Germany: BSW Solar Presents Solar Heat Roadmap – Finally

July 10, 2012

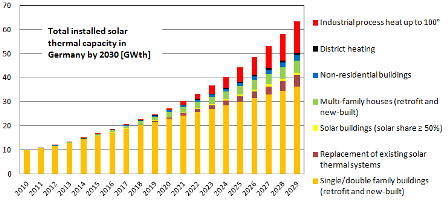

Total installed solar thermal capacity in Germany by 2030

With half a year delay, the German solar industry association Bundesverband Solarwirtschaft (BSW Solar) officially presented its Roadmap for Solar Heat at the Intersolar Europe in June 2012. The roadmap describes scenarios to develop solar thermal in Germany and shows the policies needed to implement them. While the roadmap’s outlook is being criticised for sounding too optimistic, one of the authors, Matthias Reitzenstein, emphasises that the paper is not meant to be a prediction of what will happen but rather a guide about what needs to be done.

With half a year delay, the German solar industry association Bundesverband Solarwirtschaft (BSW Solar) officially presented its Roadmap for Solar Heat at the Intersolar Europe in June 2012. The roadmap describes scenarios to develop solar thermal in Germany and shows the policies needed to implement them. While the roadmap’s outlook is being criticised for sounding too optimistic, one of the authors, Matthias Reitzenstein, emphasises that the paper is not meant to be a prediction of what will happen but rather a guide about what needs to be done.

Chart: Roadmap of Solar Heat, BSW Solar

The study contains three scenarios: “business as usual”, “forced expansion” and “global change”. The main scenario is the “forced expansion” one. In it, the authors make the following assumptions:

- Companies will succeed in significantly reducing the costs of solar thermal systems. Costs will be 14 % lower by 2020 and almost down to half by 2030.

- Prices for fossil fuels keep going up by around 8 % per year. Together with the cost reductions mentioned above, this will lead to a payback time of 3 years for a solar thermal system in 2030.

- There will be an adequate incentive scheme which encourages home owners, as well as factory owners to install solar thermal systems. Like the feed-in tariffs for renewable electricity, this system will not rely on a yearly budget and incentives will decrease over time.

The authors are convinced that if these assumptions come true, solar thermal installations can grow by an average 12.5 % per year, resulting in a total installed collector area of 39 million m2 (27 GWth) by 2020 and 99 million m2 (69 GWth) by 2030. While the classic segment of single and two-family houses would remain the main driver in the near future, solar process heat would become more important in the medium- and long-term outlook. By 2020, solar heat would cover 0.4 % of the process heat demand at temperatures below 100 °C, which is equivalent to 1 million m2 of collector area. By 2030, the share would be 10 % or 19.6 million m².

Reitzenstein thinks that more political support for solar heat is realistic as solar thermal technology plays a crucial role in meeting the climate goals and that rising fuel prices do cause some urge to take action. But, he also points out: “If the assumptions do not become reality, the market will not develop the way that we indicated.”

Well, that is exactly what several people believe will happen. In the magazine of the German Solar Energy Society (DGS), Sonnenenergie, journalist Klaus Oberzig strongly criticises the roadmap for not focussing enough on what solar companies have to do themselves. “It seems as somebody has just dreamed up a world that is just as he wants it to be,” writes Oberzig, a man with intimate knowledge of the heating sector. Consultant Dietmar Lange shares Oberzig’s doubts about the rapid growth scenario. “The scenario is based on many optimistic assumptions. One of them is that solar thermal will become a political priority over other renewables and energy efficiency. Nothing right now leads me to believe this will happen”.

Another subject of discussion is the potential of solar process heat and solar district heating. The potential for process heat below 100 °C assumed in the roadmap (22 TWh) is higher than the potential stated in a recently published and detailed study by Kassel University: 16 TWh for process heat below 250°C. At the same time, the stated potential for solar district heating in the roadmap 0.6 TWh in 2030 is significantly lower than the potential assumed in the pilot study by the German Federal Environment Ministry from 2011, which estimated a district heating volume of 14.7 TWh/a for 2030.

Reitzenstein adds: “No matter how big the figures are exactly: compared to the sold collector area, the potential is huge. It is not the potential in square meters or kilowatt hours which limits the market for solar thermal, but there are other obstacles, such as market insight, cost efficiency and tailor-made system solutions. So, the most important thing is to get the market started at all.”

Download the preliminary version of the roadmap (so far in German only)

Brief version

Full version