Signs of growth in Indian solar thermal market

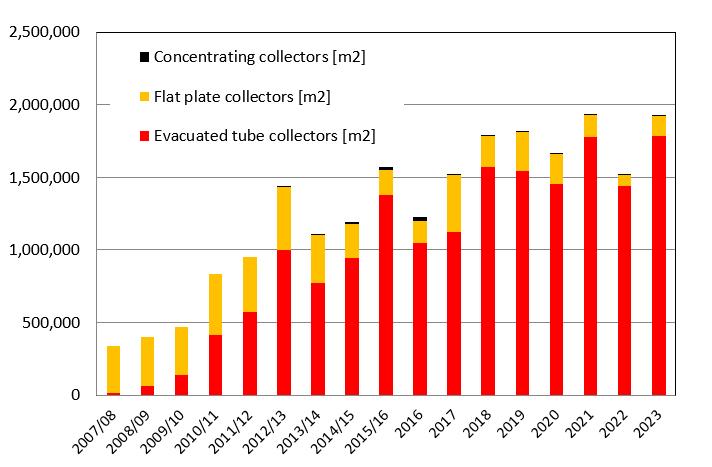

The Indian solar thermal market recovered to a growth path in 2023 that can be largely attributed to overcoming the COVID pandemic. A survey carried out by the Indian Malaviya Solar Energy Consultancy revealed a respectable growth of 24 % in vacuum tube collector sales and 79 % increase in flat plate collector sales compared to 2022. Solar thermal system providers sold an estimated 1.34 GW (1.92 million m2) of glazed collector area in 2023 compared to 1.06 GWth (1.52 million m2) in the previous year. Crashing PV prices together with the net-metering system continue to make the roofs more attractive for solar electricity harvesting. Thermosiphon systems for single-family houses dominate the solar thermal market in India.

Photo: Malaviya Solar Energy Consultancy

The survey was carried out among leading vacuum tube collector suppliers and the major flat plate and absorber fin manufacturers. The following table shows the break-up in terms of number of vacuum tubes sold in the calendar year 2023 according to the size of the tubes. An authorized market research agency that maintains data on imported goods in India validated the figures according to import statistics under the four HS codes (84191920, 84199010, 84199090 and 84191910).

| Size of tube | Estimated No. of tubes sold | Share of tube size among total vacuum tube market | Area per tube (m2) | Total net area (m2) |

| 47 x 1500 mm | 15,937 | 0.25 % | 0.158 | 2,518 |

| 58 x 1800 mm | 3,165,343 | 50 % | 0.261 | 826,155 |

| 58 x 2100 mm | 3,133,638 | 50 % | 0.306 | 958,893 |

| Total number of tubes | 6,314,918 | Total absorber area | 1,787,566 |

Data for vacuum tubes imported to India in the calendar year 2023. A little over 6.3 million tubes were sold, making close to 1.79 million m2 of collector area.

Source: Malaviya Solar Energy Consultancy

The majority of collector manufacturers belonging to the national body Solar Thermal Federation of India attribute this significant growth to the easing of the financial situation post COVID pandemic. But they are sceptical regarding business sustainability in the longer term as PV prices have already crashed and become economical under the net-metering scheme. Power from the grid costs in excess of 8 Indian Rupees (INR) per kWh against the cost of PV electricity at a little over 3 INR/kWh. “Unless solar collectors are bought on the same level playing field as PV, the markets will continue to face challenges”, concluded Consultant Jaideep Malaviya in his market assessment.

Indian solar thermal market 2007 to 2023 divided into collector technologies. Source: Malaviya Solar Energy Consultancy

Flat plate collector industry might vanish

A silver lining is the surge in the flat plate collector market. The country produced 135,065 m2 against 75,572 m2 produced in 2022, a bit more than in 2021 with 151,267 m2. However, the industry is under stress as it does not sell the desired volumes, except wherever pressurized systems are needed. A few commercial organizations are also using flat plate collectors in combination with heat pumps for round-the-clock hot water.

Heat pumps continue their market growth

Heat pumps are witnessing a surge in the commercial and industrial sector. Innovative approaches with higher temperatures are fast becoming commercially attractive to industry, hospitality and hospitals. With the much lower prices for PV it is fast becoming economically viable to have fossil-free heating.

Sathya Kiran, Managing Director of Greentek India, manufacturer of fin-tubes for flat plate collectors said that “the heat pump market is already growing its presence for renewable heating. Once their prices drop in line with PV they will present a tough challenge to solar water heaters owing to their efficiency and round-the-year service.”

Concentrating heat plants on a low level

The area of concentrating collectors sold in 2023 of around 1,100 m2 was slightly higher than in the three previous years – for example 665 m2 in 2022. However, this market remained well below its potential compared to the peak year 2016 with 26,040 m2 of new concentrating collector area due to the investment cost subsidy at the time.

The new systems installed in 2023 with concentrating collectors are being used for very different applications. Quadsun Solar has used its small concentrating dish collectors with only 4 mirrors to create solar process heat for the automotive industry, among other things. The project developer Sunrise CSP has built the first large dish collector with an aperture area of 450 m2 to supply steam to a hospital. There were also 25 small dishes with 16 m2 each installed for cooking in the Ladakh region in Northern India.

Organizations mentioned in this news article:

Solar Thermal Federation of India: http://www.stfi.org.in/

Quadsun Solar: https://www.quadsuntechnology.com/

Greentek India: https://greentekindia.co.in/