Webinar: New Business Models for Commercial Solar Thermal Applications

June 29, 2015

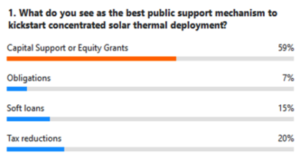

The solar thermal industry is facing a great challenge in entering new commercial solar thermal markets, be it tourism, solar process heat or large solar district heating. It needs new business models to convince commercial customers to use or to invest in solar thermal. A webinar jointly organised by International Solar Energy Society (ISES) and solarthermalworld.org on 23 June 2015 thoroughly analysed the current situation during presentations by the International Renewable Energy Agency (IRENA) and three turnkey system suppliers: Industrial Solar, Germany, S.O.L.I.D., Austria, and Nextility, USA (find all four presentations attached to this news article). One thing to take away from the webinar was: Financing is a crucial bottleneck for large-scale turnkey system suppliers.

The solar thermal industry is facing a great challenge in entering new commercial solar thermal markets, be it tourism, solar process heat or large solar district heating. It needs new business models to convince commercial customers to use or to invest in solar thermal. A webinar jointly organised by International Solar Energy Society (ISES) and solarthermalworld.org on 23 June 2015 thoroughly analysed the current situation during presentations by the International Renewable Energy Agency (IRENA) and three turnkey system suppliers: Industrial Solar, Germany, S.O.L.I.D., Austria, and Nextility, USA (find all four presentations attached to this news article). One thing to take away from the webinar was: Financing is a crucial bottleneck for large-scale turnkey system suppliers.Commercial applications are gaining momentum, as was underlined by Industrial Solar, a provider of solar concentrating plants with Fresnel collectors: Over the last years, the company received requests for about 1.3 GW of industrial systems alone. Despite the good market environment, many complementary factors often still reduce the willingness of customers to invest their own money in such solutions: Risks of a not very well-known technology (e.g., uncertainty about O&M costs), missing experience of proven benefit and saving, as well as competition with budget requests from core business.

Don’t be afraid of O&M

Actually, field experiences of large-scale solar thermal plants show that such systems have been easy to handle and maintain, making O&M costs not a great concern. Or to say it in the words of Christian Holter, Managing Director of S.O.L.I.D: “In many projects, O&M costs have been so low that it has even been hard to calculate them.” In S.O.L.I.D’s experience, in large plants above 5,000 m2 these costs are less than expectations and calculations and they never exceed 5 % of the annual revenues by the system.

A key point is that a solar thermal plant shows fixed costs for monitoring, management, insurance, reporting, customer care, metering and legal issues, meaning that small systems with annual revenues of some thousand euros are a challenge in continuous cost coverage, and their budget can sometimes not even cover repairs. But that also means that for large plants, O&M costs as well as financial and administrative burdens become less significant.

All speakers agreed on the fact that keeping O&M costs low is inextricably linked to a detailed remote monitoring system, which uses an automated alarm messaging system to detect and report defects when they arise and, therefore, prevent underachievement and – more importantly – failures that would mean the replacement of components. “We monitor the performance of over 250 solar thermal systems in multi-family buildings 24/7 with automatic flagging of maintenance issues,” David Hoedeman, Business Development Manager at Nextility, confirmed. Such monitoring also allows for providing the customer with a detailed report on plant performance.

One major finding was that many simple problems arise from the solar section behind the interface, which can significantly reduce performance. “Solving these problems in the start-up phase through an optimisation of the operation can increase project revenue by up to 20 %,” Holter confirmed. It is clear that such high-tech monitoring and maintenance can be cost-effective only in combination with a large portfolio of relevant projects.

ESCO models work

One possible model to overcome many of the above-listed barriers is an ESCO solution, in which an energy service provider invests and through which it sells the produced solar heat to the customer. This model, used by both Nextility for residential multi-family buildings and S.O.L.I.D., e.g., for solar cooling, was initially seen as a sales-supporting strategy, but has now become a business in its own right, since it ensures long-term O&M contracts and revenues after the break-even point.

In addition, the service provider has the chance to continuously learn about technology performance and has a personal interest in optimising the system to maximise plant operation income.

Real-life ESCO experiences have shown that large solar projects can be financed over a period of 10 to 15 years and have proved to be safe investments with good economic performance. Nevertheless, dependency on a single customer – for instance, an industrial site buying the solar heat – can be risky, especially in this phase of economic instability, meaning it will require appropriate legal provisions and a risk management plan.

Change your view on payback periods

The speakers demonstrated that, as with other types of investment, the Internal Rate of Return (IRR) seems to be the most appropriate parameter to evaluate economic feasibility of a large plant at a glance. It can be defined as the discount rate at which the sum of discounted future cash flows becomes zero and, hence, equals the initial investment.

Despite the clear-cut parameter, many potential customers, especially in the industrial sector, still focus on payback periods and look for investments with a payback period of 3 to 5 years which is not very common among large solar thermal systems. Tobias Schwind, Managing Director of Industrial Solar, stressed that “fortunately, this view is changing, since many customers are realising that investments in green energy should span over a longer period than the ones for core business.” The result is that a payback period of 5 to 7 years is now often considered acceptable and, in some cases, even values below 10 are seen as feasible by investors.

Is it really large?

A solar thermal plant of 1,000 m², which is definitely considered a large system by solar professionals, means an investment of about EUR 500,000, which is regarded as absurd by potential investors, since they usually talk in terms of millions of euros. Hence, it is obvious that the two sides have completely different views on financing and solar thermal may additionally be one of the lesser-known technologies among banks and financing institutions, even among the ones more keen on investing in renewables.

To get investors to support large solar thermal projects, some prerequisites are needed: A certain amount of equity (for instance, 50 % of the total investment), availability of real performance data for similar systems and a contract allowing the parties to leverage all risks regarding performance degradation, customer bankruptcy, etc. Holter recommends finding medium-size investors to come in direct contact with in-house decision makers, who put their trust in the technology.