New dynamism on the Canadian solar thermal market

May 9, 2024

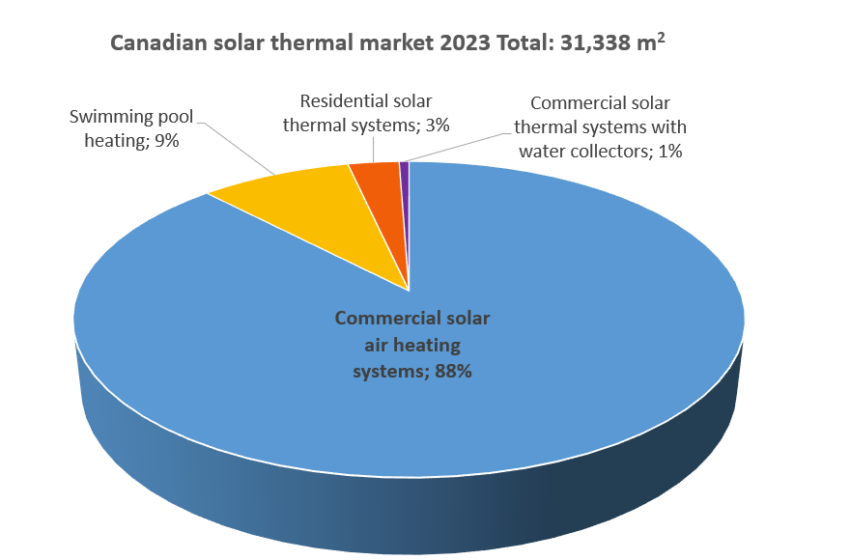

Solar air heating is the main application for the solar thermal industry in Canada. 88% of newly installed collector area in 2023 was glazed and unglazed air collectors. This market segment grew by 35% compared to 2022 because of support policies in the eastern Canadian province of Quebec. The fact that residential solar water heaters are not eligible technologies within the national Greener Homes Grant Program makes it hard to sell them to homeowners. This share of the overall market is correspondingly small (3%). The solar thermal industry sees solar process heat, solar district heating and solar assisted heat pumps as the applications with the best growth potential in Canada. These are some of the findings of the most current survey of the Canadian Solar Thermal Market Development 2022 and 2023. You find the full market report for download here. Natural Resources Canada commissioned the German agency solrico to carry out this year’s survey. Source: NRCan, Report about Canadian Solar Thermal Market Survey (2024)

“The Canadian solar thermal industry has a broad portfolio. It offers solar heat solutions with various collector types to a wide range of customers. Most of the collectors are produced in Canada which means high local added value and makes the industry independent of international supply bottlenecks,” said Lucio Mesquita, pointing out some important results of the study. He is Senior Engineer of the Renewable Heat and Power Group at CanmetEnergy of Natural Resources Canada and commissioned the study.

New dynamism in the solar thermal industry in Canada

Altogether solrico identified 21 Canadian companies which are engaged in manufacturing, planning, and/or selling solar thermal systems. These entities received a 3-page questionnaire in February 2024. The companies are grouped according to their portfolio (see also table on page 4/5 of the report for download below):

- Four manufacturers of solar air heating systems

- Two manufacturers of flat plate collectors

- Three manufacturers and importers of unglazed solar pool heating collectors

- Two importers of PVT collectors

- Six importers/resellers of evacuated tube and/or flat plate collectors

- Four manufacturers and/or suppliers of concentrating solar collectors (including two start-ups)

The final category listed above was added to the industry survey for the first time, and includes Rackam, Solarsteam, Phoenix Solar Thermal and Maxun Solar.

“A new branch of solar thermal industry is emerging here mainly based on different concepts of parabolic trough collectors. They want to develop large green heat projects for industrial customers under the good direct normal irradiation of Canada”, Mesquita said in reference to the new dynamism in the solar thermal industry.

Alberta-based Solarsteam, for example, is developing an enclosed ultra-lightweight parabolic trough collector. The first demonstrator with 10 m2 aperture area has been in operation since May 2022. Phoenix Solar Thermal takes a different path; the company from Ontario signed a purchase agreement with the Swedish company Absolicon to set up a production line for covered parabolic trough collectors in Canada back in 2021. Phoenix transferred a first upfront payment, so that Absolicon can order robots and electronic components for the new manufacturing line. Phoenix plans to follow up with several multi-MW plants for the food and agricultural industry in Canada and the USA.

Solarsteam´s demonstrator (right) and Absolicon´s glazed parabolic trough collector field in Sweden Photo: Solarsteam / Absolicon

Fully satisfactory response rate

16 companies took part in the survey – a response rate of 76%. This is a fully satisfactory response rate, as last year only six companies responded to the survey, of which two indicated zero sales during 2022.

Across all collector types the participating companies reported sales of 31,339 m2 of collector area in 2023, an increase of 27% compared to the 24,592 m2 of the year 2022. The strong growth was due to the air collectors. Sales figures rose here, particularly in Quebec. Two reasons were given for this in the survey: Increased subsidies by Quebec´s gas and electricity utilities and more stringent rules on mandatory heat recovery in the building code.

Encouragingly, eight companies indicated that they would support financially and organizationally the foundation of a Canadian Solar Heat Alliance or Association and two more companies answered “perhaps”. Only one company ticked a “no” here.

| Answers | Yes | Perhaps | No |

| Would you support (financially and organisationally) the foundation of a Canadian Solar Heat Alliance or Association? | Eight companies | Two companies | One company |

| Would you support (financially and organisationally) the foundation of a North American Solar Heat Alliance or Association? | Eight companies | One company | Two companies |

Source: NRCan, Report about Canadian Solar Thermal Market Survey (2024)

Lack of interest in solar thermal by the government

It seems important for the industry to join forces to gain a stronger voice in the political arena. The majority of solar thermal manufacturers and resellers are not satisfied with their business development, with only two of the twelve companies selecting ‘satisfied’ in the survey question. The main reason for dissatisfaction is the lack of political support. “Solar water heaters should have benefited from being included in the Greener Homes Grant Program”, claimed one survey participant.

Among the eligible retrofits are heat pumps, photovoltaics, and insulation or new windows. Homeowners can apply for interest-free loans up to CAD 40,000 and receive grants up to CAD 5,000 for heat pumps and PV systems since May 2021. The solar thermal industry notes a lack of interest by the government, caused by a negative perception of solar thermal. Parallel to the generous incentives for PV and heat pumps, some suppliers have withdrawn solar thermal energy from their programs in the last two years.

The situation is different for manufacturers and suppliers of solar pool heating systems with unglazed collectors. They have always offered these systems without subsidies and demand is growing again, as one satisfied participant reported during the survey.

Effective communication will be key factor for unlocking the sector’s growth potential

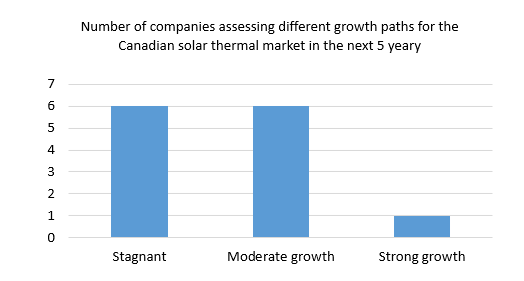

Despite the unfavourable political situation at present, numerous solar thermal companies expect demand to grow. Six companies anticipate ‘moderate growth’, one even expects ‘strong growth’ (see figure below). Various reasons are given here. “Carbon taxes stimulate demand in the smaller commercial installations”, is one of them. “Moving away from natural gas heating will increase interest in solar thermal”, is another one. But also internal factors such as “strong promotion” or “effective communication” are mentioned as key factors for unlocking the solar thermal sector’s growth potential.

Source: NRCan, Report about Canadian Solar Thermal Market Survey (2024)

Websites of organizations mentioned in this news article:

Natural Resources Canada: https://natural-resources.canada.ca/home

Solrico: http://www.solrico.com

Eligible retrofits within the Green Homes Grant Program: https://natural-resources.canada.ca/energy-efficiency/homes/canada-greener-homes-grant/start-your-energy-efficient-retrofits/plan-document-and-complete-your-home-retrofits/eligible-grants-for-my-home-retrofit/23504

Phoenix Solar Thermal: https://phoenixsolarthermal.com/

Solarsteam: https://solarsteam.ca/

Maxun Solar: https://maxun.solar/

Rackam: http://www.rackam.com/en/