Great Britain: Contradictory Results from two Market Surveys

October 4, 2010

A recent survey of UK Solar Trade Association (STA) members has concluded that solar thermal business has dropped dramatically over the last 3 months. Since the arrival of the new UK Coalition Government, the survey found that almost 50% of solar thermal installers are reporting a 75% or greater reduction in business. New jobs are also being affected, with 65% of members considering temporarily leaving the solar thermal sector and 7% leaving permanently (find the full report attached).

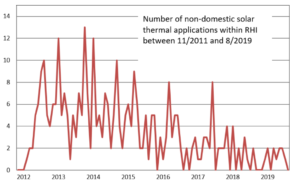

The new Conservation and Liberal Democrat Coalition came into power on 6th May, and by the 24th May had withdrawn the Low Carbon Building Programme (LCBP), which assisted solar thermal with other technologies. This programme was due to run until April 2011. The replacement support scheme, the Renewable Heat Incentive (RHI),is now also uncertain, even though this was intended to equalise the equivalent scheme for electricity: the UK feed-in tariff (Clean Energy Cashback scheme).

The STA believes that this has led to a general unwillingness by the trade and customers to commit to solar thermal projects, which has contrasted strongly with the rapid growth seen in the solar PV market since the inception in April 2010 of the UK feed-in tariff scheme. Since then, the UK’s electricity and gas regulator, Ofgem, has released figures showing that in the past four months PV has significantly overtaken any other renewable energy source, with installations totalling 11.3 MWp since April 1st.

Stuart Cooper of the British company Solfex describes the 2010 solar thermal market as “very stop-start”. “We started off four years ago selling solar thermal equipment, and this is still our stronger area”, explains Cooper. “But we decided to enter the PV market fifteen months ago and did so at the start of this year. It proved to be a very wise decision.” He cites the reason for this as the feed-in tariff scheme, which has meant that for Solfex the PV market is currently the “easier sell” over solar thermal. Solfex are planning to sell at least 5 MWp in 2011.

However, despite the relatively low effect of the redundant LCBP Solfex had a small growth in sales for solar thermal for 2010 although this was “a lot less than we anticipated.” Nonetheless, Cooper claims to be “very optimistic” about the future of solar thermal under the proposed RHI scheme, and is “confident that next year will be a different story for solar thermal in the UK”. When asked whether the UK solar thermal market will be able to survive without the RHI, he answered: “It can, but we are just not going to progress. It is crucial that the RHI is set in stone and quick so people will have a sense of positivity and direction.”

In contrast to the STA, the Heating & Hot Water Industry Council’s (HHIC) market update for August 2010 has reported consistent overall growth in solar thermal sales, especially for flat-plate collectors with sales having risen by 46.6% over the past 12 months (report attached).

This is borne out by the experience of Dave Hall from Grant UK, who states that: Although I have heard that solar thermal is taking a dive we are finding quite the opposite and we have been having record months almost every month this year. Our solar PV is also doing the same with massive growth in this area.” The HHIC is predicting that sales will continue to rise during the “traditionally buoyant” third quarter of the year.

These contradictory results leave the possibility open that STA or HHIC are reporting only on a limited impression of the market.

More information:

Solar Trade Association (STA): http://www.solar-trade.org.uk

Heating & Hot Water Industry Council (HHIC): http://www.centralheating.co.uk