Germany: Excel-Based IRR Commercial Project Calculations

September 25, 2014

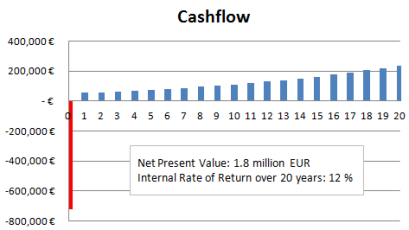

German Fresnel collector manufacturer Industrial Solar is experiencing an increasing demand from clients all around the world: “Five years ago, we received two requests per month. Now, we receive around 50 each month and the requests are more serious,” Tobias Schwind, who is one of the Managing Directors of the company founded in 2009, confirms. Schwind has begun to notice a shift in the industry: “Whereas payback times of three to four years have, so far, been commonplace, the industry is steering towards five- to six-year periods,” he says and adds: “We, however, try to explain to our clients that they are investing in their infrastructure, and payback time is therefore not really the best criterion.” Industrial Solar offers potential clients a calculation of the Net Present Value (NPV) and the Internal Rate of Return (IRR). According to the managing director, an economic analysis based on these parameters often shows that solar process heat is worth further consideration.

German Fresnel collector manufacturer Industrial Solar is experiencing an increasing demand from clients all around the world: “Five years ago, we received two requests per month. Now, we receive around 50 each month and the requests are more serious,” Tobias Schwind, who is one of the Managing Directors of the company founded in 2009, confirms. Schwind has begun to notice a shift in the industry: “Whereas payback times of three to four years have, so far, been commonplace, the industry is steering towards five- to six-year periods,” he says and adds: “We, however, try to explain to our clients that they are investing in their infrastructure, and payback time is therefore not really the best criterion.” Industrial Solar offers potential clients a calculation of the Net Present Value (NPV) and the Internal Rate of Return (IRR). According to the managing director, an economic analysis based on these parameters often shows that solar process heat is worth further consideration.|

Project data |

|

Further assumptions |

|

|

Collector field size |

1,760 m² |

System efficiency degradation per year |

0.25 % |

|

Investment (minus incentive) |

720,000 EUR |

Boiler efficiency |

85 % |

|

Backup |

Diesel |

Annual O&M cost share in total turnkey investment |

2 % |

|

Fossil fuel price |

60 EUR/MWh |

Escalation of O&M costs |

2 % |

|

Equity share |

100 % |

Lifetime of system |

20 years |

|

Irradiation (DNI) |

1,500 kWh/m²a |

1,000 kWh/m²a |

1,500 |

2,000 kWh/m²a |

||

|

Annual increase in fossil fuel prices |

5 % |

7.5 % |

10 % |

7.5 % |

||

|

NPV (in EUR) |

1,080,712 |

1,809,771 |

2,820,806 |

849,887 |

1,809,771 |

2,769,656 |

|

IRR |

9 % |

12 % |

15 % |

7 % |

12 % |

16 % |

|

Equity share in total investment costs (10 % loan costs) |

100 % |

75 % |

50 % |

|

NPV (in EUR) |

1,809,771 |

1,717,590 |

1,618,865 |

|

Internal Rate of Return |

9 % |

12 % |

13 % |