Polish heating device market with interesting ups and downs

July 28, 2023

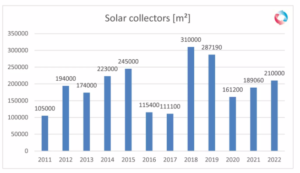

2022 was the second consecutive year of growth in the Polish solar thermal market. Solar collector sales increased by 11 % after growth of 17 % in 2021. According to Janusz Staroscik, President of the Association of Heating Appliance Manufacturers and Importers in Poland (SPIUG), sales mainly increased towards the end of the year and totalled 147 MW (210,000 m2). SPIUG researches the Polish heating device market annually based on a survey and conversations with manufacturers and installers (see PDFs for download below). One of the main trends that Staroscik identifies from the current report is towards hybrid systems, meaning solar collectors retrofitted to systems with other heat sources such as heat pumps and gas, biomass or electric boilers. Their increasing popularity could help the solar sector in Poland to grow further in the coming years.

Photo: SPIUG

In 2022, retrofitted solar thermal systems were added mainly to reduce gas consumption in spring and summer in residential buildings. Also, “the market has informed building owners about the installation of hybrid systems with solar collectors and heat pumps,” according to the report, which sees the motivator for the purchase of hybrid systems in the price increase for energy carriers. But there are still no activities that promote solar thermal technologies as completely emission-free with negligible operational costs, regrets Staroscik. SPIUG started promoting such solutions in 2020. In 2021, it issued a data sheet for the construction and selection of hybrid installations using solar collectors. The photo above is taken from a 15-minute Youtube video on the SPIUG homepage that introduces the various residential renewable heating options.

Figure 1: Large fluctuations in sales of collectors in Poland due to the changing political framework. Flat solar collectors still dominate sales; the share of vacuum tube collectors is only 1%. These facts from the report show that cost is still the key factor in Poland.

Source: SPIUG

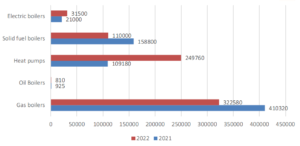

Heat pumps increased significantly, with almost 250,000 units sold (+129 %)

Sales of heating devices show that electrification of the heating sector is a strong trend in Poland. While sales of heat pumps increased rapidly by 129 % to almost 250,000 units in 2022 (see figure 2), gas boilers decreased by 21 % due to the “rising and uncertain fuel prices and the anti-gas campaign”, says the report.

According to Staroscik, heat pumps are currently being very strongly promoted by an extensive media campaign. He sees the reason for this as EU policy, which supports heat pumps as, in practice, the only technology that can meet EU regulations and strategies in the future. “In these regulations, solar thermal is omitted or treated marginally. If one talks about solar panels, this is now equated with photovoltaics and not with solar collectors.”

Solid fuel boilers is a mixed category including biomass and coal boilers, which both reduced in sales volume (-31 % in total). The report gives some reasons for this decline. Firstly “the price of coal as a fuel increased significantly, so the cost of heating with coal is no longer competitive”. The second effect came from increased sales of unclassified boilers, which theoretically cannot be sold and therefore are not part of the official statistics. These include biomass boilers.

Figure 2: Polish heating device market: Comparison of sales figures for 2021 and 2022 for different heating technologies. Source: SPIUG

High demand for planning services for solar district heating

The report also mentions a “noticeably increasing interest in using solar collector systems to supply process heat in industry”. The report highlights the growing interest in PVT collectors and also that the idea of using solar collector fields for heat networks is being discussed in Poland more and more seriously. Staroscik underlined the new trend when he said that “there are quite a lot of heating grid modernization projects under development, both at the boiler house and at the heat transfer stations.

Currently, he knows of “five projects that have been started in heating networks throughout Poland in which the construction and modernization of boiler houses with the use of solar installations and heat storage facilities is planned, with a total area of over 100,000 m2 of solar collectors.” He also mentioned that every month “district heating grid operators come forward with a request for help in carrying out design work for a specific solar installation, usually with a share in the annual heat demand of between 5 and 10 %.”

Those observations display the increasing interest in the use of solar collectors for district heating in Poland. Staroscik sees the reasons for this growth mainly in EU requirements in connection with decarbonization, high fossil fuel prices and also the fact that energy utility companies (PECs) have become aware of renewable energy systems as a way of improving their ecological image – e.g. PEC Gliwice. He also mentioned, that “district heating network operators have started to calculate the cost of heat generation carefully and take action to become independent of rapid changes, for example, the prices on the fuel market.”

Nevertheless, according to Staroscik there is a long list of challenges and barriers that are causing the solar market in Poland to continue to be unstable. In addition to a lack of funding, legislative errors, and difficulties with building permits, clear rules for the construction of large renewable installations (over 500 kW) still do not exist. In an example he illustrated the current situation: “It took us six month to convince the state water authority Wody Polskie that the collectors do not have to be washed from time to time and that the atmospheric precipitation will not be contaminated with glycol or other impurities as a result of contact with solar collectors.”

In addition, the report sees other barriers in the limited supply of buffer storage tanks with volumes over 1,000 litres and in the fact that the installers lack knowledge and skills regarding selection and completion of such systems. Also, the fact that manufacturers have reported issues with the supply of components and raw materials required to make solar collectors is not helpful for stable market growth.

What can be expected for Polish solar thermal systems in 2023?

The growing interest in hybrid heating systems could help solar thermal to achieve a stable market position in Poland. But the report concludes that “in the installation and heating industry, the year 2023 is one great unknown due to the consequences caused by the difficult-to-anticipate aftermath of the international situation, which impacted supply from the Far East as well as access to fossil fuels, among other things.” According to Staroscik, “there is a new programme in preparation aimed at the use of heat from renewables in district heating networks called ‘RES – a source of heat for district heating’, whose launch is planned either at the end of 2023 or as late as 2024. This programme should also cover solar thermal.” Since much depends on the policy of the central and EU authorities, it remains exciting to see what this year will bring for the solar thermal sector in Poland.

More information:

SPIUG: https://spiug.pl/