Average gas price of 140 EUR/MWh over the next four years

September 14, 2022

The E.ON group is positioning itself more and more as a provider of sustainable energy solutions for commercial customers. Solar industrial heat (SHIP) is one of the solutions being considered, especially because good funding is available for SHIP in many European countries, as Kevin Bär pointed out during his presentation at the Forum Concentrating Solar Heat for Industry and Heating Networks on 30 June 2022 in Berlin. The Senior Manager Sales and Global Growth from E.ON explained that the market is indicating a gas price for industrial customers of 140 EUR/MWh on average over the next four years. E.ON is one of the largest utilities in Europe with 50 million customers, EUR 77 billion turnover in 2021 and around 72,000 employees.

Photo: E.ON

It is a remarkable development that E.ON executives are taking the floor as speakers at purely solar thermal events. Especially since solar heat is not even mentioned as an option in the 146-page Sustainable Report 2021 that was published by E.ON in March 2022. Solar heat is also not among the eleven technologies that are listed on the company’s website on the subpage for City and Business Energy Solutions.

“Two events have made us aware of the topic of solar thermal energy,” said Bär. “Firstly, the European Climate Law with its target of climate neutrality by 2050 and then, obviously, the war in Ukraine with the resulting increase in gas and electricity prices.” He heads the department that offers sustainable energy solutions to industrial customers across Europe. Breweries and also cement and glass factories have been among the recent clients.

“Solar concentrating heat is not really complex for us”

According to Bär, solar thermal plants are sometimes part of a hybrid energy supply system, but his team has also designed stand-alone solar heat fields, for a large beverage manufacturer, for example. The project failed, however, due to a lack of sufficient space. Bär sees the space requirement as one of the greatest difficulties in the implementation of solar thermal systems for industrial customers. E.ON offers both the installation of fixed assets and the signing of solar heat delivery contracts. “From the engineering side, it’s not really complex for us to offer a concentrating solar heat plant”, said Bär, since E.ON also builds and operates large integrated energy solutions including combined heat and power plants, Organic Rankine Cycle (ORC) and biomass-fuelled plants or gas turbine systems.

Gas prices will remain high indefinitely

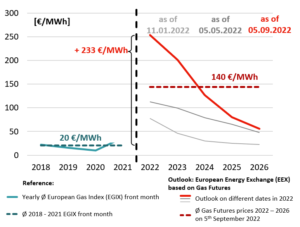

Bär used the presentation at the forum in June to explain a forecast for gas prices in Europe. The graph below shows gas price developments before and after 24 February 2022, the day Russia attacked Ukraine. The blue line on the left-hand side illustrates the mean annual European Gas Index (EGIX) for the years 2018 to 2021, which averaged 20 EUR/MWh.

The outlook for the years 2022 to 2026 marked with red and grey lines on the right-hand side reflects the futures market of the European Energy Exchange (EEX), where the gas suppliers secure gas quotes for up to four years in advance. According to Bär, this outlook is decisive for the development of gas prices for small and medium-size heat customers because all large utilities procure their energy sources on the exchange and pass the purchase prices on to their customers.

Gas price outlook 2022 to 2026 based on average gas futures (right-hand side) compared with the average European Gas Index for the years 2018 to 2021 (left-hand side)

Source: E.ON

“The gas price will probably remain high in the long term”

“Current gas price futures as of 5 September for the last quarter 2022 are over EUR 250/MWh and have risen again since 5 May,” explained Bär. Over the period 2022 to 2026, the average purchase price on the exchange is above 140 EUR/MWh (red bold dotted line). This is seven times more than the 20 EUR/MWh average for the years 2018 to 2021.

“We assume that due to the phasing out of Russian gas imports and the more expensive alternatives, the gas price will probably remain high in the long term, even though the filling level of the gas storage in Germany has temporarily increased”, said Bär.

The chart shows pure commodity prices. In the case of large energy consumers with net heat demand exceeding 20 MW from industry or the municipal utility sector for example, the price for EU allowances (EUA) in EUR/tonne of CO2 equivalent within the European Emission Trading System (ETS) must be added to the gas price. Here the settlement price emission futures at the EEX are relevant. According to Bär the 10-year-average EAU settlement price was at around 105 EUR/tonne in May. Assuming CO2 emissions of 201 g/kWh this results in an additional cost of 21 EUR/MWh which needs to be added to the purchase price of gas.

Subsidiaries in 15 European countries

Today´s E.ON group originated from the split with Uniper in January 2016. Since then, E.ON has focused on energy networks and customer solutions providing energy to around 50 million private households and SMEs across Europe. The conventional generation and energy trading business with large customers remained with Uniper. E.ON, with its headquarters in Essen, Germany, has subsidiaries in 15 European countries.

Websites of organisations mentioned in this article:

E.ON: https://www.eon.com/en.html

Deutsche CSP: https://deutsche-csp.eu/en/

Forum Concentrating Solar Heat for Industry and Heating Networks: https://www.deutsche-csp.com/termin-dcsp/termin-dcsp/download-juli-2022