Brazil: Residential Demand Drives Market

July 24, 2013

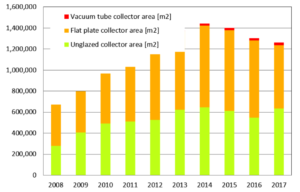

In 2012, the Brazilian market of glazed collector area increased by 21 % to 625,866 m², whereas the unglazed swimming pool market segment only grew by 3 % to 525,508 m². According to the market statistics of the Solar Heating Department, DASOL, of the Brazilian Association of Refrigeration, Air Conditioning, Ventilation and Heating, ABRAVA, it is still the residential sector which drives the market, representing 66% of the sales in 2012, while the segment of industry, business and services accounts for 17 % and the social housing programme makes up another 17% (see the attached market survey in Portuguese). The chart shows the strong market growth over the last five years, which almost doubled in newly installed collector area from 671,156 m² in 2008 to 1,151,300 m² last year.

The tank production grew accordingly, from 128,790 units in 2011 to 168,825 units with an average capacity of 107 litres per m². DASOL´s market report states that the demand of tanks with 200 litres of capacity almost tripled from 19,745 units in 2011 to 57,378 units one year later, mainly because this type of tank is used in the social housing market. Other market segments usually use 500 litre tanks, which increased by only 2%.

“The Brazilian market is mainly residential, with a growing demand in this segment,” says Carlos Alencar, DASOL’s President and Managing Director of Enalter, a major solar thermal collector manufacturer and system supplier located in Minas Gerais. “The industrial sector has still a rather small effect on the Brazilian market, but there is a significant demand from health clubs, hotels and sports academies.”

Factors contributing to the growing market are social housing programmes which require the installation of solar water heaters, such as Minha Casa, Minha Vida, several municipal building regulations which stipulate the use of solar water heaters in new buildings and a growing awareness of sustainability issues among citizens. “Solar thermal energy is really competitive in Brazil, it is a good investment,” says Alencar. The extremely favourable weather conditions and high electricity prices – electric showers are the most common system used to heat water in the country – make solar water heaters a very attractive option, because the systems can pay off in just two years.

Thermosiphon systems with glazed flat plate collectors dominate the residential hot water market, while bigger projects, such as multi-family houses, mostly include forced pumped systems.

The southeast of the country is where most of the solar thermal systems are sold, with 74 % of the newly installed collector area being located in this area. Sales in the northeast and the northern region have had hardly any share in collector sales.

The Brazilian market is fairly dynamic, with companies regularly entering and exiting the market. “There are about 150 solar thermal system suppliers,” says Alencar. The majority targets the Brazilian market, but there has been a very small number of exporters, mainly focused on other South American countries.

By the beginning of the year, Brazilian solar companies were very optimistic about 2013. 67% expected to grow up to 15 %, whereas around 33 % anticipated even above 20 % growth in the current year. Now, entering the second half of the year, Alencar says that feelings are mixed: “In informal talks with stakeholders, some say the business is going great, others say that the market is too weak,” tells the association’s president. But there has not yet been a statistic for 2013, “so it’s hard to paint a clear picture of the market right now”.

More information:

http://www.dasolabrava.org.br/