Turkey: Vacuum Tubes in Residential, Flat Plate in Commercial Segment

May 19, 2017

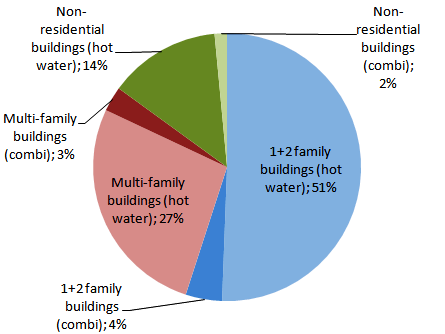

Turkey’s solar thermal market remained strong in 2016. However, sales figures are hardly easy to come by, as there is a formal market, on which businesses offer well-known brands, and an informal one, on which systems are supplied by unregistered small producers. Solar Thermals: Turkey, the latest report on the Turkish market by British consultancy BSRIA has shown that the formal market remained fairly stable last year, with an estimated 1.53 million m² (1.1 GWth) compared to 1.5 million m² in 2015. Owners of residential one- and two-family buildings again accounted for the lion’s share of purchases, as 51 % of all new systems for hot water preparation and a small but growing number of space heating systems were sold to them last year (see the chart above).

Source: BSRIA

The second-largest segment was multi-family property, one mostly supplied by centralised pumped systems. BSRIA expects sales in this segment to increase, as one- and two-family buildings are often replaced by houses offering several individual units. Most of the non-residential segment consists of hotels and leisure centres, followed by educational and healthcare facilities. Flat plate collectors have been used primarily as part of large centralised systems at commercial buildings and multi-family property. The size of commercial systems varies greatly, but will, on average, be between 30 and 100 m². The supply chain is mostly in the hands of Turkish-based flat plate collector manufacturers; the largest brands found on the market last year were Eraslan, Solimpeks, Sergun, Anages, Ezinç and Baymak.

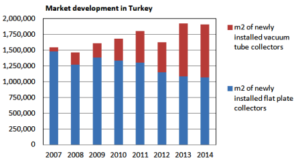

The share of vacuum tubes in new installations increased to 47 % in 2016, up from 40 % the year prior. Vacuum tubes were “popular mostly for residential applications” and there was no significant demand for their commercial use. BSRIA said that “the boost came from marketing campaigns which were run in the country’s colder regions, such as middle and east Anatolia, and promoted vacuum tubes as a more efficient and durable solution in cold weather.” In 2016, vacuum tubes were supplied by Turkey’s three manufacturers Lara Solar, Solarsan and Assolar. They were established after a tax had been imposed on Chinese imports in 2011. BSRIA estimates the domestic market share of Lara Solar and Solarsan to be similar to the one of Assolar, which had a slightly lower market penetration than its two competitors.

One-third of sales in informal sector

Over the last years, Kutay Ülke, who used to be export manager at Ezinç Metal and is working today for Bural Heating, has provided annual sales figures for the entire Turkish market, both the formal and informal one. Ülke´s statistics show that there were 2.1 million m² newly installed in 2015. The informal sector is assumed to make up the difference between this number and the 1.5 million m² researched by BSRIA, so that around one-third of all collectors were supplied by small “backyard producers” from the corresponding region.

The 38-page study Solar Thermals: Turkey can be purchased from BSRIA, a British-based consultancy focused on strategic market research in the building services industry. BSRIA’s report on the Turkish market situation was based on interviews with key stakeholders from the country’s solar thermal market, including solar collector and tank manufacturers. The country reports on solar thermal include comprehensive information on solar thermal market size, broken down by type of collector and system, plus details on segmentation, market trends and drivers, supply structures, distribution and target groups. Similar reports have been available for air conditioning, heating, renewable technology, energy, smart homes, cabling and building controls. BSRIA is headquartered in Bracknell, near London, and engages more than 200 staff.

Websites of organisations mentioned in this news article: