Global SHIP market reaches five-year high despite national fluctuations

March 17, 2025

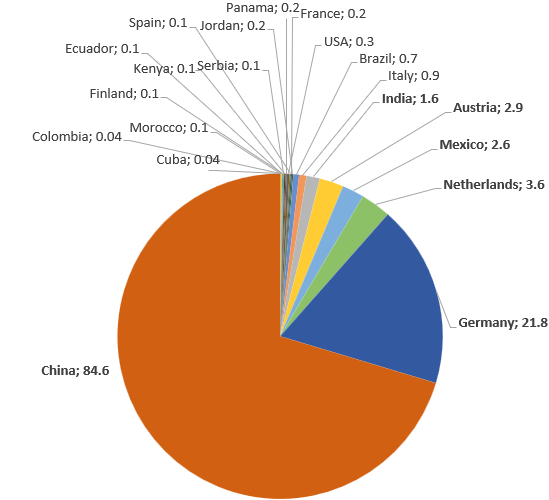

The global solar industrial heat (SHIP) market maintained its dynamic development in 2024. The project developers reported 106 new systems with a total capacity of 120 MW for the year. A further 125 MW were under construction by the end of 2024. This is an enormous capacity increase compared to the new SHIP capacity of 94 MW in 2023. The results last year were significantly influenced by three countries. China installed by far the largest SHIP capacity (84.6 MW). This came about through the commissioning of the 80 MW parabolic trough field in Handan, one of the uses for which is snow production for a tourism resort (see photo). The Netherlands and Mexico led the world market in 2024 with 24 and 22 new systems respectively. The survey was carried out by the German agency solrico in January and February 2025 and supported by Natural Resources Canada.

Photo: Mongolia XuCheng Energy

Table 1 shows SHIP market development over the years, which is still fluctuating strongly. The 120 MW of newly installed SHIP capacity in 2024 was the highest increase for five years. The number of new systems dropped slightly from 116 in 2023 and 2022 to 106 plants in 2024. The decline mainly occurred in the Netherlands. There, the number of clients from the agricultural sector has dropped because the ISDE subsidy programme decreased the subsidy level by around 30 %, as one Dutch project developer reported. As a result, the number of new SHIP installations fell from 43 in 2023 to 24 in 2024. Outside of the Netherlands, the global market grew: 73 systems in 2023 versus 82 systems in 2024.

The implementation rate of the SHIP specialists increased further. For 2024, 29 developers were able to report at least one completed project, a significant increase compared to previous years. For example in 2021 only 19 and in 2020 only 17 companies completed at least one plant.

Around 70 technology suppliers and project developers from 25 countries worldwide participated in this year’s SHIP survey. The data from the survey will be used to update the SHIP Turnkey Supplier World Map in the coming weeks. As part of the revision, the new plants will be added as references for the specific project developers and their portfolios will be updated. For all companies, there is information as to whether they produce collector technology and if so which kind, and whether they offer heat supply contracts.

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | End of year total 2024 | |

| No. of commissioned SHIP systems | 107 systems | 99 systems | 86 systems | 85 systems | 73 systems | 116 systems | 116 systems | 106 systems | at least 1,315 systems |

| Newly installed collector area | 219,280 m2 | 55,583 m2 | 358,641 m2 | 132,316 m2 | 51,866 m2 | 43,664 m2 | 134,990 m2 | 171,874 m2 | 1.531 million m2 |

| Newly installed solar thermal capacity | 153 MW | 39 MW | 251 MW | 93 MW | 36 MW | 31 MW | 94 MW | 120 MW | 1.071 MW |

Table 1: Global SHIP market development between 2017 and 2024. The large fluctuations in added capacity are the result of large capacity additions in Oman and China in certain years. Capacity was calculated using the factor 0.7 kW/m2 for all collector types. Source: Annual surveys carried out by solrico between 2017 and 2025 of the companies listed on the Turnkey SHIP Supplier World Map: http://www.solar-payback.com/suppliers/

Top SHIP markets 2024: Netherlands, Mexico, China, Germany, and Austria

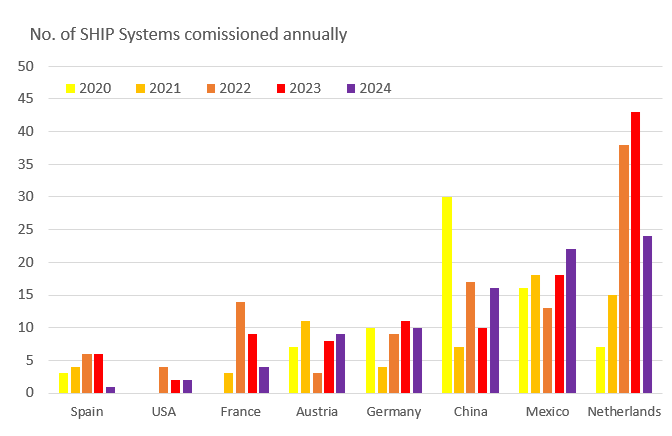

Figure 1: Top markets in terms of the number of new SHIP plants commissioned per year between 2020 and 2024. Source: Annual surveys of the companies listed on the SHIP Supplier World Map

Figure 1 takes a look at the top markets in terms of the number of new installations per year. As in the previous year, the Netherlands, Mexico, China and Germany led the ranking, but China has overtaken Germany and is now in third place.

Mexico contributed significantly to the SHIP world market again. Four Mexican companies reported new systems plus one linear Fresnel installation at Unilever was installed by a Spanish project developer. But not all companies are satisfied with business development in Mexico. “It has been very hard to close deals since the natural gas is extremely cheap and companies cannot justify solar heat investments”, commented one Mexican system developer in the questionnaire.

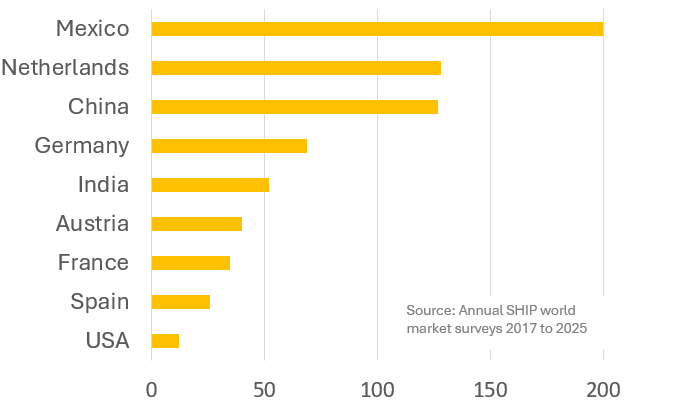

Mexico is also the country with the most SHIP systems worldwide, now with 200 installations, followed by the Netherlands and China with 128 and 127 systems respectively. However, the data available in China is not complete. The reason is that the major Chinese collector manufacturers often only supply materials to construction sites, where local companies take care of the installations, so that the material suppliers do not necessarily know how the solar heat is used by the customer. It is therefore virtually impossible to fully capture the Chinese SHIP market by surveying collector manufacturers.

The majority of the new German plants were again installed for drying of agricultural products. However, this application has been excluded from the Energy Efficiency in the Economy (EEW) subsidy scheme since the beginning of 2024. Several customers have received rejections from the funding agency and have postponed their investment decision, according to a German air collector provider. In 2024, air collector manufacturers were still putting some systems into operation with subsidy agreements from the previous year, but it can now be assumed that the market will decline.

In France, only a few smaller agricultural plants went into operation last year. The established Fonds Chaleur funding programme almost exclusively supported systems in the multi-family housing and accommodation sector, but not industrial and agricultural clients. There are numerous positive funding decisions for multi-MW SHIP plants from previous years, but their planning and implementation is taking longer, so that no major plant went in operation in 2024. Only one plant with 4.2 MW for greenhouse heating was under construction at the end of 2024 according to the funding administrator ADEME.

Figure 2: Top SHIP markets worldwide in terms of total number of SHIP systems installed between 2017 and 2014. Source: Annual surveys of companies listed on the SHIP Supplier World Map

High fluctuations in terms of new national SHIP capacity 2024

The country breakdown of newly installed SHIP capacity in 2024 changed completely compared to the previous year (see figure 3). In 2024, China dominated the statistics, while in the previous year over 50 % of the capacity was installed in Spain. This country only came eleventh in the ranking for newly installed SHIP capacity last year. However, this is only a temporary slump, as SHIP specialists have reported some major Spanish projects for the Solar Industrial Heat Outlook 2025-2027, which will be published soon.

Germany ended up in second place, a surprising leap forward from last year’s seventh place. This was due to the fact that a 20 MW plant went into operation at a biomass company in southern Germany. The flat plate collector field provides drying of animal feed and biomass products in the factory of the investor Bauer Biomasse, but also provides the entire hot water requirement of the households connected to the district heating system in the village of Bad Rappenau.

France dropped from the second place in 2023 to position 10 in 2024 because no multi-MW plants went into operation last year.

The SHIP world market diversified further. In 2024, systems were put into operation in 20 countries, which is more than in the previous years – 16 in 2023 and 18 in 2022.

Figure 3: SHIP capacity additions in 2024 in MW per country. In total, SHIP installations with 120 MW started operation worldwide last year. Source: Survey 2025 of the companies listed on the SHIP Supplier World Map

Wide variety of collector technologies in use

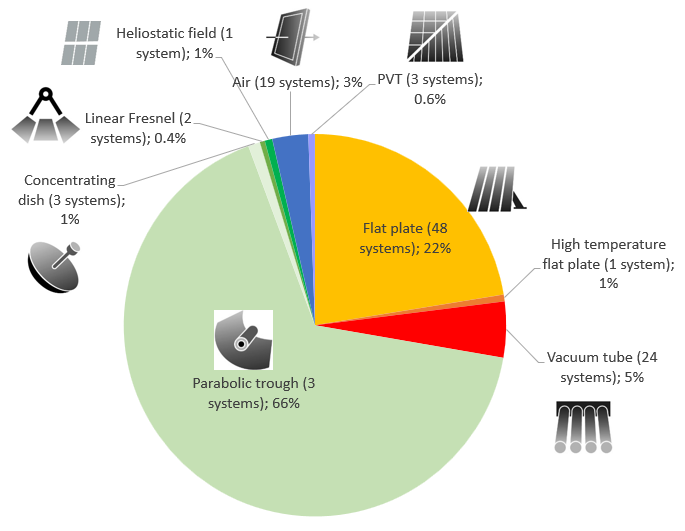

2024 shows a completely new picture in terms of the distribution of collector types compared to previous years. Concentrating collectors dominated the global market with 69 %, compared to 43 % and 16 % respectively in previous years. The 80 MW parabolic trough field in China for the leisure park mentioned above had a very strong influence on the collector type distribution, of course. If this large-scale plant is excluded, the share of concentrating solar collector capacity only accounts for 7 % of the global market.

Figure 4: Distribution of collector type area in the SHIP world market 2024 (Total: 171,874 m2). Only the two small systems with unglazed collectors totalling 326 m2 are not illustrated. Source: Survey 2025 of the companies listed on the SHIP Supplier World Map

Websites of organisations mentioned in this news article:

Solrico: https://www.solrico.com/

Turnkey SHIP Supplier World Map: https://www.solar-payback.com/suppliers/