the world market

September 5, 2023

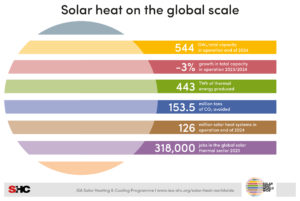

Solar air heating for space heating and drying is one of the most economical uses of solar thermal. The 2,500 m2 unglazed solar air heating façade at Turkish Aerospace Industries in Ankara, for example, will pay for itself in only 2.4 years according to the project developer Solarwall Turkey. Solar heated air at 20 °C is used in the paint workshops. However, solar air heating is rarely reported on and there are few reliable market figures. Solar Heat Worldwide still has the most comprehensive data. It reported a world market excluding China of 21,073 m2 in 2021, a plus of 21 % compared to 2020. Growing demand was reported from Spain and Turkey, and declining market volumes from the USA and Canada. But these figures only partially capture the dynamic development of individual solar air heating providers as not all organizations provide data in the segment of air heating. Photo: Solarwall Türkiye

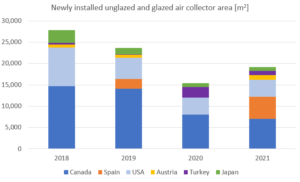

According to Solar Heat Worldwide, the top markets for solar air heating and drying in 2021 were Canada, Spain, the USA, Austria, Turkey and Japan. Sales figures in these five markets are listed in the chart below for the period of 2018 to 2021– based on the four most recent Solar Heat Worldwide studies.

Solar air heating and drying market data taken from the four most recent editions of Solar Heat Worldwide. For the sake of simplicity, the chart does not distinguish between unglazed and glazed air heaters. China has also been one of the key markets for air heating in recent years, but the data is not included in this chart. Source: Solar Heat Worldwide editions 2019 to 2023

Pandemic prevented cross-boarder travel between Canada and the USA

The North American markets (blue and light blue in the chart above) shrank significantly in the period under consideration, whereas markets in Europe, such as Spain and Turkey, gained importance.

John Hollick, President of the company Conserval Engineering – better known under their brand name Solarwall, lists a number of reasons for the declining sales in North America: “The problem has been the lack of national incentives for solar heating in Canada since 2011 and the low natural gas prices, which are most likely the lowest in the developed world”. The situation was made worse by the Pandemic, according to Hollick. It “prevented any cross border travel between Canada and the USA for two years” and “killed the retrofit market” because hardly any visits to jobsites were possible. Conserval profiles and perforates the metal sheets for the façade installation at their factory near Toronto in the province of Ontario.

The company sells its products primarily via architects and installers for space heating of new public buildings as there is an energy-efficiency standard in place for that kind of construction. Things are different in the retrofit market, where there are no requirements to adopt energy-efficiency standards.

Canada: Quebec is a good place to sell solar air heating

Trigo Energies, headquartered in Trois-Rivières in the province of Quebec, has a different view of the North American market. “We profit from great subsidies in Quebec, as solar air systems are supported by several organizations in our province – the electricity utility Hydro Quebec, the gas utility Energir and the Ministry of Natural Resources,” explained Christian Vachon, Vice President Technologies and R&D at Trigo. He assumes that the Canadian market is a lot larger than the numbers from Solar Heat Worldwide show, as not all technology providers report to the national solar thermal survey each year. Natural Resources Canada – the Canadian energy ministry – commissions the regular market survey and then delivers the data to Solar Heat Worldwide.

Trigo Energies currently has nine employees directly involved on planning, engineering and installing solar air heating systems and teams up with several partner contractors to install newly built and retrofit projects. “We are loaded with projects from public and industrial clients”, confirmed Vachon, the majority of them in Quebec.

The market statistics on air collectors in the USA are also most likely not complete. Here, Hollick of Conserval Engineering provides the previous year’s sales figures to Solar Heat Worldwide, indirectly estimating the sales of his competitors, as he confirmed.

Solar air heating façade under construction in 2021 for Ford Otosan, the automotive manufacturer Eskişehir Turkey Photo: Solarwall Turkey

Spain and Turkey: Successful Solarwall licensees

Spain came second after Canada in terms of newly installed air collector area in 2021 with 5,200 m2. The market data from Spain on air collectors is collected by the association ASIT via a survey.

The market leader here is Solarwall Europe, using unglazed collectors partly designed as PVT solutions. The company first came into existence as a southern European sales base for Conserval from Canada around ten years ago. Recently this sales office was transferred into an independent company that has licenses from Conversal in Canada to sell, manufacture and install perforated Solarwall technologies in Europe.

The strong growth of air collectors in Spain in 2021 is due to a 3.5 MW solar air collector drying system commissioned by Solarwall Europe in 2021, partly covered with PV modules, that provide heat for an animal feed factory of L. Pernia located in Castille La Mancha. Currently, Solarwall Europe is building an even larger system for an industrial customer – to be reported on once completed, and other smaller projects in France and Italy.

The background of Solarwall Turkey is similar. Here, too, John Hollick initially founded a sales office, which has since been taken over by Birol Mancuhan as a licensee. Mancuhan is now Chairman of the Board. He can show an extensive list of references. Mancuhan reports two main usages of the Solarwall transpired solar collector manufactured in Turkey. The first is space heating of factory buildings either with existing or new HVACs systems; the second common usage is the integration into processes that have thermal requirements for fresh air intake for drying such as the processing of fruit, vegetables, tobacco, nuts, tea, coffee or malt. The market data from Turkey is reported directly by Solarwall Canada to Solar Heat Worldwide because there is no national association here that does a regular market survey.

The external monitoring of this 219 m2 glazed air collector system on a storage building of the wood chips in Natters, Austria, showed a specific solar yield of 642 kWh/m2 during the summer season, according to Georg Hubmer from the project developer Cona Solar. In winter the system was not in operation Photo: Cona Solar

Austria and Germany: Funding for drying of agricultural and wood products with glazed collectors

Austria is also among the key solar air heating markets worldwide. Here, glazed air collectors are the standard. They are mostly used for drying wood or agricultural products such as grain or feed. Market data on air collectors in Austria is collected via an annual industry survey.

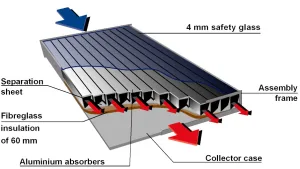

The Austrian company Cona Solar is one of the glazed air collector manufacturers that also develops projects. “We design our systems to operate at a maximum temperature of 60 °C and let the heated air flow directly into the warehouse. Due to the large diameter of the air ducts, we only have a low power consumption for the fans of 2 to 4 kWh per cubic metre of wood chips,” explained Georg Hubmer, Founder and Senior boss at Cona Solar. With this fairly low power consumption, solar air drying achieves an enormous energetic upgrade of an average of 200 kWh per loose cubic meter of wood chips. For the biomass suppliers, also storage times are reduced. The glazed air collector systems are funded by the Austrian Climate and Energy Fund.

In Germany there is also funding for drying agricultural and wood products with glazed air collectors via the Federal Office for Economic Affairs and Export Control (BAFA). Funding used to be through the Market Rebate Programme, now it takes place via the federal funding for Energy and Resource Efficiency in Business (EEW).

Grammer Solar, the market leader for air heating systems in Germany, sees good market potential for its glazed air collectors in the agricultural sector, among others. However, the processing of funding applications by BAFA was slow in 2022. Furthermore, the installed volume of air collectors in Germany is not reported to Solar Heat Worldwide by the German Solar Association: another gap in the world market overview described above. Because unglazed air collectors are not funded by BAFA, the market for this technology in Germany does not exist.

Construction of a glazed air heater from Grammer. Graphic: Grammer Solar

Websites of organizations mentioned in this news article:

Solarwall Türkiye: http://www.solarwall.com.tr

Conserval Engineering: https://www.solarwall.com/

Trigo Energies: http://trigoenergies.com/en/

Solarwall Europe: https://www.solarwallspain.com/

Cona Solar: https://www.conasolar.com/en/

Grammer Solar: https://www.grammer-solar.com/de/