Austria: Low Oil Price and Lack of Political Support Weakens Market

February 15, 2016

According to the ISOL Index by solrico and market data from the industry association Austria Solar, the solar thermal industry is heading into another year of declining markets. Low oil prices and corresponding campaigns of the fossil heating industry have had a substantial impact on this renewable technology. The banner shows the slogan “Heizen mit Öl – das zahlt sich aus” (The Benefits of Using Oil to Heat Your Home) on the website of the Austrian mineral oil industry, which offers grants of EUR 2,500 for the installation of a condensing oil boiler in a single-family building. Austria Solar has also criticised the reduction in the renewable budget of the Austrian Climate and Energy Fund as well as the complicated incentive scheme rules throughout the states. The large-scale project market is what keeps the industry alive.

According to the ISOL Index by solrico and market data from the industry association Austria Solar, the solar thermal industry is heading into another year of declining markets. Low oil prices and corresponding campaigns of the fossil heating industry have had a substantial impact on this renewable technology. The banner shows the slogan “Heizen mit Öl – das zahlt sich aus” (The Benefits of Using Oil to Heat Your Home) on the website of the Austrian mineral oil industry, which offers grants of EUR 2,500 for the installation of a condensing oil boiler in a single-family building. Austria Solar has also criticised the reduction in the renewable budget of the Austrian Climate and Energy Fund as well as the complicated incentive scheme rules throughout the states. The large-scale project market is what keeps the industry alive. Banner: http://www.heizenmitoel.at/

The ISOL Forecast Business Index rose from 24 to 26 points compared to last year´s survey. 80% of the participating companies expect the market to contract in 2016. The reason for the Forecast Business Index being better than a year ago – despite the expected negative growth – can be explained by the outcomes of Austria Solar’s general assembly in November 2015. The company representatives gathered at the event expected a decline of no more than -3 % in 2016. Compared to a -17 % average in 2015, the 2016 figure almost seems like a sign of relief.

Renewable Incentive Schemes Suffer from Budget Cuts

Mischensky added that the solar sector lacked the support of policy makers. The Austrian government’s actions betrayed the climate goals set after the conference in Paris – or more to the point, the government’s inaction, since it is waiting on European directives to be established. And the overall budget of the Climate and Energy Fund, which also provides the funding for federal solar thermal incentives, had EUR 50 million shaved off and went from EUR 130 million in 2015 to EUR 80 million in 2016. Of this money, a mere four million were allocated to solar thermal projects this year (2015: EUR 9.1 million).

Besides this budget cuts, the Austrian solar thermal market is, of course, suffering from the oil price low. “Every renewable heating technology had at least two-digit declines in sales figures in 2015 whilst oil and gas boilers enjoyed a significant plus,” Mischensky said. The mineral oil industry has been underlining their current price advantage by producing image campaigns such as the one mentioned above. The oil industry is using incentives to make out a case for condensing oil boilers. Grants range from EUR 2,500 for single- and two-family homes to more than EUR 5,000 for large buildings with more than eleven units. Low-income households will receive an extra EUR 500.

At the same time, the large utilities are lobbying for air-sourced heat pumps by having adverts on TV, on the radio and in print media.

New Business Models and Initiatives to Combat Market Decline

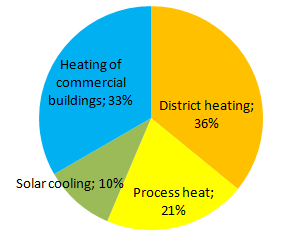

The hope for the solar thermal sector lies in large-scale applications for industrial and district heating, often in combination with biomass boilers. “The industry has finally switched to marketing systems by showing their heat prices per kWh and selling them directly to customers,” Mischensky explained. This had made solar competitive with gas and had led to costs that were significantly lower compared to the single-family home market, which was dominated by the three-tier distribution channel.

Additionally, solar thermal stakeholders have initiated various projects to combat the market decline. An online tool for customers to calculate solar thermal costs per kWh of heat has been programmed and is expected to be published in spring. In September 2015, the confederation of renewable energy associations in Austria, the EEÖ, presented a joint energy strategy, including all renewable energies. The aim is to increase the renewable share to 60 % by 2030 while reducing CO2 emissions by 60 % compared to 1990. The primary factor to consider for such a project would be the carbon price, which would range from EUR 20 per tonne in 2020 to EUR 125 per tonne in 2040, in line with the recommendations by the IEA. Austria has not yet developed a national energy strategy up to 2030. The energy strategy for 2020, which had been created in 2010, was not approved by the council of ministers and many measures have not been employed since. The revenue from the carbon tax was planned to be used to reduce income tax and employee on-costs as well as to finance directly applicable measures in the energy sector.

At the country’s largest energy trade fair, the Energiesparmesse Wels from 26 to 28 February, Solar and five suppliers of ready-to-install solar thermal heating systems will have a shared booth to make people more aware of solar heating. “We are promoting the next generation of solar systems called ‘the SunHeatingSystems’ with a group of innovative companies, among them start-ups such as ruvi and MySolar and the second generation of solar pioneers from Gasokol and Siko,” Mischensky explained. The next-generation initiative is supported by pump manufacturer Wilo Group and the association Solar Home Austria Initiative (Initiative Sonnenhaus Österreich).

More information:

Austria Solar: http://www.solarwaerme.at

ISOL Navigator: http://www.solrico.com/en/isol-navigator/

Austrian Energy Agency: en.energyagency.at/

Energiesparmesse: http://www.energiesparmesse.at

Company and initiatives mentioned in the article:

mysolar.at/

http://www.naturkraftheizung.com (Siko Solar)

Sole Home Austria Initiative: http://www.sonnenhaus.co.at/ (only in German)

Wilo Pumpen: http://www.wilo.de