Innovative trends on the still declining Chinese market

June 20, 2024

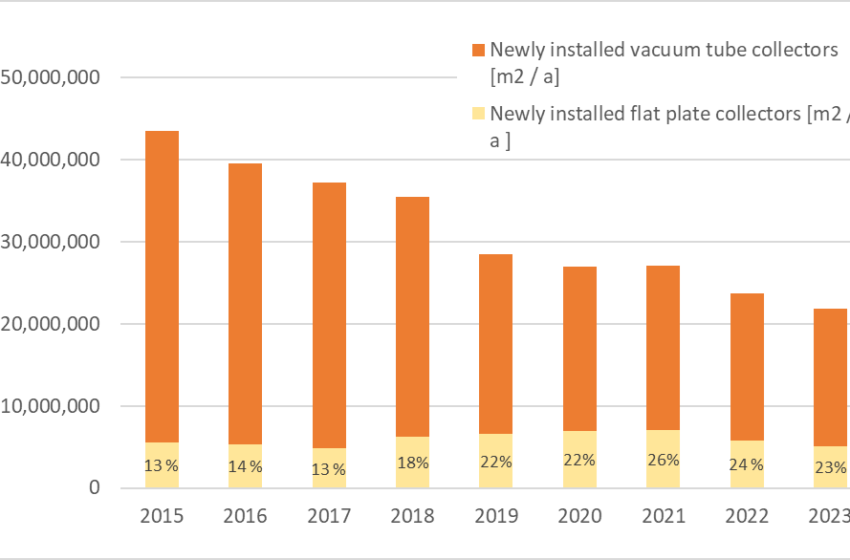

Despite numerous innovative trends, the Chinese solar thermal market continues to shrink. In 2023, 15.3 GW of collectors were installed in China, 8 % less than in the previous year. This number also includes a small portion of exported collectors. The annual industry report from the Chinese Solar Thermal Industry Federation (CSTIF) cites the general economic situation as the reason for the decline and the lower rate of new construction. As innovative trends, the association cites the market launch of the first PVT collectors, the offering of large-area flat-plate collectors, hybrid heating systems in which solar thermal energy is combined with a biomass boiler or heat pump and more marketing through e commerce.

Source: CSTIF

“In 2023 a group of medium-sized solar thermal manufacturers became a significant force in the market. The companies have made technological advancements and achieved considerable business results in the field of residential water heating”, explained Hongzhi Cheng, Managing Director of Sun’s Vision, who is one of the authors of the annual industry report on behalf of CSTIF. The following three medium-sized companies are explicitly mentioned in the report: Jinheng New Energy, Jingpu Solar Energy Technology and Haohua Solar.

Haohua put a new production line for pressurized enamelled water tanks up to 500 litres into operation last year, which has a “leading technical standard in the country”, it says in the report. The market volume of enamelled water tanks in 2023 is estimated at 800,000 units. Among them, jacketed enamelled water tanks of 80 to 120 litres are the main type. Jingpu made headlines with its IPO. In April 2023 the National Stock Transfer Company announced that Jingpu successfully entered the listing of innovative companies on the stock market.

According to Cheng, another positive trend can be observed in the area of solar heating. In 2023, the proportion of collector systems used for space heating in residential, commercial and industrial buildings continued to increase, by 11 %. A total of 3.428 million m2 were installed in this area, which was 15.6 % of the total market volume. Cheng expects this segment to continue to grow because “the central and local governments have introduced many coal-to-clean energy policies, which will definitely stimulate market development”.

The CSTIF market report emphasized the fact that vacuum tube solar water heaters have made a substantial breakthrough in e-commerce. Residential solar water heater kits are offered on all three big e-commerce platforms in China: Jingdong, Taobao and Tiktok. Taobao is the B2C platform of Alibaba. Jingdong.com is similar to Taobao, initially it was in the form of an online platform and now there is also an app. Cheng confirmed that the installation service supply chain has improved and that there are many installation companies acting as local agents, and therefore residential systems purchased through e-commerce are installed quickly.

Another product innovation was mentioned in the CSTIF industry report: the launch of the first laminated PVT collector from the company Shandong Shanke Blue Core Solar Energy Technology in September 2023, which is shown in the photos on a test stand. Photos from http://www.sdsklx.com/

- And now an overview of a few more market figures:

Flat-plate collector sales fell more sharply in 2023 (-12 %) than vacuum tube collector sales ( 6 %). This was due to the fact that flat-plate collectors are mainly used in multi-storey residential buildings in cities where there are mandatory laws for solar water heaters in place. As the construction sector is now in sharp decline, flat-plate collector sales are also falling. - The Chinese market statistics differentiate between small systems for residential housing units and the engineering segment, which includes larger systems for all other customers. In 2023, the share of the engineering segment was 76 % of the newly installed collector area. This is a bit lower than 2022 (83 %), but still higher than 2021 with 72 %.

2023 also marked the finalization of the 80 MW parabolic trough collector field for the Water World leisure park in Handan, China. Originally the operation start was planned for October 2022, but Corona delayed the construction work of the leisure complex which is now supposed to open its doors on 1st June 2024. Photo: Handan Jianxu New Energy

This news article was written in cooperation with Qian Zhang, a China-based researcher and translator.

Websites of organizations mentioned in this news article:

Jinheng New Energy: http://www.jinhengsolar.com/

Jingpu Solar Energy Technology: http://www.sdjptyn.com/

Haohua Solar: http://haohua899.51sole.com/companyabout.htm

Shandong Shanke Blue Core solar Energy Technology: http://www.sdsklx.com/

Original market report in Chinese: https://mp.weixin.qq.com/s/sfgpH30oJEJGEcnkFhPfww