EU to extend emissions trading to private households and transport

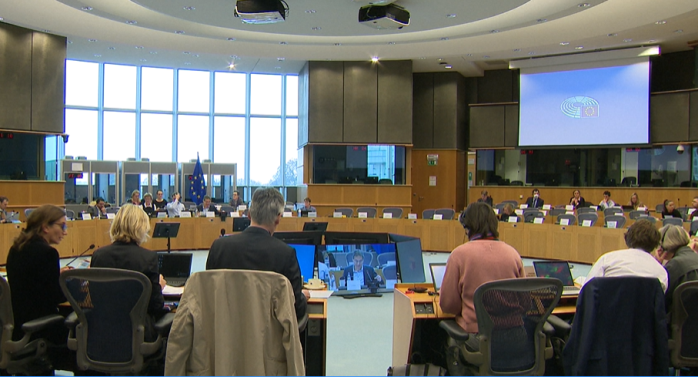

From 2027 onward, private households in the European Union will also have to pay a CO2 tax on the fossil fuels they use. This is envisaged by the reform of the EU Emissions Trading Scheme (EU ETS), on which negotiators agreed in mid-December 2022 in the so-called Trilogue of the three legislative EU institutions Council, Commission and Parliament (see photo). According to Michael Bloss, who was a negotiator for the parliamentary group of the Greens, the reform not only tightens the emissions trading system that has been in place since 2005, but a second emissions trading system (ETS II) for the transport and buildings sectors is also planned.

Photo: Trilogue on EU Emissions Trading System/European Parliament

The European Council confirmed the reform project on 10 February 2023. Therefore, Bloss expects the final approval from the European Parliament to come in mid April 2023 and the new directive to enter into force in mid-May 2023. “Member States will then have until the end of 2023 to transpose it into national law,” wrote Bloss in an online article published on the carboneer website on 29 January 2023. However, if energy prices remain permanently high, the obligation to pay the CO2 tax for private households could be postponed until 2028, commented Bloss.

Two experts on emission trading systems: Michael Bloss, Member of the EU Parliament for the Greens (left) and Simon Göß, Managing Director of German consulting firm carboneer. Photos: private

Revenues will flow into a climate social fund

So far the ETS has covered about 10,000 companies, which are obliged to buy certificates for pollution rights at fixed CO2 prices. They are mainly in the field of electricity and heat generation or energy-intensive industrial sectors such as oil refineries and steel, cement and glass producers as well as commercial aviation in the European Economic Area. The annual reduction in the issue of allowances is intended to encourage companies to reduce their emissions and bring about a reduction in pollutant emissions.

By supplementing the existing EU ETS I with EU ETS II for road transport and private households, considerably more European CO2 emissions will be tied to emission rights certificates in the future. In order to soften socially the unavoidable increase in energy prices, a price cap of 45 EUR per tonne of CO2 emissions is to be set. The additional revenue generated is to flow into a climate social fund, from which not only innovations and environmentally friendly technologies are to be promoted, but also energy-poor citizens and financially weak small businesses should receive financial support.

“In this way, the EU is showing that it is consistently pursuing the path to climate neutrality without losing sight of social balance. It is thus setting standards for the implementation of climate policy worldwide”, commented Robert Habeck, the German Federal Minister for Economic Affairs and Climate Protection.

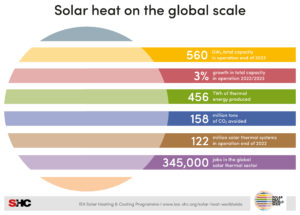

Infographic about the ETS system in Europe Source: European Council

Fossil fuel suppliers will charge higher costs resulting from emission pricing

But does the EU ETS II reform mean that in the future private individuals will have to purchase pollution rights and submit a CO2 tax declaration? Simon Göß, Managing Director of consulting firm carboneer, finds this unlikely. In his opinion, the effort involved would hardly be worthwhile. “In the EU ETS I, the actual emitters such as power plants or industrial facilities are obliged to purchase emission allowances; in the EU ETS II it’s the distributors of the energy sources such as oil and gas suppliers or petrol stations and liquid gas sellers,” he explained.

“So their customers, be they businesses or private individuals, will not have to buy pollution allowances directly for the petrol they use to drive their cars or the oil or gas they use to heat their homes. They will be charged by their oil and gas suppliers for the higher costs resulting from emission pricing,” said Göß. This improves the competitive position for companies that supply their customers with less CO2-intensive energy sources such as solar thermal systems.

Clarity about the direction of European emission trading

For Germany, however, he does not expect the EU ETS II to bring about any particular change in the energy price level and thus hardly any incentives for the use of more climate-friendly technologies, since a kind of national emission trading system has already been in place since 2021. It prices pretty much exactly the emissions that are to be covered by the EU ETS II in the future.

For the development of solar thermal in Germany in particular, Simon Göß considers the requirements for buildings under the Building Energy Act to be more significant. It already exists, but is currently being revised. It requires the use of at least 65% renewable energies in new or renewed heating systems in buildings from 2024. This can be achieved with solar thermal energy, as well as with biomass, photovoltaics, heat pumps, fuel cells, heating grids or a combination of all of these.

For the other EU member states, the EU ETS II should have real effects, according to Göß. He welcomes the fact that now “there is finally clarity about the direction in which European emissions trading will develop. This gives affected companies planning security”.

Boost for green district heating in countries without emission pricing yet

However, since the introduction at EU level is planned for a relatively late date in 2027 or even 2028 and includes a price stabilisation mechanism, Göß sees fewer economic incentives set than “necessary to enable decarbonisation in the building and transport sectors”. For example, the EU ETS II alone will hardly provide any impetus for the switch to less CO2-intensive energy sources such as solar thermal systems. At least the harmonisation of CO2 pricing in the new sectors will create a level playing field for all participants within the EU.

But can the introduction of a CO2 tax for the buildings sector give impetus to the development of green district heating, including the use of solar collectors? Göß could imagine a positive impact for green heat in networks with a lower capacity of under 20 MW because of the new carbon pricing that makes fossil-fuel operation more expensive. In Germany, however, these fossil-fuel heat generators are already priced with the national emissions trading system. “Therefore, the EU ETS II will hardly give a further boost to green district heating in Germany, but this could be different in other EU countries where there is no pricing yet,” said Göß. However, this would require more detailed analyses.

“I assume that in the district/proximity heating sector the decisions regarding mandatory municipal heating planning will play a more important role,” said Göß, adding that more detailed rules on this should be published by the German Economy Ministry before the end of this year. According to Göß, only making fossil primary energy sources more expensive will not make the heat turnaround work here, “many different policies and measures have to flow together and are gradually doing so”.

Organisations mentioned in this news article:

Carboneer

Trilogue

EU ETS II agreement