“Demonstrate that your business model is scalable”

March 17, 2014

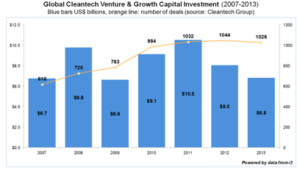

Solar thermal technology is said to offer enormous potential over the coming decades. However, to grow and develop a technology, you need investments, and these investments are hard to come by for the solar thermal sector. Investors don’t know much about the solar thermal sector and the sector hasn’t had much experience with investors either. Nicholas Atkins was the only representative from the cleantech venture capital market to participate in the international industry conference. He felt like a “fish out of water” as a panellist at SMEThermal 2014, which took place in Berlin, Germany, in February. The partner of Georgieff Capital Advisors listed some do’s and don´ts when start-up companies address potential investors.

Solar thermal technology is said to offer enormous potential over the coming decades. However, to grow and develop a technology, you need investments, and these investments are hard to come by for the solar thermal sector. Investors don’t know much about the solar thermal sector and the sector hasn’t had much experience with investors either. Nicholas Atkins was the only representative from the cleantech venture capital market to participate in the international industry conference. He felt like a “fish out of water” as a panellist at SMEThermal 2014, which took place in Berlin, Germany, in February. The partner of Georgieff Capital Advisors listed some do’s and don´ts when start-up companies address potential investors. Photo: Stephanie Banse

- Be clear on what you need and what you are looking for in terms of capital. Allow plenty of time to raise capital and do not start the process when cash is going to run out in just three months, because you will not succeed.

- Target the right type of investors: Focus your search on investors which invest in your type of business and your stage of development. Use advisers to help introduce you to the right investors. Any blank approach is a waste of your time – and, at the same time, you will still have to run your business.

- Keep competition going. Keep all options on the table. Even if one investor signs a term sheet, do not stop talking to the others, because things can go wrong at the last minute.

- Put together a good business plan: Investors are looking for unique, proven and defensible technology companies. So emphasise clearly whatever is the intellectual property of your company and go into details. It may be the technology or the know-how. Obviously, the management team is key, so if you have a great team, not just one person, then add the personal track-records of your management team.

- Demonstrate that your business model is scalable: Of course, it is important to show that you can expand and grow quickly. Present partnerships or distributors elsewhere in the world who can help roll out your products and services. They should offer a big market opportunity. If your company is addressing a EUR 10 million market, it will not really excite any investor.

- Create a capital-light business model: Obviously, go for very capital-light business models based on know-how, design or technology. If you do not need to make it yourself, do not make it – hence, subcontract manufacturing. It is much more attractive for the investor if you keep your business model capital-efficient.

- Demonstrate attractive return to the investors: Overall, you have to present a business plan which provides attractive returns to the investors, as they will want to have an exit in three to seven years’ time. When you put together the financial forecast, be ambitious, but be realistic, too, and leave something on the table, because a crazy hockey-stick forecast – flat in the previous years and then a magically steep growth – does not do anything to help improve your evaluation – quite the opposite.

For more information:

Nicholas Atkins, Partner, Georgieff Capital Advisors