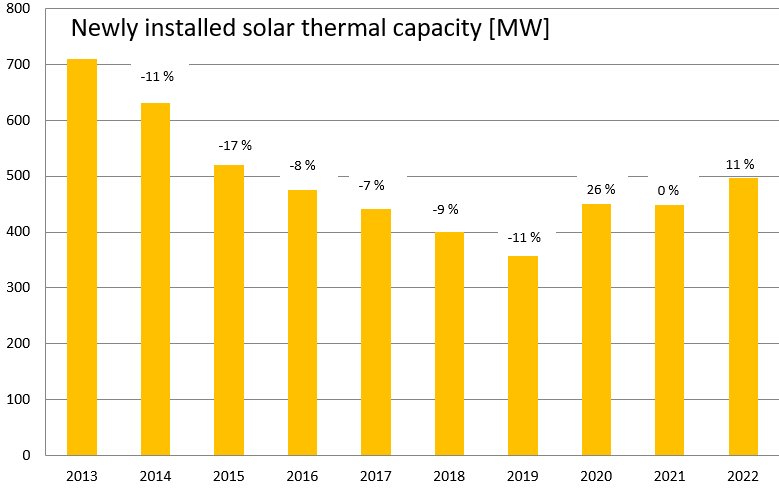

The German solar thermal market only grew slightly in the energy crisis year 2022

February 14, 2023

The German industry associations BSW Solar and BDH have published the market statistics for the German solar thermal market in 2022. With 11 % growth, collector sales developed positively. The newly installed solar thermal capacity in 2022 amounted to 496 MW, up from 448 MW in the previous year (see figure above). A sales boom as a result of the energy crisis did not, however, take place. Some large solar district heating systems went into operation last year and accelerated sales of evacuated tube collectors in particular. The share of evacuated tube collectors in newly installed capacity was 26 % in 2022, significantly higher than in the previous year (18 %).

Source: BSW Solar / BDH statistics

The industry associations calculate that around 91,000 new solar thermal systems were installed. The majority of these systems are small rooftop systems installed by owners of private houses. According to the press release from the associations, large systems accounted for 6 % of the newly installed capacity. Eight plants totalling 30.8 MW (44,000 m2) started operation in 2022.

The German consulting engineer Dietmar Lange attributes the market growth to rising fuel prices. He thinks that the new legislation and subsidy conditions passed by the German government newly elected in September 2021 have not yet had any statistically recognisable market impact.

More than 50 % solar water heater systems

Lange puts the share of hot-water solar systems at more than half of new installations. To estimate this, the long-standing industry observer analysed the sales figures for heat storage systems provided by BSW Solar and BDH. According to these figures, the heating industry sold 111,000 solar storage tanks in 2022. Around 57,000 of these were hot water cylinders. The rest were combi and buffer cylinders for solar space heating systems. Thus the number of solar storage tanks sold exceeded the number of newly installed systems. Industry expert Lange attributes the difference to the fact that many people installed a solar-capable thermal storage tank when modernising their heating system in order to be able to retrofit a solar heating system later. Until mid-August 2022, so-called renewable-ready gas condensing boiler systems that could be retrofitted with solar thermal or other heat generators based on renewable energies within two years were eligible for a grant from the BEG funding programme for energy-efficient buildings.

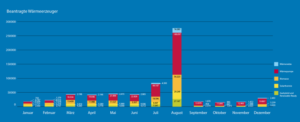

Until August 2022, building owners could also receive subsidies for gas condensing boilers if they installed a gas hybrid heating system coupled with renewable energies. In mid-August, the funding agency ended support for such hybrid systems and also reduced the funding quotas for renewable heating technologies in general. Therefore, there was a boom in applications in August for subsidies under the better, old conditions. Within one month, investors submitted 276,699 applications (see Chart 2), of which 29,249 included the installation of a solar heating system (see figure below).

Breakdown of funding applications by heat generator per month in 2022. Double counting of applications may have occurred where applicants combined solar thermal with biomass boilers. Light blue represents a connection to a heating network, red for heat pumps, orange for biomass boilers, yellow for solar thermal and green for gas-hybrid systems or gas boilers that are renewable ready. Source: BAFA

After that, there was a sharp drop in the number of applications in September, which recovered somewhat in December 2022. In total, the Federal Office of Economics and Export Control (BAFA) received just under 77,000 applications for funding in 2022 that included a solar thermal system. This corresponds to an increase of 75 % compared to the previous year. This growth rate is rather in the lower range, as the comparison in the following table shows. Heat pumps increased the most (429 %) compared to the previous year and access to district heating grids was also very popular (282 %).

| Number of applications 2021 | Number of applications 2022 | Growth 2022/2021 | |

| Access to heat networks | 9,876 | 37,692 | 282% |

| Heat pumps | 65,932 | 348,724 | 429% |

| Biomass boilers | 77,802 | 138,566 | 78% |

| Solar thermal systems | 44,052 | 76,906 | 75% |

| Gas-hybrid and renewable-ready systems | 34,864 | 56,335 | 62% |

| Total | 232,526 | 658,223 | 183% |

Number of applications with different heating technologies in 2021 and 2022 within the subsidy scheme BEG. Source: BAFA

Proportion of vacuum tube collectors is growing

The annual market statistics of the BSW/BDH associations show a continuous increase in vacuum tubes. In 2020, 15 % of the newly installed collector area was vacuum tubes, in 2021 the share was already 18 % and in 2022 it rose to 26 %. This surge in demand is partly due to the large new solar heating plants that used vacuum tube technology in 2022. At the same time, however, home owners have also increasingly turned to evacuated tube collectors.

Economic uncertainty in the construction sector

For the current year, the industry associations again expect a positive market development. In a market survey commissioned by the BSW, 11 % of home owners stated that they intended to invest in solar heating this year. In addition, not all of the solar thermal systems applied for in summer 2022 have been realised yet.

Industry expert Lange is less optimistic about the situation. On the one hand, supply bottlenecks or long delivery times for numerous products persist. On the other hand, demand in the construction and renovation segments has weakened due to the economic uncertainty. Therefore, Lange expects the worsening conditions to have a negative impact on the market development of solar thermal in 2023.

This article will also be published in the German Solar Thermal Year Book which is planned to be published in March 2023. You can order the Year Book here.

Websites of organisations mentioned in this news article:

BDH: https://www.bdh-koeln.de/

BSW Solar: https://www.solarwirtschaft.de/en/home/

Federal subsidy for Efficient Buildings: https://www.bafa.de/DE/Energie/Effiziente_Gebaeude/effiziente_gebaeude_node.html