Supply chain constraints in concentrating solar thermal

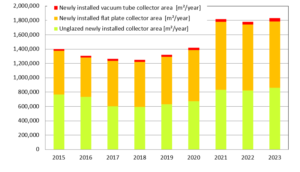

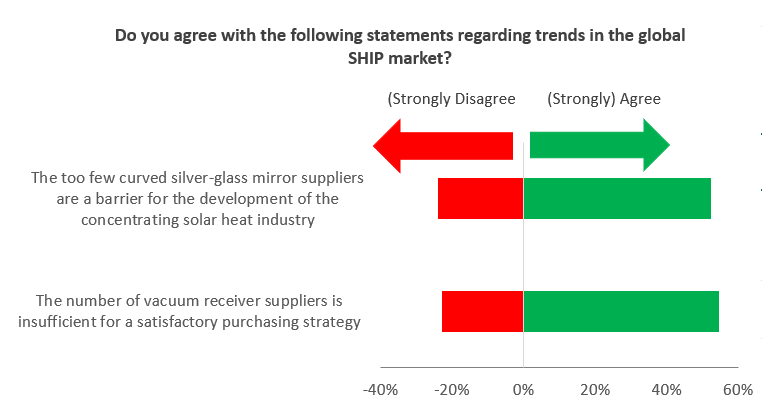

The demand for heat above 100 °C in industry is huge. More and more project developers offer solutions with concentrating collectors that can provide heat between 100 and 400 °C. On the regularly updated World Map of SHIP Turnkey Suppliers, the number of concentrating collector providers has now grown to 27. In the last survey in March 2023, we asked these suppliers what they think about the supply chain constraints for the two key components of concentrating collectors – the receivers and the mirrors. More than half of the 23 companies that answered these questions (strongly) agreed that there are too few silver-glass mirror suppliers and that the number of vacuum receiver manufacturers is not enough for a satisfactory purchasing strategy (see chart above). You can also read other news articles about the survey results here. Figure: solrico / source: Survey 2023 among the companies listed on the Turnkey SHIP Supplier World Map

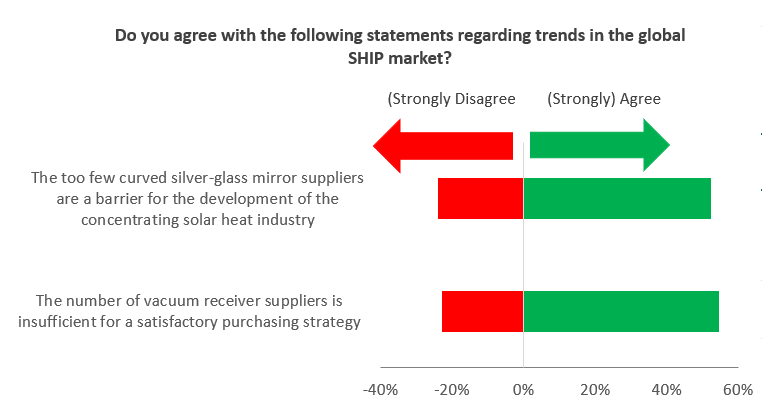

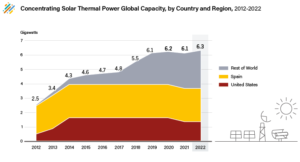

The reason for the low number of suppliers is the slow development of the concentrating solar power (CSP) market, which has influenced the demand for receivers and mirrors over the past ten years. After a boom in the early 2010s in the USA and Spain, the markets developed very slowly and only small CSP capacities have been added globally each year (see chart below).

The cumulated capacity of concentrating solar power has only grown in very small steps over the last 10 years Source: Renewables 2023. Global Status Report, Energy Supply of REN21

Only a few experienced vacuum receiver manufacturers

The weak demand has led to a concentration of component manufacturers. For example, Rioglass Solar first took over receiver manufacturing from Siemens in 2013 and then the vacuum tube technology from the German company Schott Solar CSP in December 2015. This makes Rioglass Solar the only receiver manufacturer outside China today. In the People’s Republic there are at least two established manufacturers: Huiyin Group and Himin Solar, who have already proven their receivers for international projects. As China is the cradle of glass tube coating technology, there are certainly other vacuum receiver manufacturers, but their quality is difficult to verify. Jeroen van Schijndel, Chief Sales & Marketing Officer at Rioglass Solar, also assumes that “several European and US suppliers will come back to this market if there is demand. It is, therefore, a demand problem and not a supply problem that creates this perceived restriction in the supply chain.”

According to Dirk Krüger from the German Aerospace Center (DLR), the glass-metal transition in receiver production is a particular challenge. Since the absorbers of receivers in parabolic trough and Fresnel collectors usually expand more than the glass envelope during operation, bellows have to be bonded to the glass tube to allow thermal expansion compensation. The glass envelope and metal bellows need to be welded to each other to maintain the vacuum. The surfaces at the connection must be treated in several steps and the glass and metal alloy types must be matched so that they have the same coefficient of expansion.

An evacuated receiver with the glass-metal connection and the bellows for the thermal expansion compensation Photo: Rioglass Solar

Bottleneck in supplies of tubes for non-evacuated receivers

But now let’s look at the situation of the companies that (strongly) disagree with a shortage of vacuum receiver supply. Among them are two dish technology providers, who do not see a shortage of receivers, as they use point-source non-evacuated receivers that they can buy from various suppliers. In addition, some companies ticked “disagree”, as they do not use evacuated tube receivers. In this case, they can purchase a coated metal tube and assemble the receiver themselves.

One technology provider argued that at operating temperatures of up to 200 °C there is no need to use evacuated receivers. He justifies this by saying that the thermal energy losses through convection at these temperatures are no higher than the losses through contamination and reflection on the glass surface of vacuum tubes.

But with coated metal tubes for atmospheric receivers, there is also a new bottleneck. The Swiss company Energie Solaire has announced that it will stop producing black-chrome-coated metal tubes, which have so far been used in non-evacuated receivers. The reason for this is high investments in order to comply with environmental standards of production in the future, as Wolfgang Thiele, Managing Director of Energie Solaire explained.

“No need to purchase from Asia”

For mirrors the supply situation is not much different to that of receivers. For curved silver-glass mirrors, Rioglass Solar is again the only manufacturer in Europe. The Japanese Group Asahi offers flat mirrors from its factory in Belgium. These are the only two suppliers outside China. Against this background, it is understandable that a majority of the suppliers of concentrating collector systems confirm supply chain constraints.

Here, too, a number of companies objected to the survey. First of all, Rioglass Solar itself. Project Director Pablo Del Prado filled out the questionnaire and clearly contradicted the two theses. “The capacity for producing curved solar mirrors and vacuum receivers in Europe is more than enough. There is no bottleneck and no need to source these key components in Asia. Rioglass Solar runs two factories in Spain, one for curved and flat solar mirrors and one for vacuum receivers.”

In addition, there are system providers whose concentrating collectors have aluminium-sheet-based mirrors, which makes them independent of the supposed bottleneck with silver-glass mirrors. These include, for example, the US-American company Glasspoint and Absolicon from Sweden. Both use an enclosure structure to protect the aluminium mirrors from dirt and moisture. Since highly reflective aluminium sheets are also used in the lighting industry, there are several suppliers here. Well-known in Europe are the Italian Almeco Group and the German Alanod, who also offer coated absorbers for flat-plate and vacuum tube collectors. “We cooperate with Alanod and Almeco, but also with others. We have four potential suppliers for our aluminium mirrors”, said Carlo Semeraro, Chief Sales Officer of Absolicon, explaining why he disagreed with the supply chain restraints asked about in the survey.

But there are also other voices that do not see a negative impact for solar industrial heat market development, for example Philip Gleckmann. The Managing Director of Sunvapor in the USA confirms that there are “very few hot curved mirror manufacturers; however, that is not a barrier to the growth of concentrating solar thermal”.

Silver-glass mirrors consist of three layers as standard: a copper structural layer with a silver reflective layer on the front and three coats of protective paint on the back, assuring long-term durability. The copper layer also prevents corrosion of the silver layer. Photo: Protarget

Websites of organisations mentioned in this news article:

Rioglass Solar: https://rioglass.com/en/

SHIP Turnkey Supplier World Map: https://www.solar-payback.com/suppliers/

German Aerospace Center: https://www.dlr.de/sf

REN21: https://www.ren21.net/

Energie Solaire: https://de.energie-solaire.com/

Huiyin Group: http://www.huiyin-group.com/eindex.aspx

Himin Solar: http://www.himinsun.com/

Glasspoint: https://www.glasspoint.com/www.

Absolicon: https://www.absolicon.com/

Sunvapor: https://www.sunvapor.net/

Protarget: https://protarget-ag.com/